Question: Part 1 ds 0 Points: 0 af 4 Save Unequal lives: ANPV approach. Evans Industries wishes to select the best of three possble machines, each

Part ds

Points: af

Save

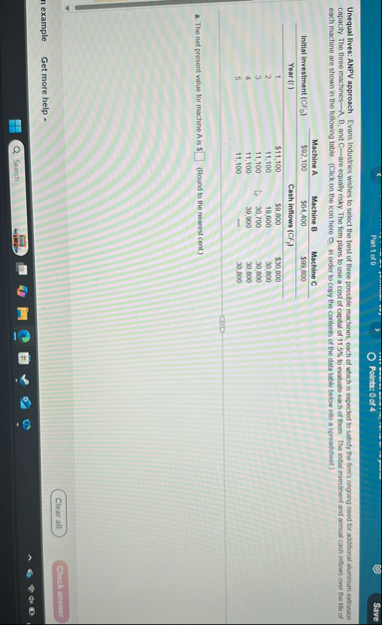

Unequal lives: ANPV approach. Evans Industries wishes to select the best of three possble machines, each of utich is expected lo satisty the firm's ongong need for aditional atiminam edruson capacity. The three machinesA B and Care equally risky. The firm plans to use a cost of capital of to evaluate each of them. The intial rvestinent and arrual cash nflows over the ife of each machine are shown in the following table. Click on the icon here O in order to copy the corflents of the data table below into a sereadsheet

tableMachine AMachine BMachine CInitial investment $$$Year fCash inflows CF$$$

a The net present value for machine is Round to the nearest cent

n example

Get more help

Search

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock