Question: Part 1 : Loan Payment and Amortization Schedule ( A B C ) , Inc. is considering purchasing new equipment and needs to

Part : Loan Payment and Amortization Schedule

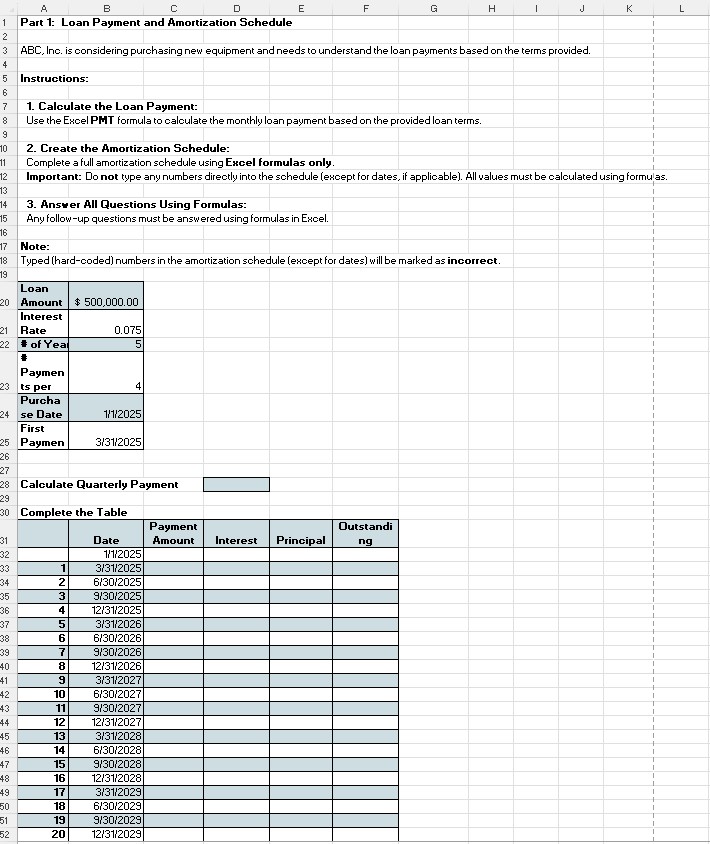

A B C Inc. is considering purchasing new equipment and needs to understand the loan payments based on the terms provided.

Instructions:

Calculate the Loan Payment:

Use the Excel PHT formula to calculate the monthly loan payment based on the provided loan terms.

Create the Amortization Schedule:

Complete a full amortization schedule using Excel formulas only.

Important: Do not type any numbers directly into the schedule except for dates, if applicable All walues must be calculated using formulas.

Answer All Questions Using Formulas:

Any followup questions must be answered using formulas in Excel.

Note:

Typed hardcoded numbers in the amortization schedule except for dates will be marked as incorrect.

Calculate Quarterly Payment

Complete the Table

How much interest expense did ABC, Inc record in each year?

How much interest expense yould be incurred by the end of the loan?

Total Interest Expense

Part : Increased YearEnd Payments

ABC Inc. expects to have excess operating cash over the next five years. They are considering increasing their December mathbf payment by $ mathbf each year.

Task:

Update the amortization schedule to reflect this annual increase and use it to answer the related questions.

By which quarter did the company pay off the loan?

How much would the interest would be for each year? How much would the company vould save each year in interest?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock