Question: Part 1: Financial Analysis (12 points) Perform A financial analysis for a project using the format provided in chapter 4, figure 4-5. Assume that the

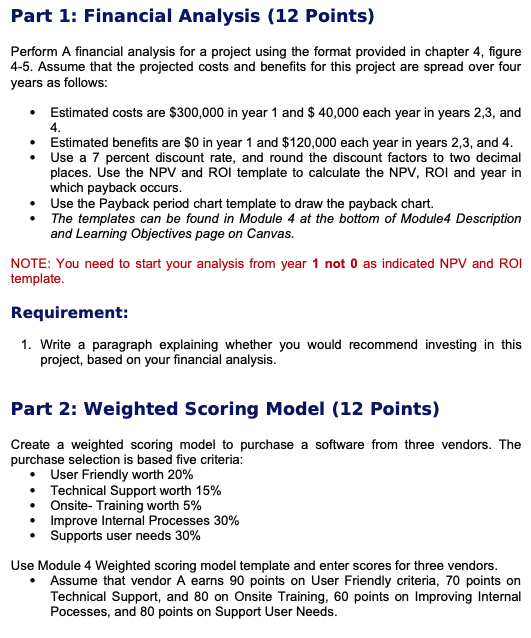

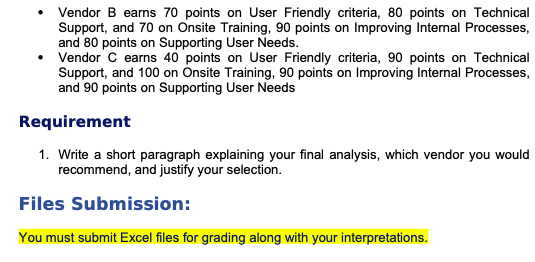

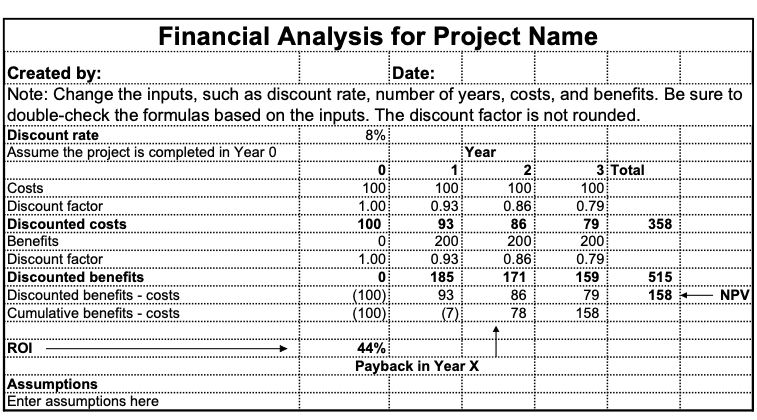

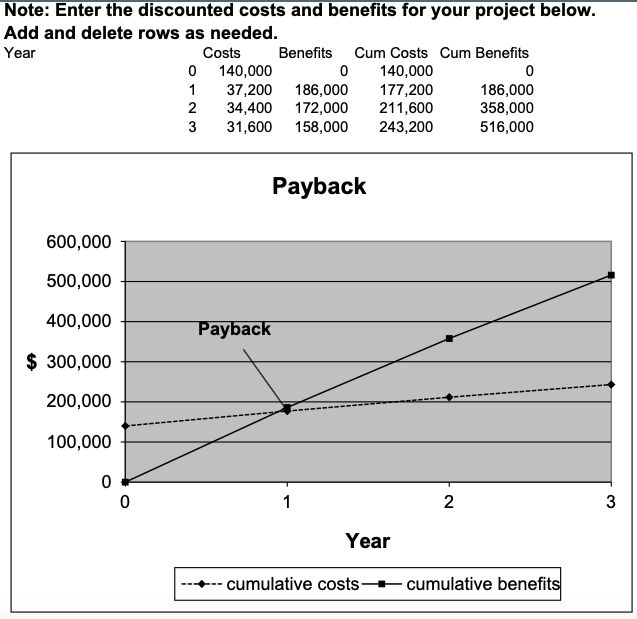

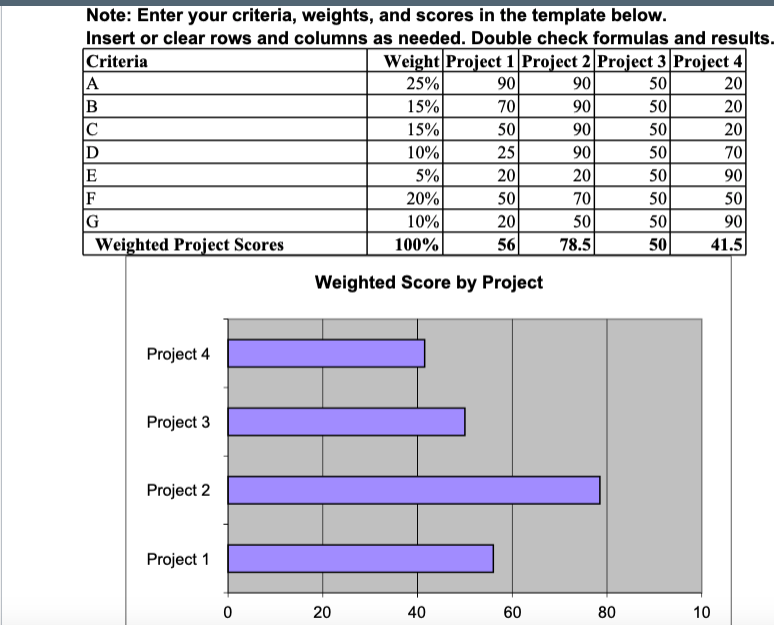

Part 1: Financial Analysis (12 points) Perform A financial analysis for a project using the format provided in chapter 4, figure 4-5. Assume that the projected costs and benefits for this project are spread over four years as follows: Estimated costs are $300,000 in year 1 and $ 40,000 each year in years 2,3, and 4. Estimated benefits are $0 in year 1 and $120,000 each year in years 2,3, and 4. Use a 7 percent discount rate, and round the discount factors to two decimal places. Use the NPV and ROI template to calculate the NPV, ROI and year in which payback occurs. Use the Payback period chart template to draw the payback chart. The templates can be found in Module 4 at the bottom of Module4 Description and Learning Objectives page on Canvas. NOTE: You need to start your analysis from year 1 not 0 as indicated NPV and ROI template. Requirement: 1. Write a paragraph explaining whether you would recommend investing in this project, based on your financial analysis. Part 2: Weighted Scoring Model (12 Points) Create a weighted scoring model to purchase a software from three vendors. The purchase selection is based five criteria: User Friendly worth 20% Technical Support worth 15% Onsite - Training worth 5% Improve Internal Processes 30% Supports user needs 30% Use Module 4 Weighted scoring model template and enter scores for three vendors. Assume that vendor A earns 90 points on User Friendly criteria, 70 points on Technical Support, and 80 on Onsite Training, 60 points on Improving Internal Pocesses, and 80 points on Support User Needs. Vendor B earns 70 points on User Friendly criteria, 80 points on Technical Support, and 70 on Onsite Training, 90 points on Improving Internal Processes, and 80 points on Supporting User Needs. Vendor C earns 40 points on User Friendly criteria, 90 points on Technical Support, and 100 on Onsite Training, 90 points on Improving Internal Processes, and 90 points on Supporting User Needs Requirement 1. Write a short paragraph explaining your final analysis, which vendor you would recommend, and justify your selection. Files Submission: You must submit Excel files for grading along with your interpretations. Financial Analysis for Project Name Created by: Date: Note: Change the inputs, such as discount rate, number of years, costs, and benefits. Be sure to double-check the formulas based on the inputs. The discount factor is not rounded. Discount rate 8% Assume the project is completed in Year 0 Year 11 2 3 Total Costs 100 100 100 100 Discount factor 1.00 0.93 0.86 0.79 Discounted costs 100 93 86 79 358 Benefits 0 200 200 200 Discount factor 1.00 0.93 0.86 0.79 Discounted benefits 0 185 171 159 515 Discounted benefits - costs (100) 93 86 79 158 NPV Cumulative benefits - costs (100) 78 158 0 ROI 44% Payback in Year X Assumptions Enter assumptions here Note: Enter the discounted costs and benefits for your project below. Add and delete rows as needed. Year Costs Benefits Cum Costs Cum Benefits 0 140,000 0 140,000 0 1 37,200 186,000 177,200 186,000 2 34,400 172,000 211,600 358,000 3 31,600 158,000 243,200 516,000 Payback 600,000 500,000 400,000 Payback $ 300,000 200,000 100,000 0 0 1 2 3 Year cumulative costs cumulative benefits 50 Note: Enter your criteria, weights, and scores in the template below. Insert or clear rows and columns as needed. Double check formulas and results. Criteria Weight Project 1 Project 2 Project 3 Project 4 A 25% 90 901 20 B 15% 70 90 501 20 C 15% 50 90 50 20 D 10% 25 90 50 70 E 5% 20 20 50 90 F 20% 50 70 50 50 G 10% 20 50 50 90 Weighted Project Scores 100% 56 78.5 50 41.5 Weighted Score by Project Project 4 Project 3 Project 2 Project 1 0 20 40 60 80 10 Part 1: Financial Analysis (12 points) Perform A financial analysis for a project using the format provided in chapter 4, figure 4-5. Assume that the projected costs and benefits for this project are spread over four years as follows: Estimated costs are $300,000 in year 1 and $ 40,000 each year in years 2,3, and 4. Estimated benefits are $0 in year 1 and $120,000 each year in years 2,3, and 4. Use a 7 percent discount rate, and round the discount factors to two decimal places. Use the NPV and ROI template to calculate the NPV, ROI and year in which payback occurs. Use the Payback period chart template to draw the payback chart. The templates can be found in Module 4 at the bottom of Module4 Description and Learning Objectives page on Canvas. NOTE: You need to start your analysis from year 1 not 0 as indicated NPV and ROI template. Requirement: 1. Write a paragraph explaining whether you would recommend investing in this project, based on your financial analysis. Part 2: Weighted Scoring Model (12 Points) Create a weighted scoring model to purchase a software from three vendors. The purchase selection is based five criteria: User Friendly worth 20% Technical Support worth 15% Onsite - Training worth 5% Improve Internal Processes 30% Supports user needs 30% Use Module 4 Weighted scoring model template and enter scores for three vendors. Assume that vendor A earns 90 points on User Friendly criteria, 70 points on Technical Support, and 80 on Onsite Training, 60 points on Improving Internal Pocesses, and 80 points on Support User Needs. Vendor B earns 70 points on User Friendly criteria, 80 points on Technical Support, and 70 on Onsite Training, 90 points on Improving Internal Processes, and 80 points on Supporting User Needs. Vendor C earns 40 points on User Friendly criteria, 90 points on Technical Support, and 100 on Onsite Training, 90 points on Improving Internal Processes, and 90 points on Supporting User Needs Requirement 1. Write a short paragraph explaining your final analysis, which vendor you would recommend, and justify your selection. Files Submission: You must submit Excel files for grading along with your interpretations. Financial Analysis for Project Name Created by: Date: Note: Change the inputs, such as discount rate, number of years, costs, and benefits. Be sure to double-check the formulas based on the inputs. The discount factor is not rounded. Discount rate 8% Assume the project is completed in Year 0 Year 11 2 3 Total Costs 100 100 100 100 Discount factor 1.00 0.93 0.86 0.79 Discounted costs 100 93 86 79 358 Benefits 0 200 200 200 Discount factor 1.00 0.93 0.86 0.79 Discounted benefits 0 185 171 159 515 Discounted benefits - costs (100) 93 86 79 158 NPV Cumulative benefits - costs (100) 78 158 0 ROI 44% Payback in Year X Assumptions Enter assumptions here Note: Enter the discounted costs and benefits for your project below. Add and delete rows as needed. Year Costs Benefits Cum Costs Cum Benefits 0 140,000 0 140,000 0 1 37,200 186,000 177,200 186,000 2 34,400 172,000 211,600 358,000 3 31,600 158,000 243,200 516,000 Payback 600,000 500,000 400,000 Payback $ 300,000 200,000 100,000 0 0 1 2 3 Year cumulative costs cumulative benefits 50 Note: Enter your criteria, weights, and scores in the template below. Insert or clear rows and columns as needed. Double check formulas and results. Criteria Weight Project 1 Project 2 Project 3 Project 4 A 25% 90 901 20 B 15% 70 90 501 20 C 15% 50 90 50 20 D 10% 25 90 50 70 E 5% 20 20 50 90 F 20% 50 70 50 50 G 10% 20 50 50 90 Weighted Project Scores 100% 56 78.5 50 41.5 Weighted Score by Project Project 4 Project 3 Project 2 Project 1 0 20 40 60 80 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts