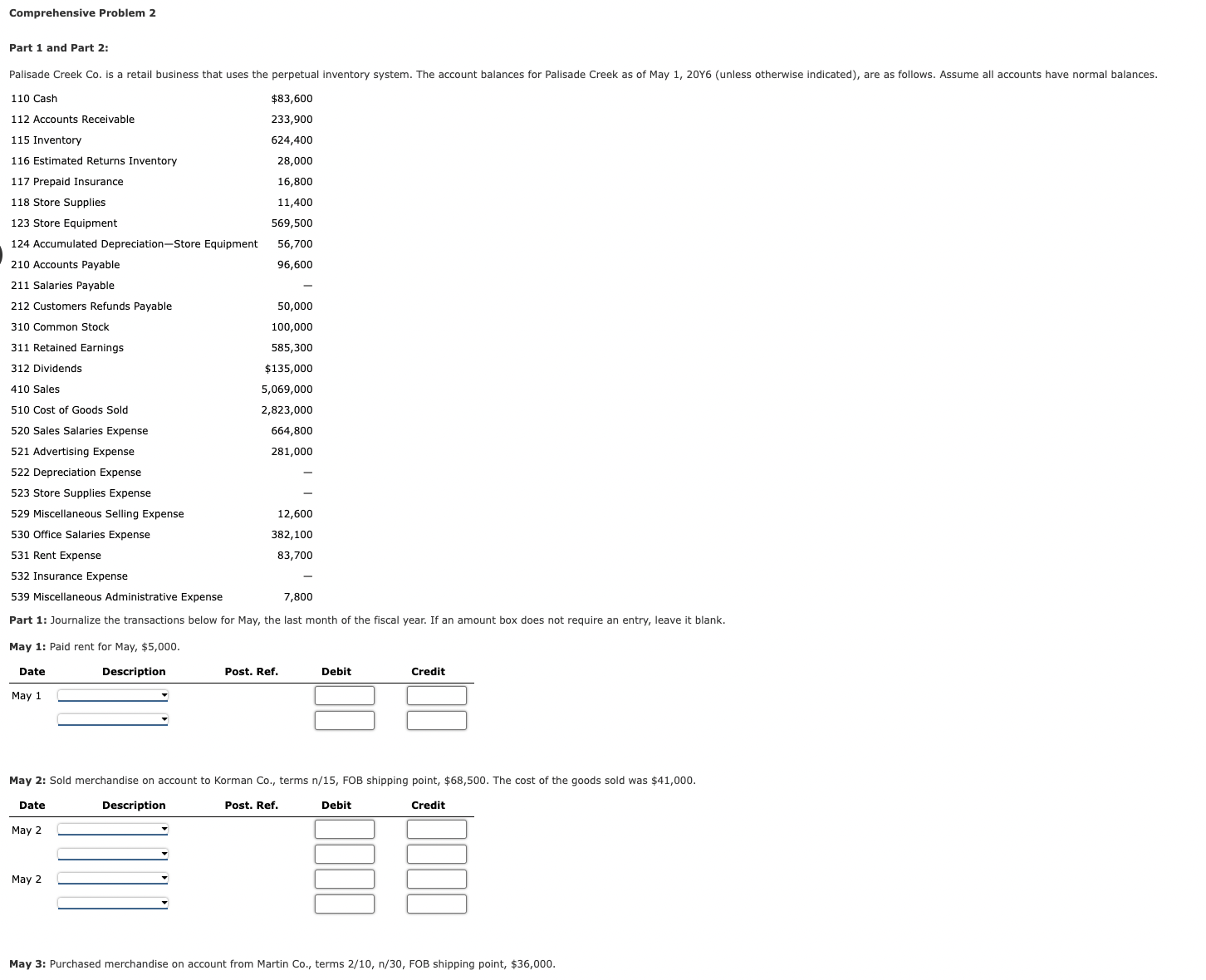

Question: Part 1: Journalize the transactions below for May, the last month of the fiscal year. If an amount box does not require an entry, leave

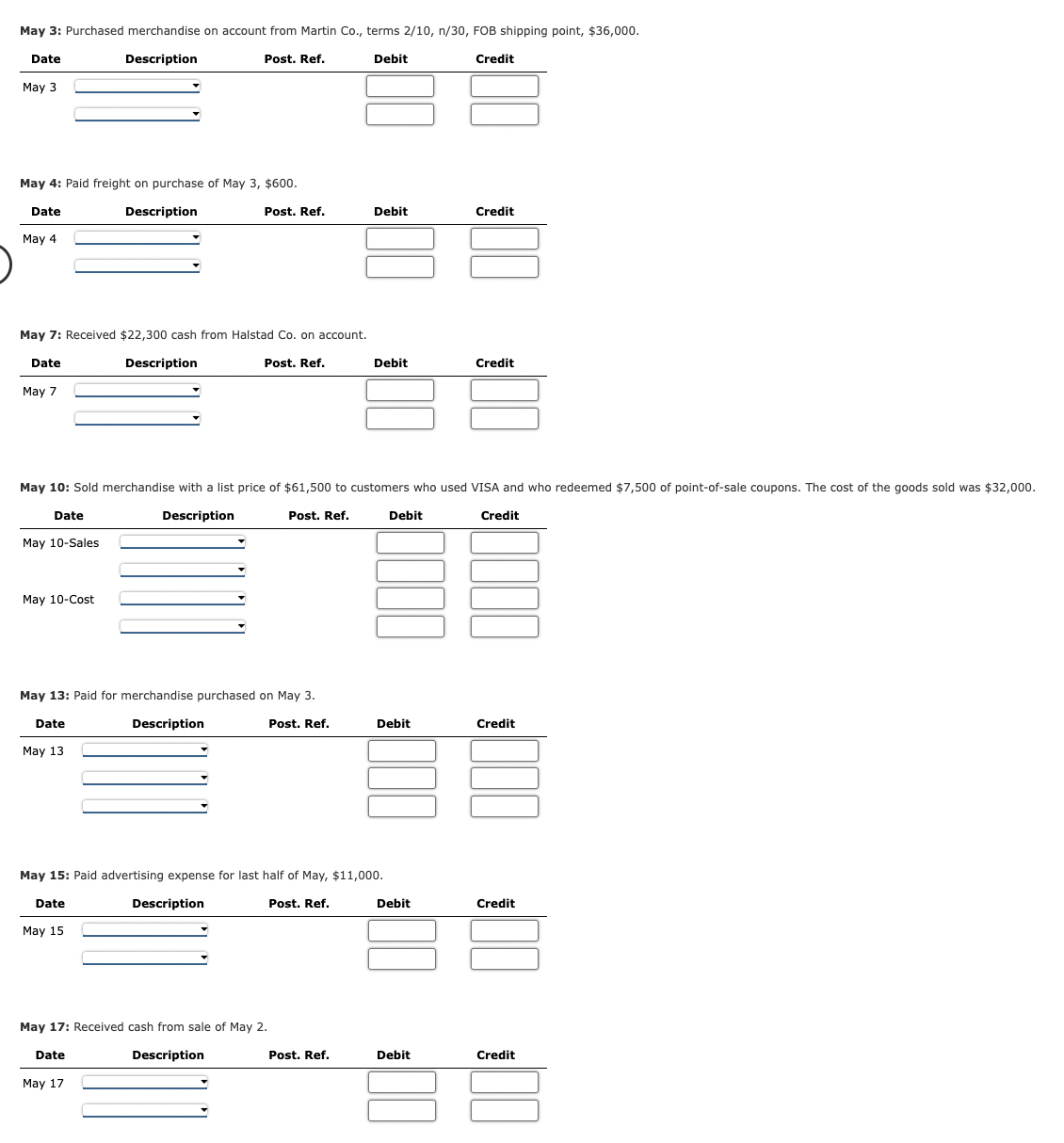

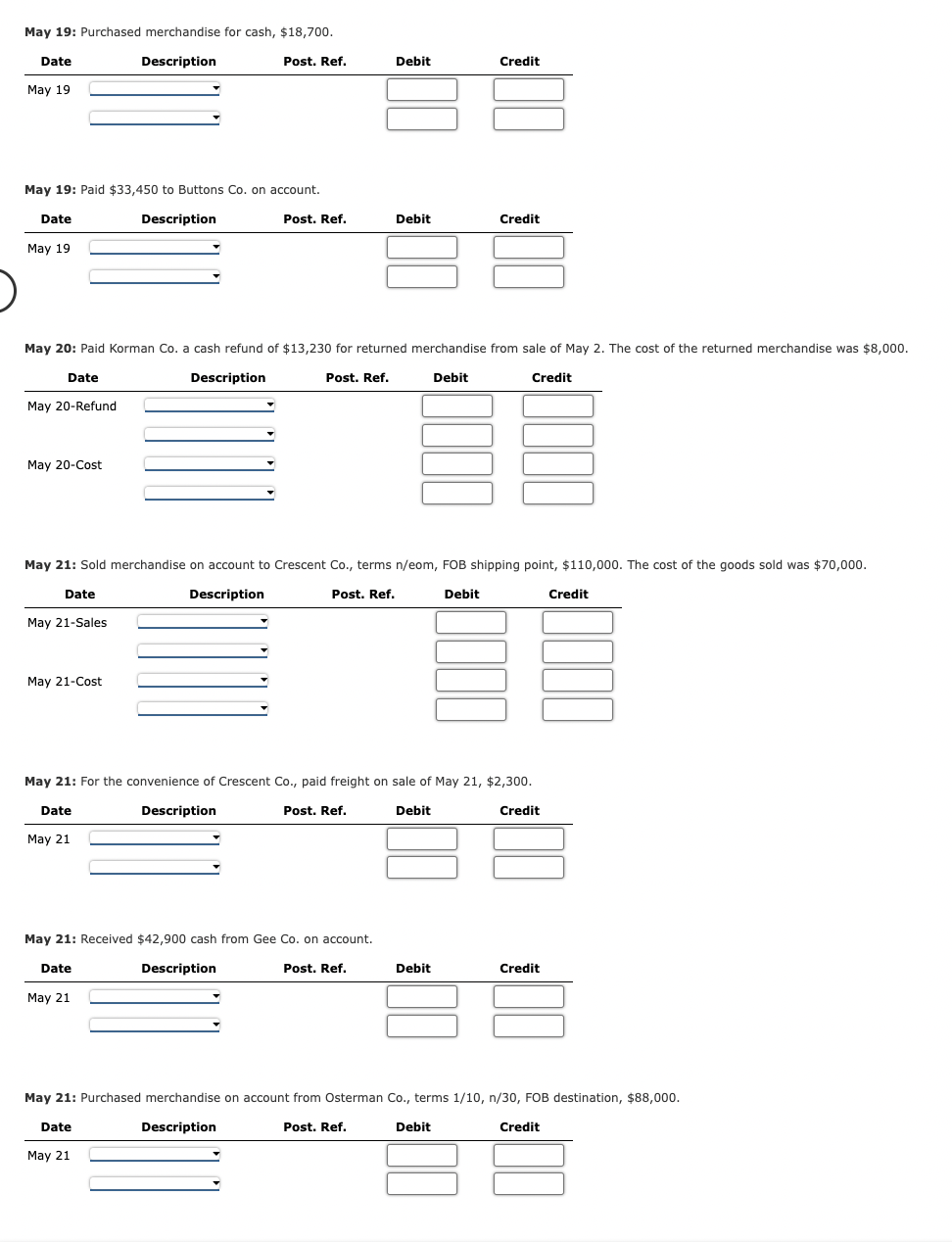

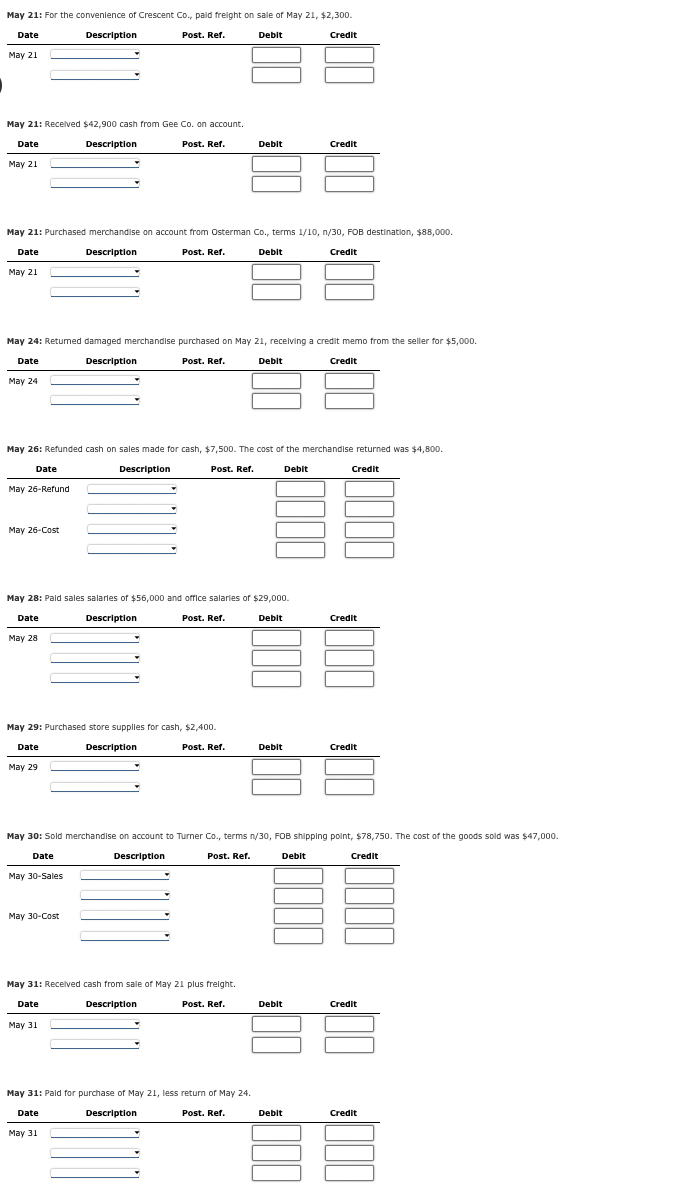

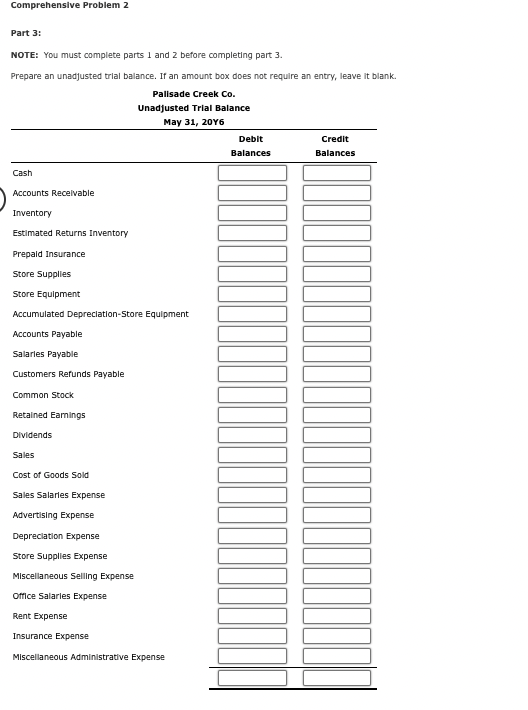

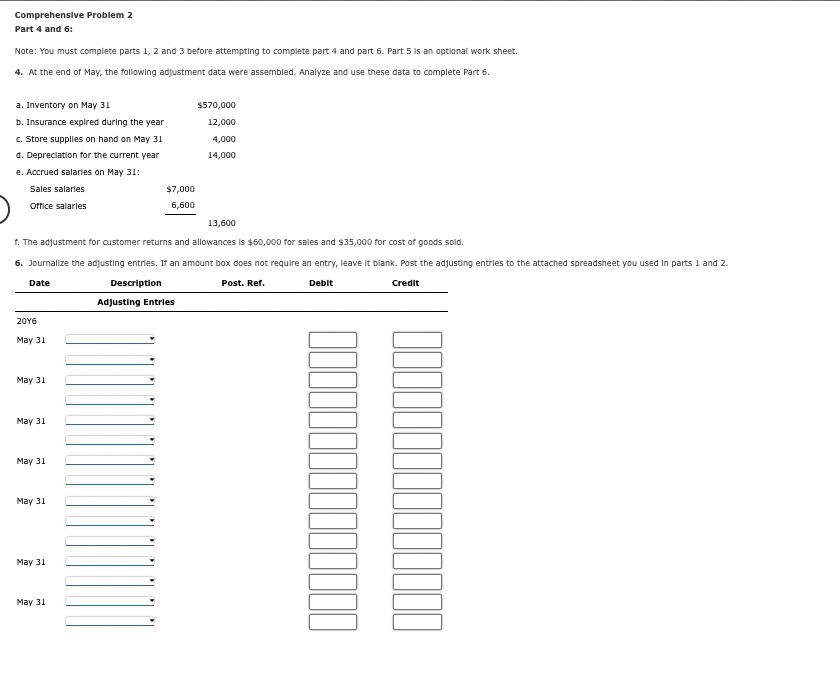

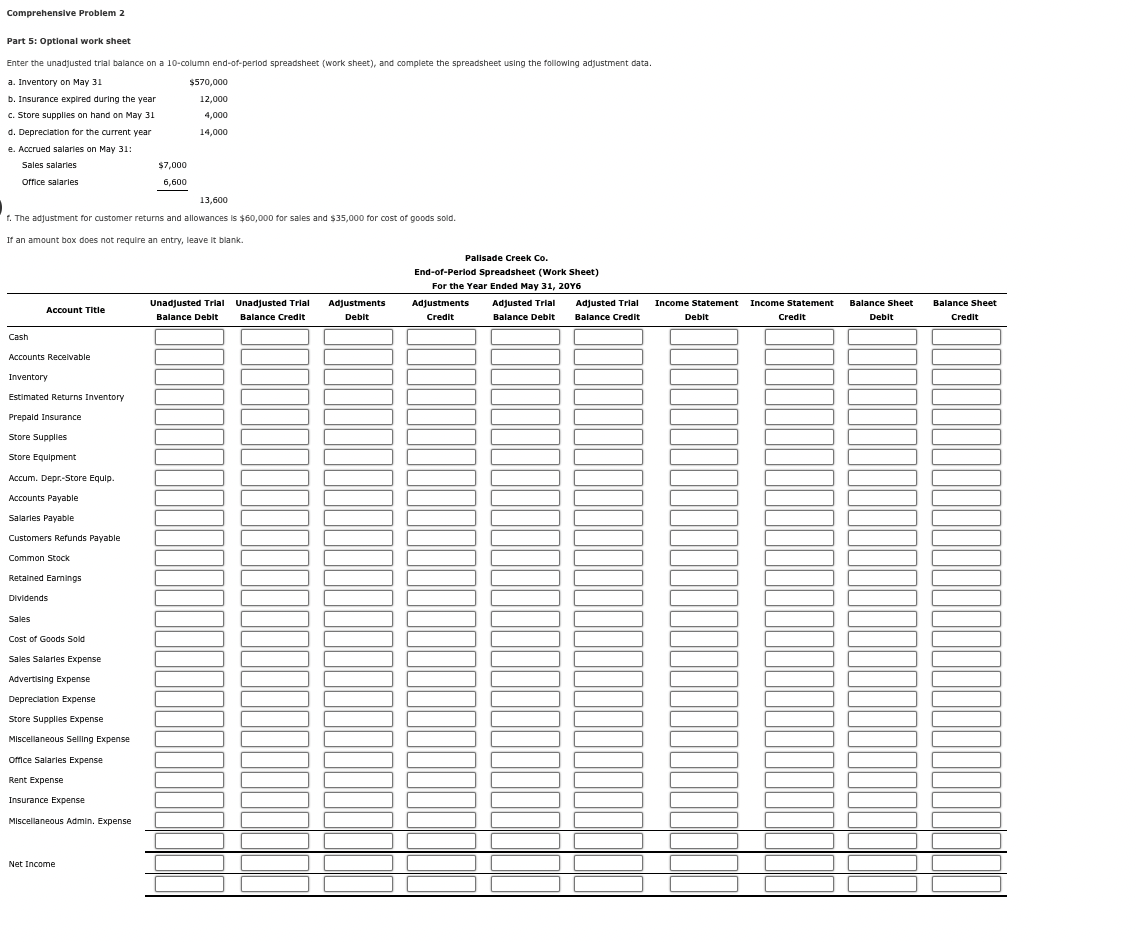

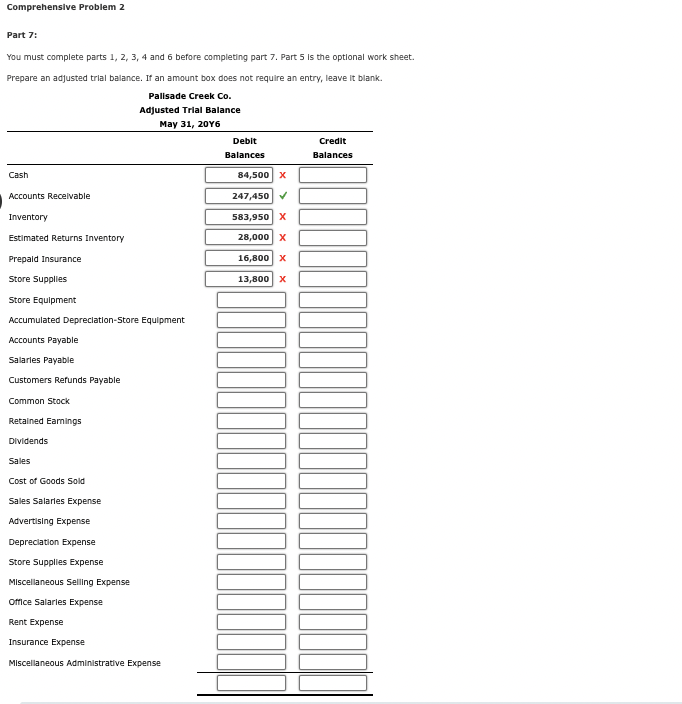

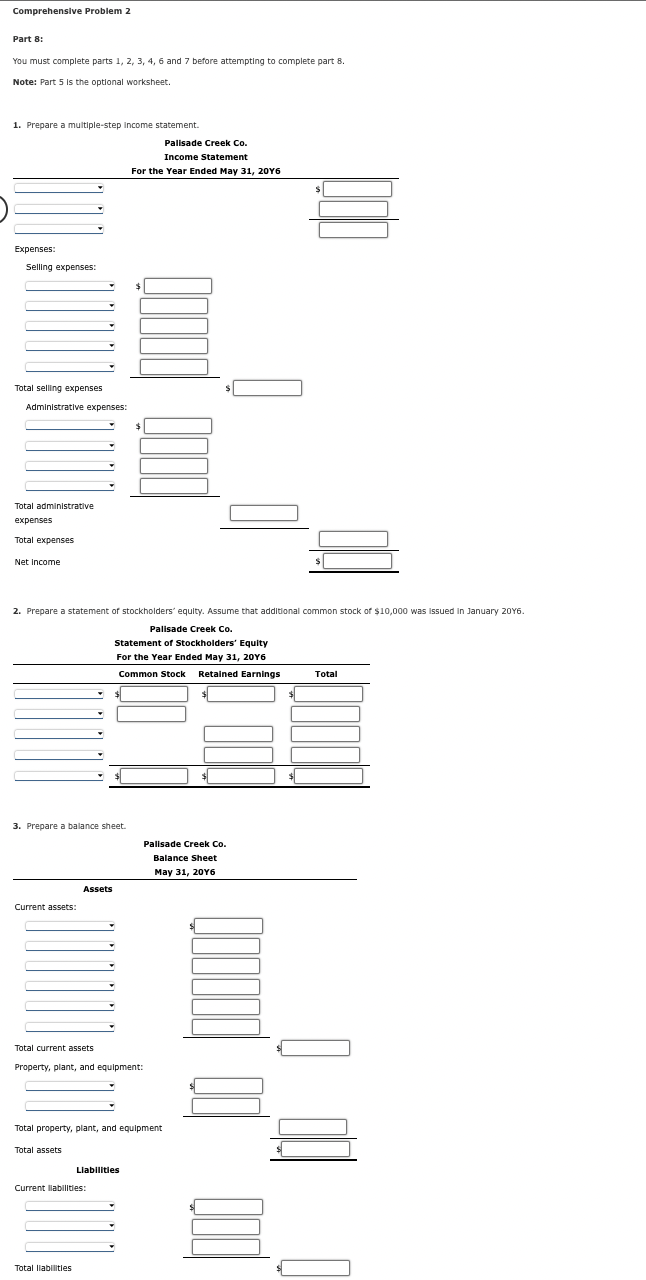

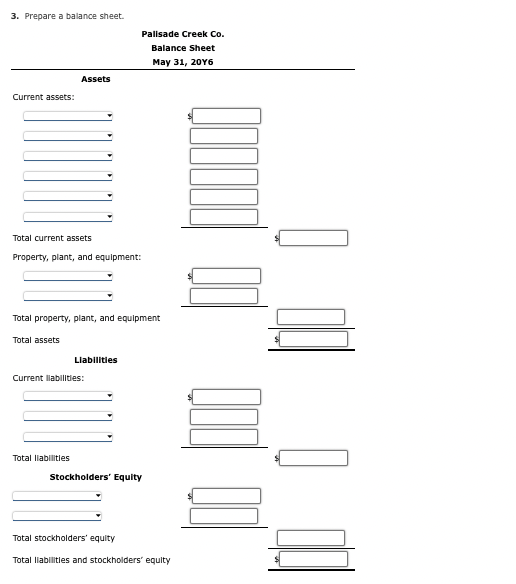

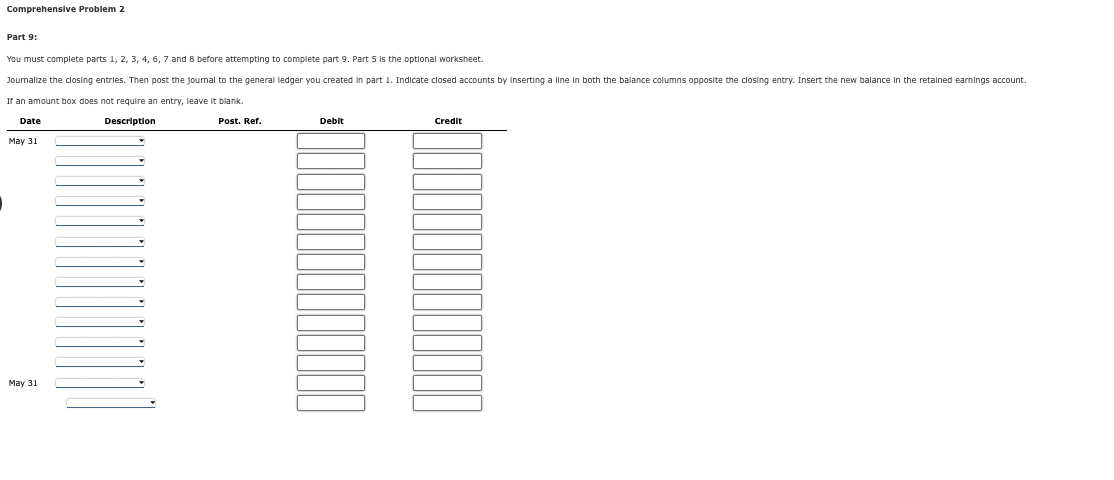

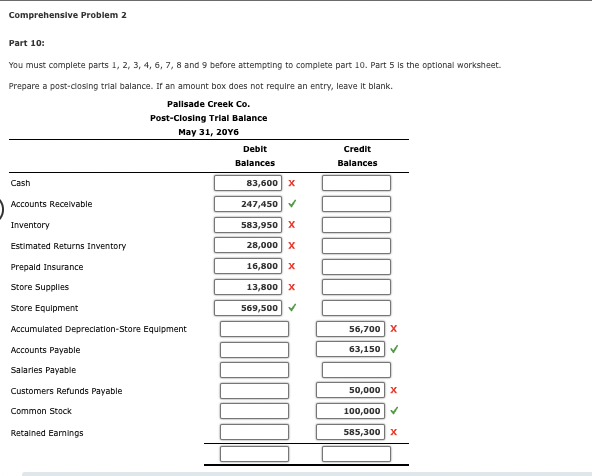

Part 1: Journalize the transactions below for May, the last month of the fiscal year. If an amount box does not require an entry, leave it blank. May 1: Paid rent for May, $5,000. May 2: Sold merchandise on account to Korman Co., terms n/15, FOB shipping point, $68,500. The cost of the goods sold was $41,000. May 3: Purchased merchandise on account from Martin Co., terms 2/10,n/30, FOB shipping point, $36,000. May 3: Purchased merchandise on account from Martin Co., terms 2/10,n/30, FOB shipping point, $36,000. May 4: Paid freight on purchase of May 3, $600. May 7: Received $22,300 cash from Halstad Co. on account. May 10: Sold merchandise with a list price of $61,500 to customers who used VISA and who redeemed $7,500 May 13: Paid for merchandise purchased on May 3. May 15: Paid advertising expense for last half of May, $11,000. May 17: Received cash from sale of May 2. May 19: Purchased merchandise for cash, $18,700. May 19: Paid $33,450 to Buttons Co. on account. May 20: Paid Korman Co. a cash refund of $13,230 for returned merchandise from sale May 21: Sold merchandise on account to Crescent Co., terms n/eom, FOB shipping poi May 21: For the convenience of Crescent Co., paid freight on sale of May 21, $2,300. May 21: Received $42,900 cash from Gee Co. on account. May 21: For the convenlence of Crescent Co., pald freight on sale of May 21,$2,300. May 21: Recelved $42,900 cash from Gee Co. on account. May 21: Purchased merchandlise on account from Osterman Co., terms 1/10,n/30, FOB destination, $88,000. May 24: Returned damaged merchandlse purchased on May 21, recelving a credit memo from the seller for $5,000. May 26: Refunded cash on sales made for cash, $7,500. The cost of the merchandlse returned was $4,800. Mav 28: Pald sales salarles of $56.000 and office salarles of $29.000. May 29: Purchased store supplles for cash, $2,400. May 30: Sold merchandlse on account to Turner Co., terms n/30, FOB shipping point, $78,750. The cost of the goods sc Mav 31: Recelved cash from sale of Mav 21 Dlus frelaht. May 31: Pald for purchase of May 21, less return of May 24. Part 3: NOTE: You must complete parts 1 and 2 before completing part 3 . Comprehenslve Problem 2 Part 4 and 6: Note: You must complete parts 1, 2 and 3 before attempting to complete part 4 and part 6 . Part 5 is an optlonal work sheet. 4. At the end of May, the following adfustment data were assembled. Analyze and use these data to complete Part 6. f. The adjustment for customer returns and allowances is $60,000 for sales and $35,000 for cost of goods sold. Comprehenslve Problem 2 Part 5: Optional work sheet Enter the unadjusted trlal balance on a 10-column end-of-perlod spreadsheet (work sheet), and complete the spreadsheet using the following adjustment data. f. The adjustment for customer returns and allowances is $60,000 for sales and $35,000 for cost of goods sold. If an amount box does not require an entry, leave it blank. You must complete parts 1, 2, 3, 4 and 6 before completing part 7. Part 5 is the optional work sheet. Part 8: You must complete parts 1,2,3,4,6 and 7 before attempting to complete part 8 . Note: Part 5 is the optional worksheet. 1. Prepare a multiple-step income statement. 2. Prepare a statement of stockholders' equity. Assume that additional common stock 3. Prepare a balance sheet. 2 Mrmavin o hallanme plannt You must complete parts 1,2,3,4,6,7,8 and 9 before attempting to complete part 10. Part 5 is the optional worksheet. Prepare a post-closing trlal balance. If an amount box does not requlre an entry, leave it blank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts