Question: Part 1. Financial Ratios Please compute the 6 ratios requested below for the Purple Company as of and for the year ended December 31, 2023.

Part 1. Financial Ratios

Please compute the 6 ratios requested below for the Purple Company as of and for the year ended December 31, 2023. Please refer to Illustration 4B.1 on page 4-34 of our textbook for a summary of financial ratios and formulas. Compute each ratio to 2 decimal places using excel rounding.

The 6 ratios you should compute are:

- Current ratio

- Inventory turnover

- Asset turnover

- Return on assets

- Earnings per share

- Debt to assets ratio

Compute the 6 ratios using the following data:

Current assets $27,210,000

Current liabilities $16,000,000

Net sales $83,200,000

Accounts receivable beginning of year $ 6,100,000

Accounts receivable end of year $ 7,500,000

Cost of goods sold $58,920,000

Inventory beginning of year $ 6,200,000

Inventory end of year $ 7,825,000

Net income $ 4,360,000

Preferred dividends $ 200,000

Weighted-average common shares outstding 500,000

Outstanding shares 500,000

Total liabilities $21,860,000

Total assets $47,100,000

Average total assets $46,345,000

Common stockholders equity $25,000,000

Part 2. Preparing a Bank Reconciliation

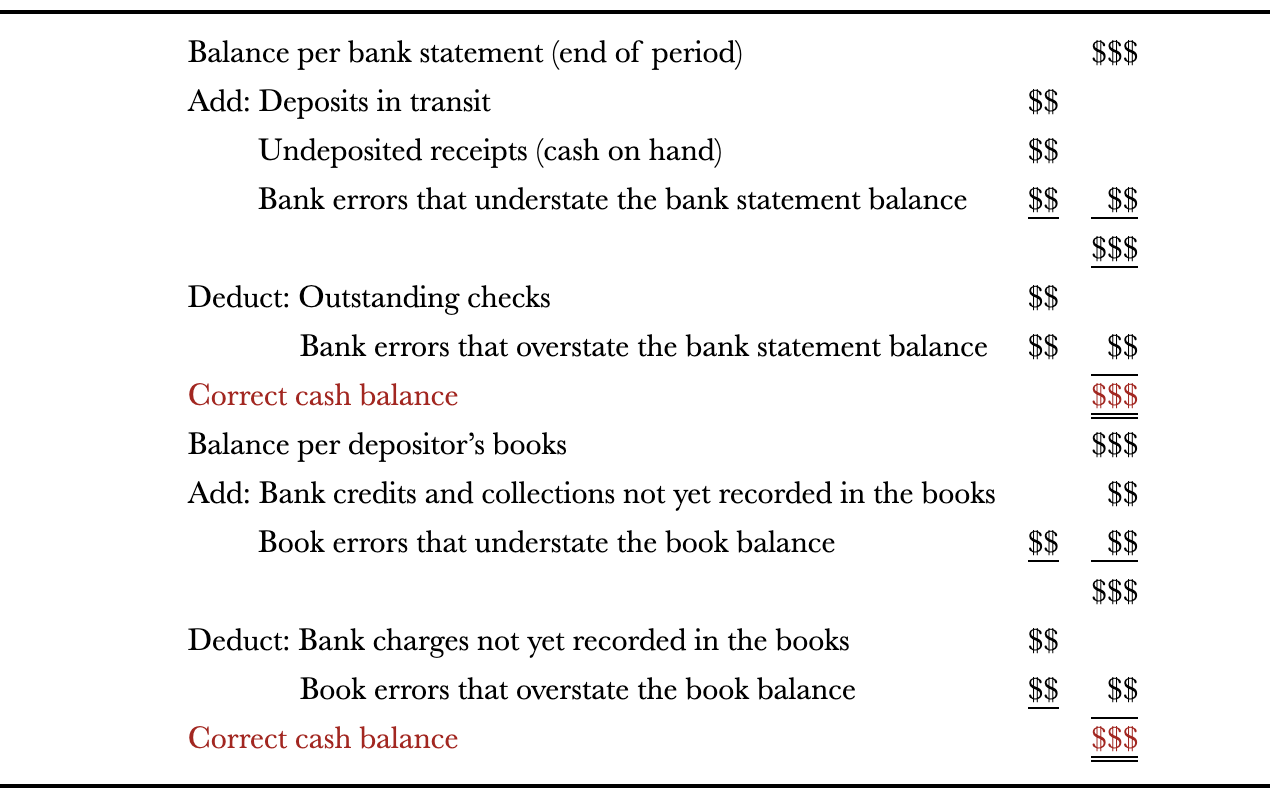

Prepare a bank reconciliation for the Purple Company as of December 31, 2023. Use the format shown in Example 6A.1 at the top of page 6-41 (this is in Appendix 6A) of our textbook. The heading should contain the name of Purple Companys Bank: Main Street Bank.

The data you will need is as follows:

Balance per bank statement as of December 31, 2023 $82,465

Deposits in transit as of December 31, 2023 $ 9,775

Outstanding checks as of December 31, 2023 $16,170

Correct Cash Balance as of December 31, 2023 $76,070

Balance per Books as of December 31, 2023 $75,795

Interest collected by the bank in December, 2023

but not recorded in Purples books as of

December 31, 2023 $ 600

A Not Sufficient Funds (i.e. NSF) check was

recorded by the bank in December, 2023 but

not recorded in Purples books as of

December 31, 2023 $ 325

\begin{tabular}{|c|c|} \hline Balance per bank statement (end of period) & \\ \hline Add: Deposits in transit & $ \\ \hline Undeposited receipts (cash on hand) & $ \\ \hline Bank errors that understate the bank statement balance & $ \\ \hline & \\ \hline Deduct: Outstanding checks & $ \\ \hline Bank errors that overstate the bank statement balance & $ \\ \hline Correct cash balance & \\ \hline Balance per depositor's books & \\ \hline Add: Bank credits and collections not yet recorded in the books & \\ \hline Book errors that understate the book balance & $ \\ \hline & \\ \hline Deduct: Bank charges not yet recorded in the books & $ \\ \hline Book errors that overstate the book balance & $ \\ \hline Correct cash balance & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts