Question: Part 1 - Four questions (50 marks) Based on your review of the Eye Foundation (a fictional charity) annual report and financial statements for the

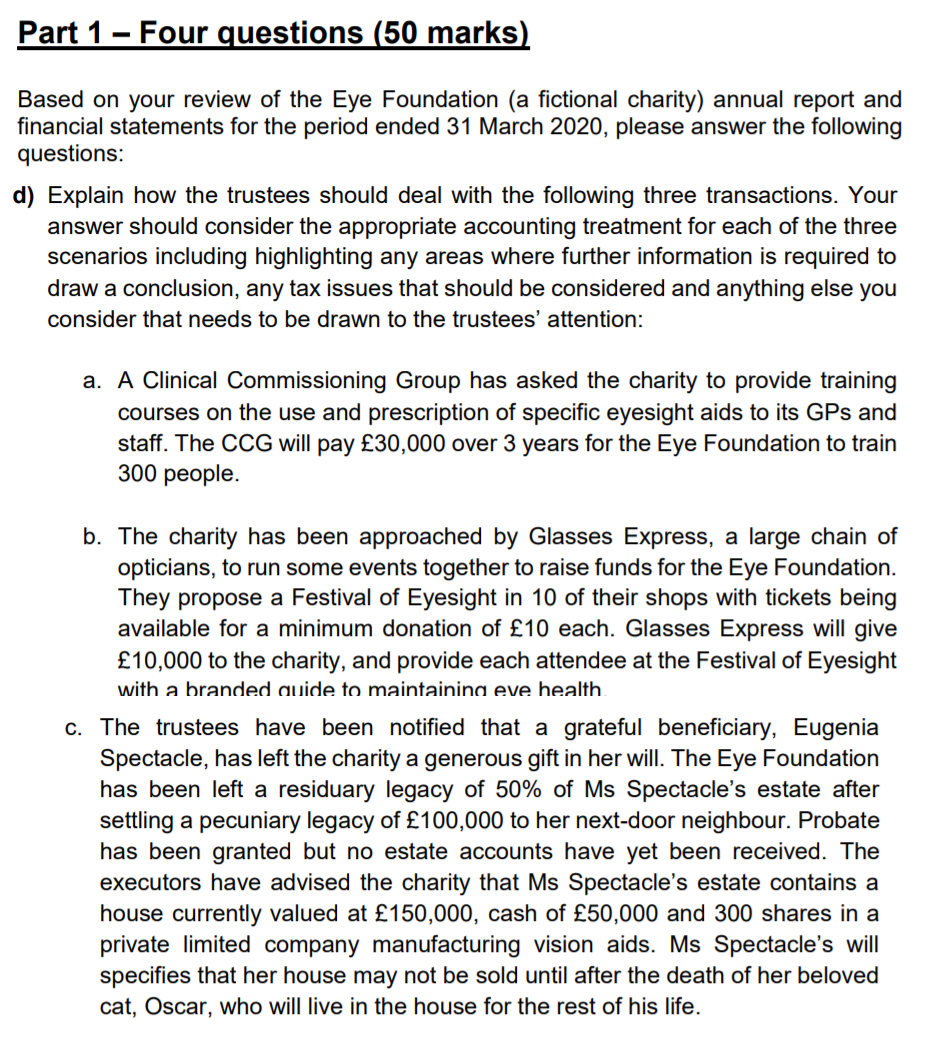

Part 1 - Four questions (50 marks) Based on your review of the Eye Foundation (a fictional charity) annual report and financial statements for the period ended 31 March 2020, please answer the following questions: d) Explain how the trustees should deal with the following three transactions. Your answer should consider the appropriate accounting treatment for each of the three scenarios including highlighting any areas where further information is required to draw a conclusion, any tax issues that should be considered and anything else you consider that needs to be drawn to the trustees' attention: a. A Clinical Commissioning Group has asked the charity to provide training courses on the use and prescription of specific eyesight aids to its GPs and staff. The CCG will pay 30,000 over 3 years for the Eye Foundation to train 300 people. b. The charity has been approached by Glasses Express, a large chain of opticians, to run some events together to raise funds for the Eye Foundation. They propose a Festival of Eyesight in 10 of their shops with tickets being available for a minimum donation of 10 each. Glasses Express will give 10,000 to the charity, and provide each attendee at the Festival of Eyesight with a branded auide to maintaining eve health C. The trustees have been notified that a grateful beneficiary, Eugenia Spectacle, has left the charity a generous gift in her will. The Eye Foundation has been left a residuary legacy of 50% of Ms Spectacle's estate after settling a pecuniary legacy of 100,000 to her next-door neighbour. Probate has been granted but no estate accounts have yet been received. The executors have advised the charity that Ms Spectacle's estate contains a house currently valued at 150,000, cash of 50,000 and 300 shares in a private limited company manufacturing vision aids. Ms Spectacle's will specifies that her house may not be sold until after the death of her beloved cat, Oscar, who will live in the house for the rest of his life. Part 1 - Four questions (50 marks) Based on your review of the Eye Foundation (a fictional charity) annual report and financial statements for the period ended 31 March 2020, please answer the following questions: d) Explain how the trustees should deal with the following three transactions. Your answer should consider the appropriate accounting treatment for each of the three scenarios including highlighting any areas where further information is required to draw a conclusion, any tax issues that should be considered and anything else you consider that needs to be drawn to the trustees' attention: a. A Clinical Commissioning Group has asked the charity to provide training courses on the use and prescription of specific eyesight aids to its GPs and staff. The CCG will pay 30,000 over 3 years for the Eye Foundation to train 300 people. b. The charity has been approached by Glasses Express, a large chain of opticians, to run some events together to raise funds for the Eye Foundation. They propose a Festival of Eyesight in 10 of their shops with tickets being available for a minimum donation of 10 each. Glasses Express will give 10,000 to the charity, and provide each attendee at the Festival of Eyesight with a branded auide to maintaining eve health C. The trustees have been notified that a grateful beneficiary, Eugenia Spectacle, has left the charity a generous gift in her will. The Eye Foundation has been left a residuary legacy of 50% of Ms Spectacle's estate after settling a pecuniary legacy of 100,000 to her next-door neighbour. Probate has been granted but no estate accounts have yet been received. The executors have advised the charity that Ms Spectacle's estate contains a house currently valued at 150,000, cash of 50,000 and 300 shares in a private limited company manufacturing vision aids. Ms Spectacle's will specifies that her house may not be sold until after the death of her beloved cat, Oscar, who will live in the house for the rest of his life

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts