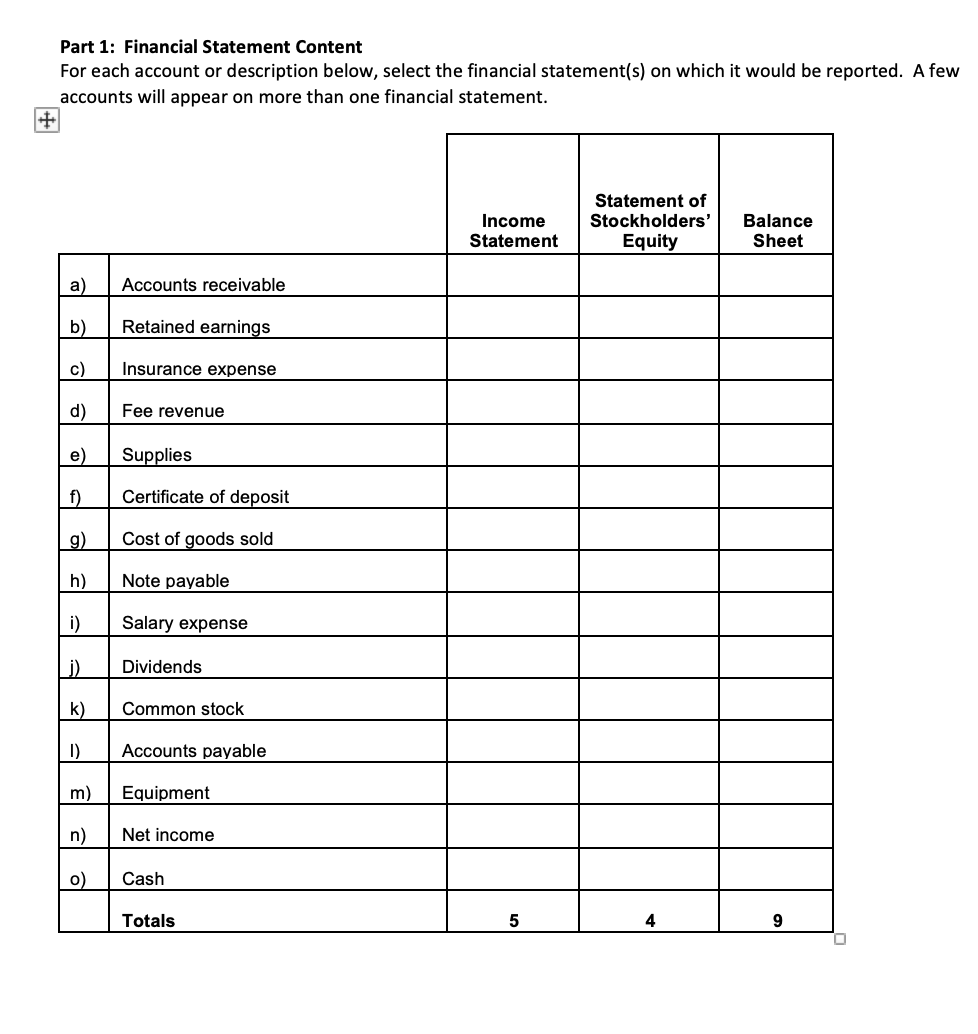

Question: Part 1: Financial Statement Content For each account or description below, select the financial statement(s) on which it would be reported. A few accounts will

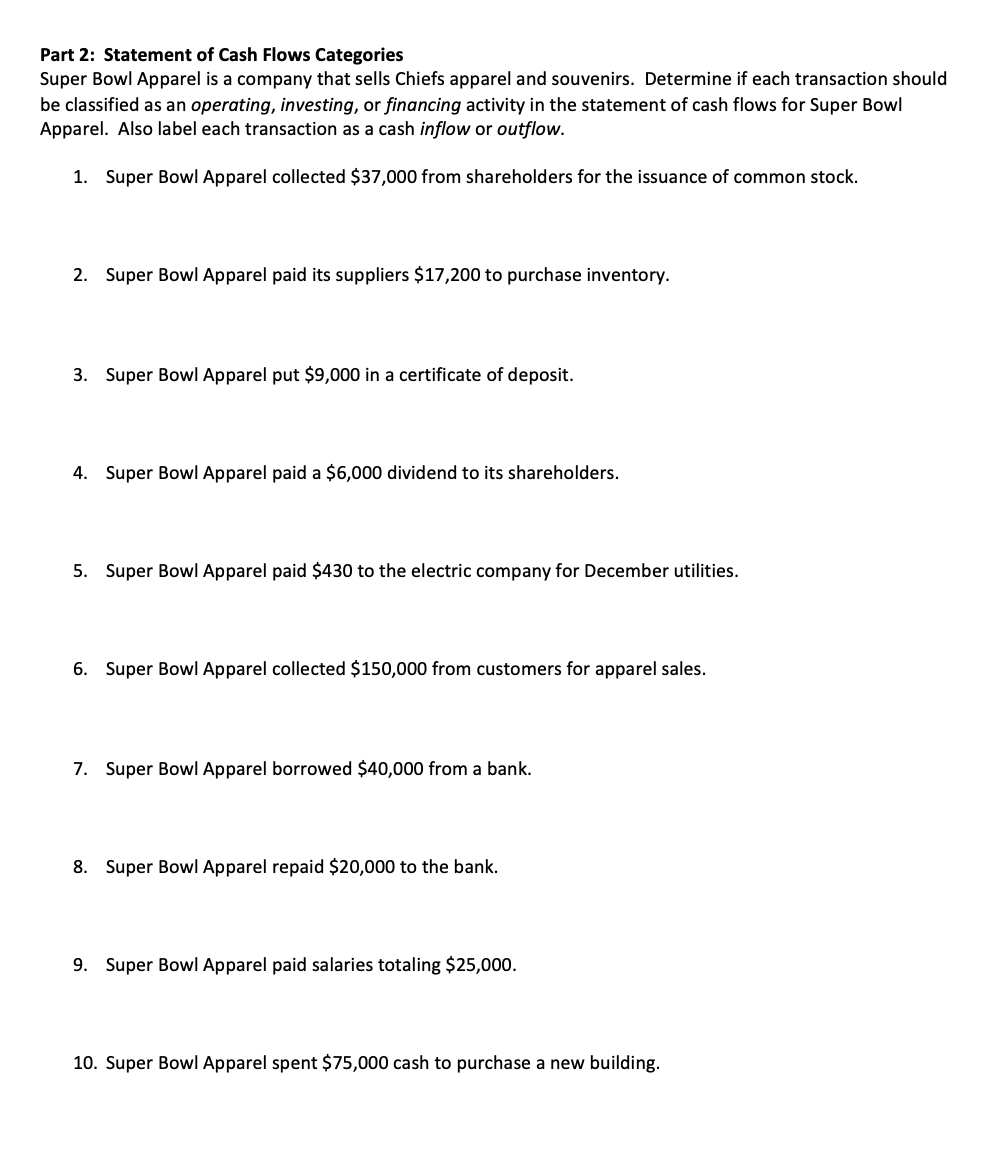

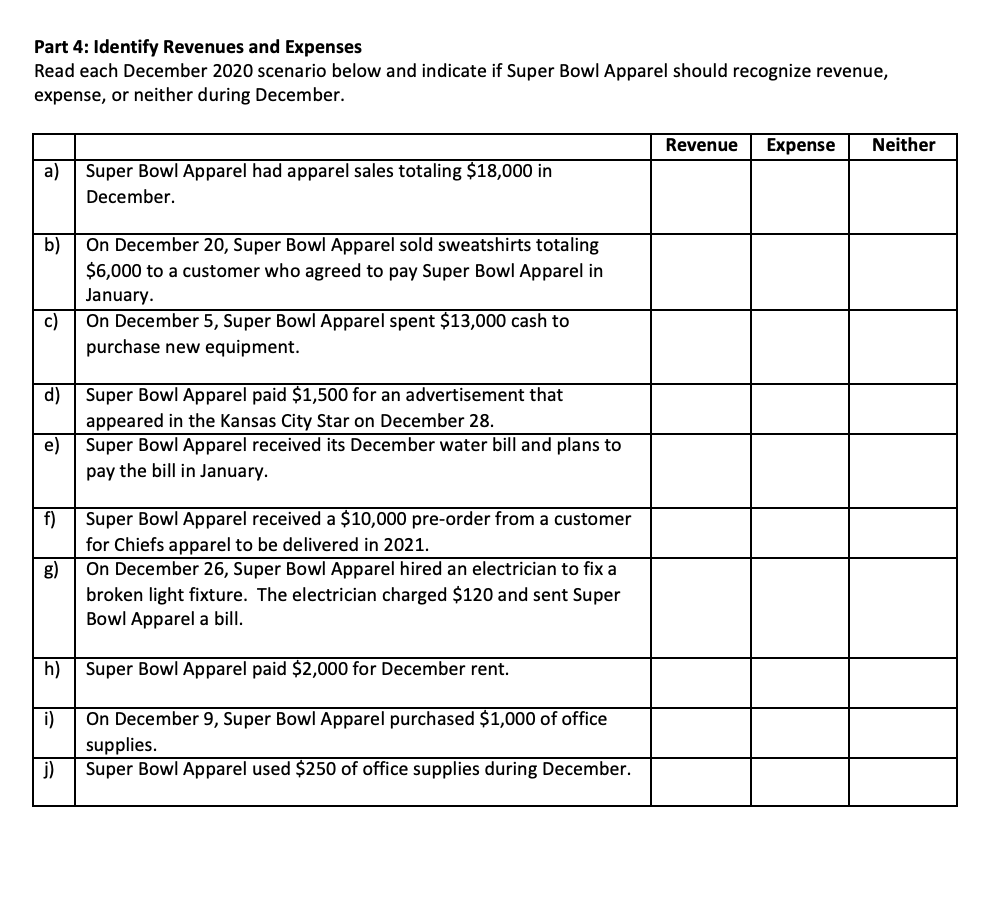

Part 1: Financial Statement Content For each account or description below, select the financial statement(s) on which it would be reported. A few accounts will appear on more than one financial statement. T Income Statement Statement of Stockholders' Equity Balance Sheet a) Accounts receivable b) Retained earnings C) Insurance expense d) Fee revenue e) Supplies f) Certificate of deposit g) Cost of goods sold h) Note payable i) Salary expense j) Dividends k) Common stock 1) Accounts payable m) Equipment n) Net income o) Cash Totals 5 4 9 Part 2: Statement of Cash Flows Categories Super Bowl Apparel is a company that sells Chiefs apparel and souvenirs. Determine if each transaction should be classified as an operating, investing, or financing activity in the statement of cash flows for Super Bowl Apparel. Also label each transaction as a cash inflow or outflow. 1. Super Bowl Apparel collected $37,000 from shareholders for the issuance of common stock. 2. Super Bowl Apparel paid its suppliers $17,200 to purchase inventory. 3. Super Bowl Apparel put $9,000 in a certificate of deposit. 4. Super Bowl Apparel paid a $6,000 dividend to its shareholders. 5. Super Bowl Apparel paid $430 to the electric company for December utilities. 6. Super Bowl Apparel collected $150,000 from customers for apparel sales. 7. Super Bowl Apparel borrowed $40,000 from a bank. 8. Super Bowl Apparel repaid $20,000 to the bank. 9. Super Bowl Apparel paid salaries totaling $25,000. 10. Super Bowl Apparel spent $75,000 cash to purchase a new building. Part 4: Identify Revenues and Expenses Read each December 2020 scenario below and indicate if Super Bowl Apparel should recognize revenue, expense, or neither during December. Revenue Expense Neither a) Super Bowl Apparel had apparel sales totaling $18,000 in December b) On December 20, Super Bowl Apparel sold sweatshirts totaling $6,000 to a customer who agreed to pay Super Bowl Apparel in January On December 5, Super Bowl Apparel spent $13,000 cash to purchase new equipment. c) d) Super Bowl Apparel paid $1,500 for an advertisement that appeared in the Kansas City Star on December 28. Super Bowl Apparel received its December water bill and plans to pay the bill in January. e) f) Super Bowl Apparel received a $10,000 pre-order from a customer for Chiefs apparel to be delivered in 2021. On December 26, Super Bowl Apparel hired an electrician to fix a broken light fixture. The electrician charged $120 and sent Super Bowl Apparel a bill. h) Super Bowl Apparel paid $2,000 for December rent. i) On December 9, Super Bowl Apparel purchased $1,000 of office supplies. Super Bowl Apparel used $250 of office supplies during December. j)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts