Question: Part 1: Journal entries, adjusting entries, calculation and the section of Stockholders' Equity (75 marks) Catte Corp. has the following selected information on 1 January

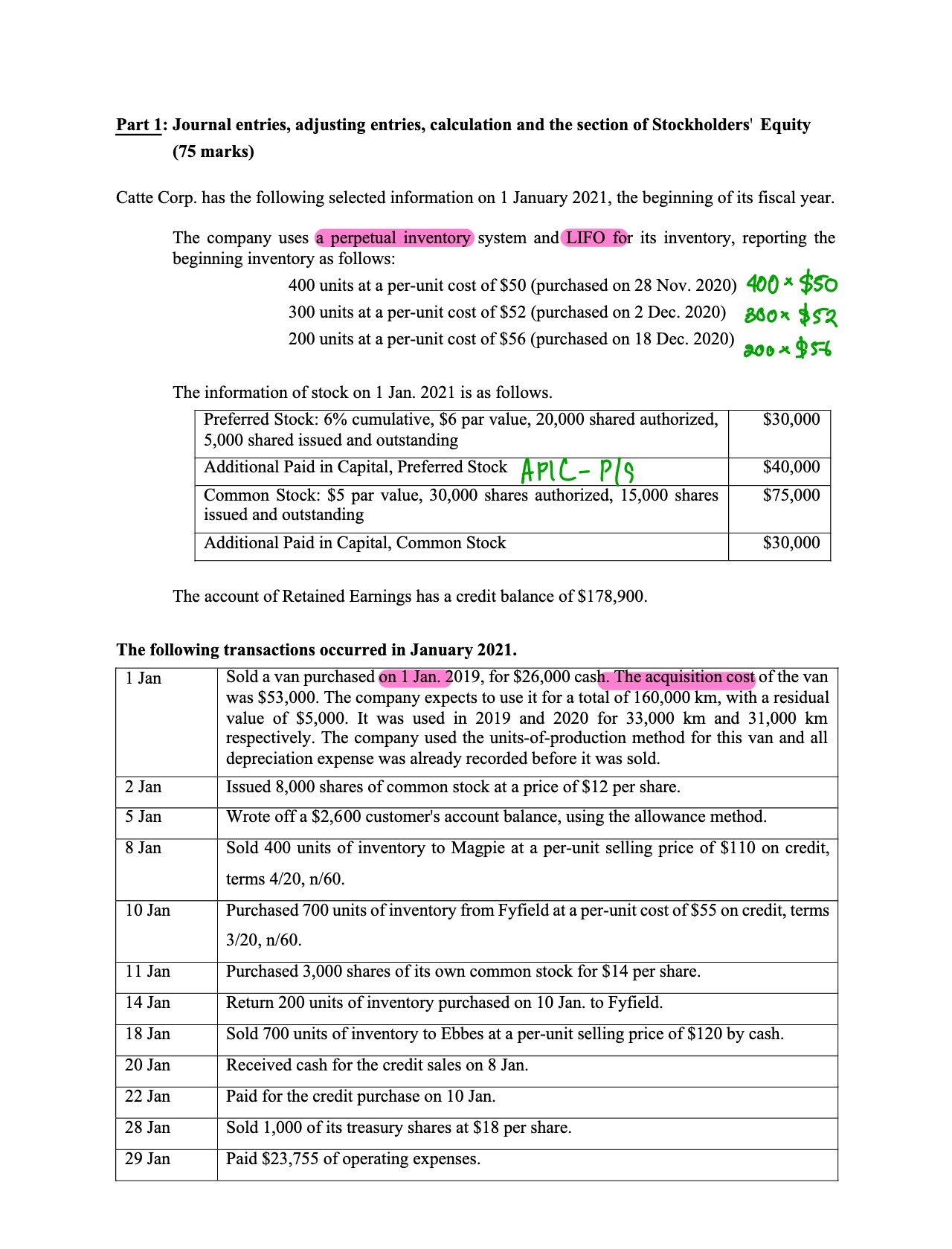

Part 1: Journal entries, adjusting entries, calculation and the section of Stockholders' Equity (75 marks) Catte Corp. has the following selected information on 1 January 2021, the beginning of its fiscal year. The company uses a perpetual inventory system and LIFO for its inventory, reporting the beginning inventory as follows: 400 units at a per-unit cost of $50 (purchased on 28 Nov. 2020) 400 * $50 300 units at a per-unit cost of $52 (purchased on 2 Dec. 2020) 360* $52 200 units at a per-unit cost of $56 (purchased on 18 Dec. 2020) 20 x 95-6 The information of stock on 1 Jan. 2021 is as follows. Preferred Stock: 6% cumulative, $6 par value, 20,000 shared authorized, $30,000 5,000 shared issued and outstanding Additional Paid in Capital, Preferred Stock APIC - PLS $40,000 Common Stock: $5 par value, 30,000 shares authorized, 15,000 shares $75,000 issued and outstanding Additional Paid in Capital, Common Stock $30,000 The account of Retained Earnings has a credit balance of $178,900. The following transactions occurred in January 2021. 1 Jan Sold a van purchased on 1 Jan. 2019, for $26,000 cash. The acquisition cost of the van was $53,000. The company expects to use it for a total of 160,000 km, with a residual value of $5,000. It was used in 2019 and 2020 for 33,000 km and 31,000 km respectively. The company used the units-of-production method for this van and all depreciation expense was already recorded before it was sold. 2 Jan Issued 8,000 shares of common stock at a price of $12 per share. 5 Jan Wrote off a $2,600 customer's account balance, using the allowance method. 8 Jan Sold 400 units of inventory to Magpie at a per-unit selling price of $110 on credit, terms 4/20, n/60. 10 Jan Purchased 700 units of inventory from Fyfield at a per-unit cost of $55 on credit, terms 3/20, n/60. 11 Jan Purchased 3,000 shares of its own common stock for $14 per share. 14 Jan Return 200 units of inventory purchased on 10 Jan. to Fyfield. 18 Jan Sold 700 units of inventory to Ebbes at a per-unit selling price of $120 by cash. 20 Jan Received cash for the credit sales on 8 Jan. 22 Jan Paid for the credit purchase on 10 Jan. 28 Jan Sold 1,000 of its treasury shares at $18 per share. 29 Jan Paid $23,755 of operating expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts