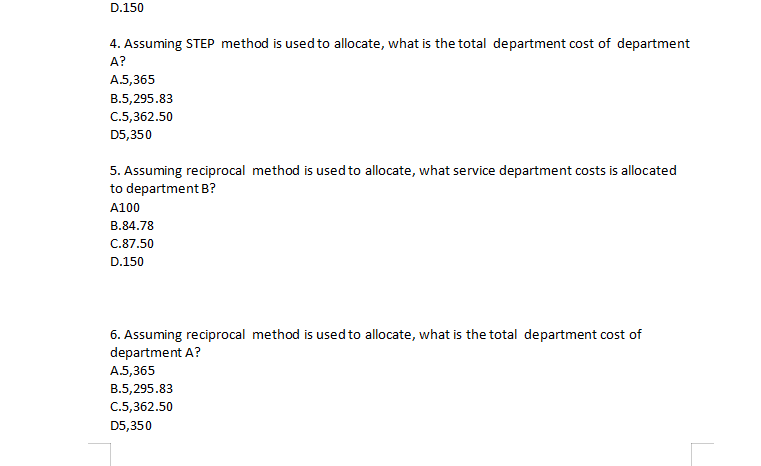

Question: part 1 D.150 4. Assuming STEP method is used to allocate, what is the total department cost of department A? A5,365 35,295.33 (25,362.50 [15,350 5.

part 1

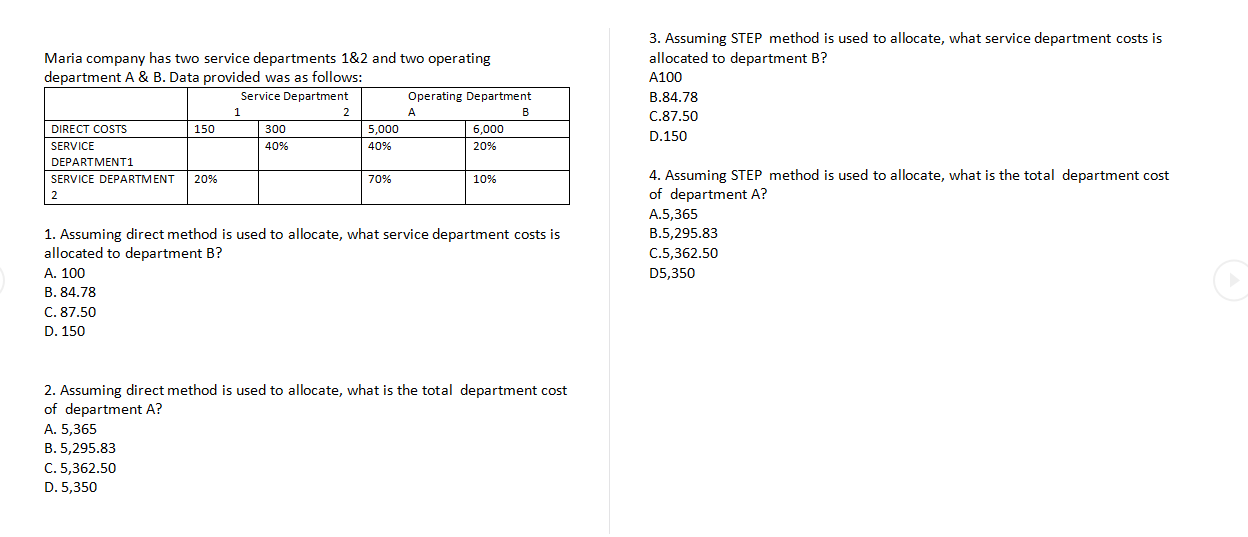

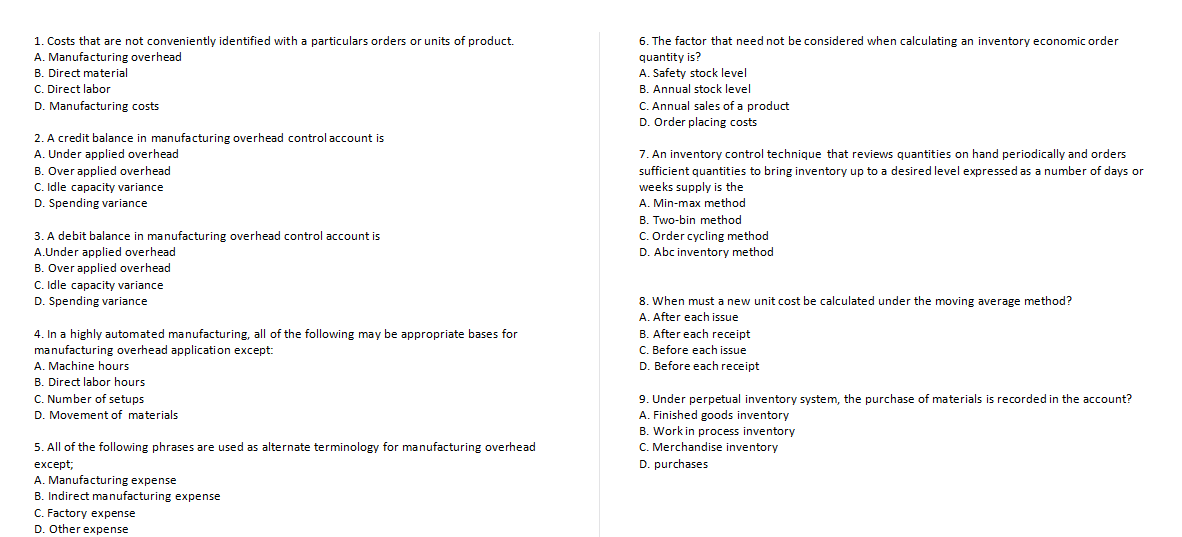

D.150 4. Assuming STEP method is used to allocate, what is the total department cost of department A? A5,365 35,295.33 (25,362.50 [15,350 5. Assuming reciprocal method is used to allocate, what SEWiCE department costs is allocated to department B? A100 3.8433 c.3150 D.150 6. Assuming reciprocal method is used to allocate, what is the total department cost of department A? A5365 35,295.83 (25,362.50 [15,350 3. Assuming STEP method is used to allocate, what service department costs is Maria company has two service departments 1&2 and two operating allocated to department B? department A & B. Data provided was as follows: A100 Service Department Operating Department B.84.78 1 A B C.87.50 DIRECT COSTS 150 300 5,000 6,000 D.150 SERVICE 40% 40% 20% DEPARTMENT1 SERVICE DEPARTMENT 20% 70% 10% 4. Assuming STEP method is used to allocate, what is the total department cost 2 of department A? A.5,365 1. Assuming direct method is used to allocate, what service department costs is B.5,295.83 allocated to department B? C.5,362.50 A. 100 D5,350 B. 84.78 C. 87.50 D. 150 2. Assuming direct method is used to allocate, what is the total department cost of department A? A. 5,365 B. 5,295.83 C. 5,362.50 D. 5,3501. Costs that are not conveniently identified with a particulars orders or units of product. 6. The factor that need not be considered when calculating an inventory economic order A. Manufacturing overhead quantity is? B. Direct material A. Safety stock level C. Direct labor B. Annual stock level D. Manufacturing costs C. Annual sales of a product D. Order placing costs 2. A credit balance in manufacturing overhead control account is A. Under applied overhead 7. An inventory control technique that reviews quantities on hand periodically and orders B. Over applied overhead sufficient quantities to bring inventory up to a desired level expressed as a number of days or C. Idle capacity variance weeks supply is the D. Spending variance A. Min-max method B. Two-bin method 3. A debit balance in manufacturing overhead control account is C. Order cycling method A.Under applied overhead D. Abc inventory method B. Over applied overhead C. Idle capacity variance D. Spending variance 8. When must a new unit cost be calculated under the moving average method? A. After each issue 4. In a highly automated manufacturing, all of the following may be appropriate bases for B. After each receipt manufacturing overhead application except: C. Before each issue A. Machine hours D. Before each receipt B. Direct labor hours C. Number of setups 9. Under perpetual inventory system, the purchase of materials is recorded in the account? D. Movement of materials A. Finished goods inventory B. Work in process inventory 5. All of the following phrases are used as alternate terminology for manufacturing overhead C. Merchandise inventory except; D. purchases A. Manufacturing expense B. Indirect manufacturing expense C. Factory expense D. Other expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts