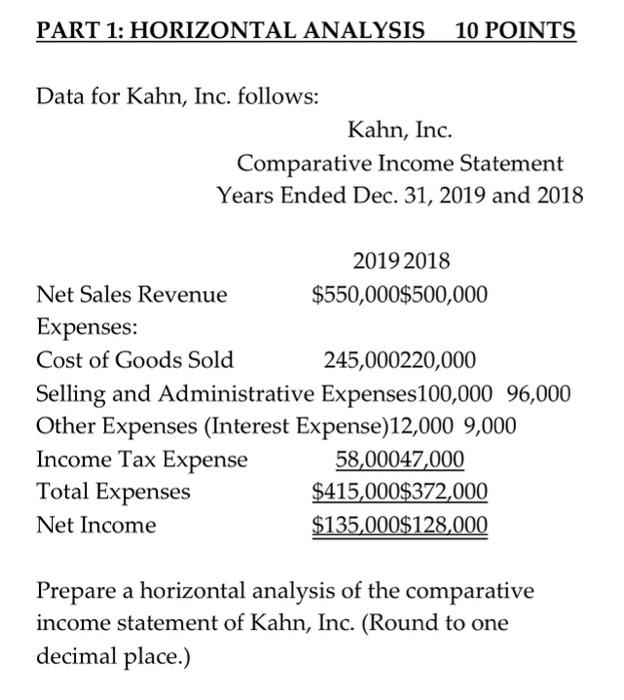

Question: PART 1: HORIZONTAL ANALYSIS 10 POINTS Data for Kahn, Inc. follows: Kahn, Inc. Comparative Income Statement Years Ended Dec. 31, 2019 and 2018 2019 2018

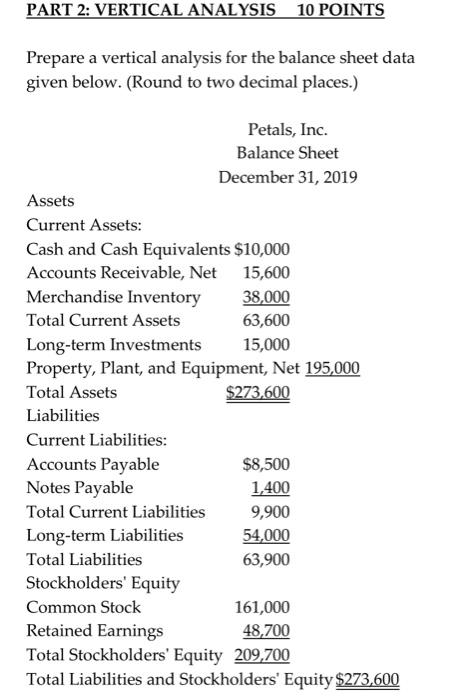

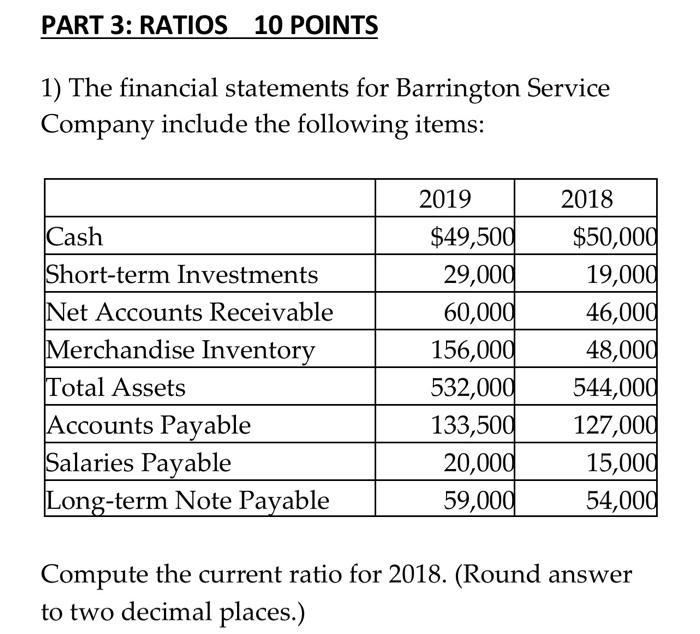

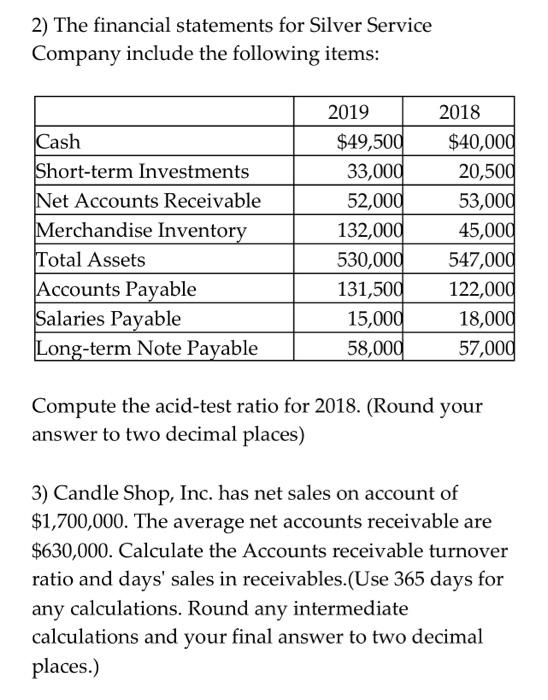

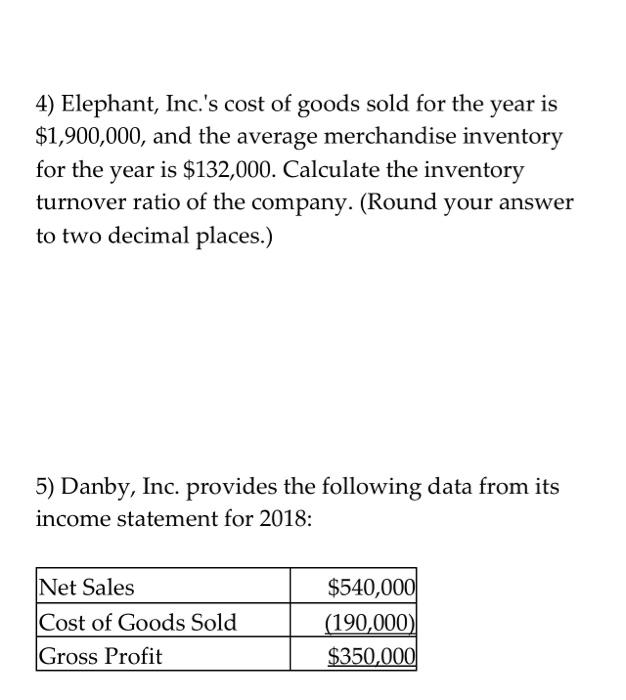

PART 1: HORIZONTAL ANALYSIS 10 POINTS Data for Kahn, Inc. follows: Kahn, Inc. Comparative Income Statement Years Ended Dec. 31, 2019 and 2018 2019 2018 Net Sales Revenue $550,000$500,000 Expenses: Cost of Goods Sold 245,000220,000 Selling and Administrative Expenses100,000 96,000 Other Expenses (Interest Expense)12,000 9,000 Income Tax Expense 58,00047,000 Total Expenses $415,000$372,000 Net Income $135,000$128,000 Prepare a horizontal analysis of the comparative income statement of Kahn, Inc. (Round to one decimal place.) PART 2: VERTICAL ANALYSIS 10 POINTS Prepare a vertical analysis for the balance sheet data given below. (Round to two decimal places.) Petals, Inc. Balance Sheet December 31, 2019 Assets Current Assets: Cash and Cash Equivalents $10,000 Accounts Receivable, Net 15,600 Merchandise Inventory 38,000 Total Current Assets 63,600 Long-term Investments 15,000 Property, Plant, and Equipment, Net 195,000 Total Assets $273.600 Liabilities Current Liabilities: Accounts Payable $8,500 Notes Payable 1,400 Total Current Liabilities 9,900 Long-term Liabilities 54,000 Total Liabilities 63,900 Stockholders' Equity Common Stock 161,000 Retained Earnings 48,700 Total Stockholders' Equity 209,700 Total Liabilities and Stockholders' Equity $273,600 PART 3: RATIOS 10 POINTS 1) The financial statements for Barrington Service Company include the following items: 2019 2018 Cash Short-term Investments Net Accounts Receivable Merchandise Inventory Total Assets Accounts Payable Salaries Payable Long-term Note Payable $49,500 29,000 60,000 156,000 532,000 133,500 20,000 59,000 $50,000 19,000 46,000 48,000 544,000 127,000 15,000 54,000 Compute the current ratio for 2018. (Round answer to two decimal places.) 2) The financial statements for Silver Service Company include the following items: Cash Short-term Investments Net Accounts Receivable Merchandise Inventory Total Assets Accounts Payable Salaries Payable Long-term Note Payable 2019 $49,500 33,000 52,000 132,000 530,000 131,500 15,000 58,000 2018 $40,000 20,500 53,000 45,000 547,000 122,000 18,000 57,000 Compute the acid-test ratio for 2018. (Round your answer to two decimal places) 3) Candle Shop, Inc. has net sales on account of $1,700,000. The average net accounts receivable are $630,000. Calculate the Accounts receivable turnover ratio and days' sales in receivables.(Use 365 days for any calculations. Round any intermediate calculations and your final answer to two decimal places.) 4) Elephant, Inc.'s cost of goods sold for the year is $1,900,000, and the average merchandise inventory for the year is $132,000. Calculate the inventory turnover ratio of the company. (Round your answer to two decimal places.) 5) Danby, Inc. provides the following data from its income statement for 2018: Net Sales Cost of Goods Sold Gross Profit $540,000 (190,000) $350,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts