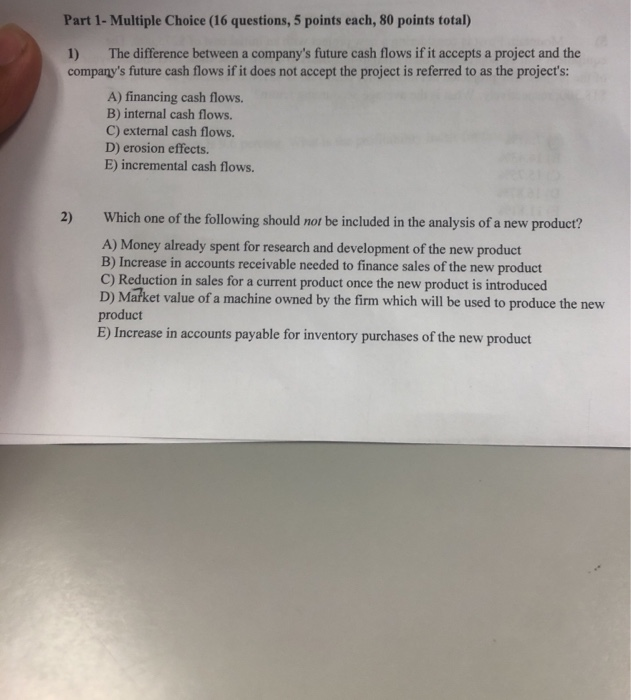

Question: Part 1- Multiple Choice (16 questions, 5 points each, 80 points total) 1) The difference between a company's future cash flows if it accepts a

Part 1- Multiple Choice (16 questions, 5 points each, 80 points total) 1) The difference between a company's future cash flows if it accepts a project and the company's future cash flows if it does not accept the project is referred to as the project's: A) financing cash flows. B) internal cash flows. C) external cash flows. D) erosion effects. E) incremental cash flows. Which one of the following should not be included in the analysis of a new product? A) Money already spent for research and development of the new product B) Increase in accounts receivable needed to finance sales of the new product C) Reduction in sales for a current product once the new product is introduced D) Market value of a machine owned by the firm which will be used to produce the new product E) Increase in accounts payable for inventory purchases of the new product

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts