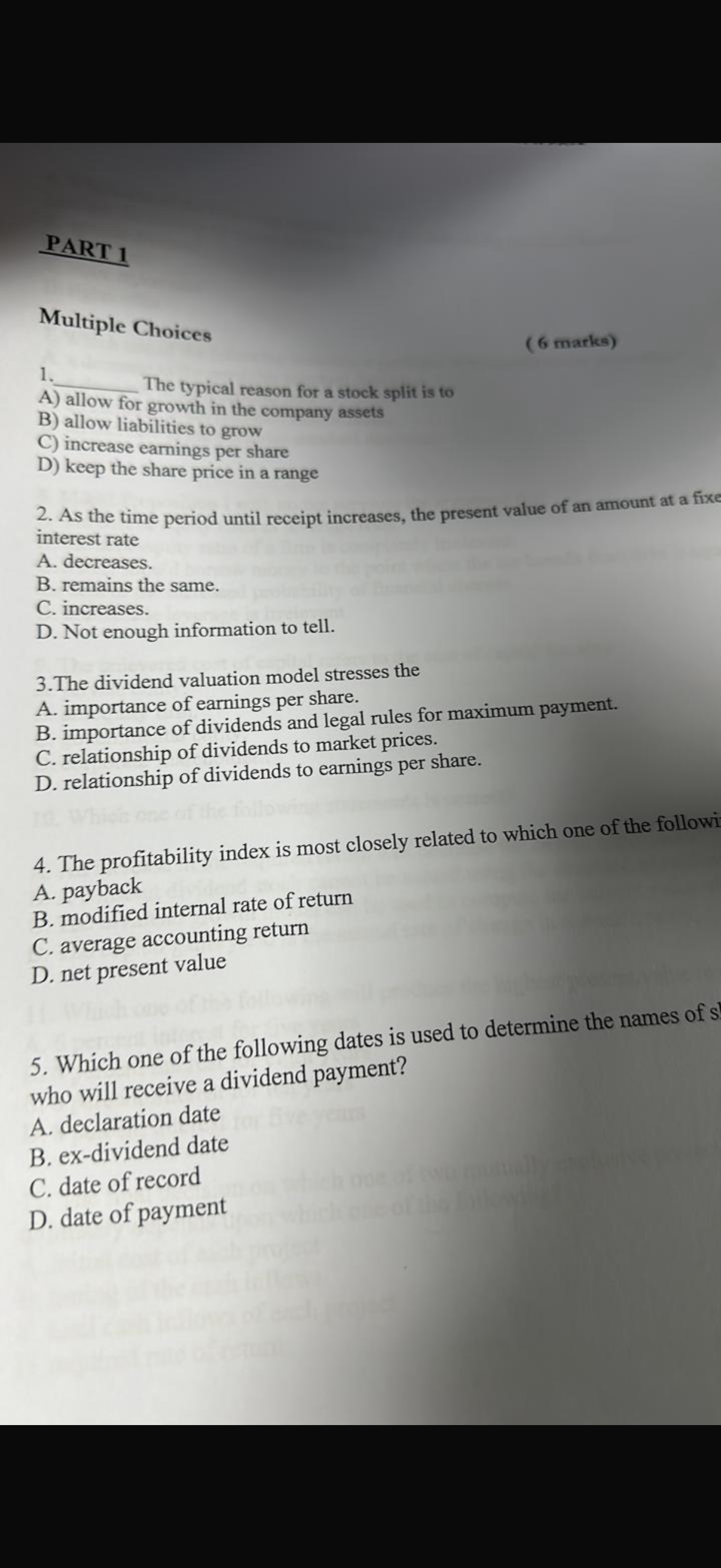

Question: PART 1 Multiple Choices ( 6 marks ) 1 The typical reason for a stock split is to A ) allow for growth in the

PART

Multiple Choices

marks

The typical reason for a stock split is to

A allow for growth in the company assets

B allow liabilities to grow

C increase earnings per share

D keep the share price in a range

As the time period until receipt increases, the present value of an amount at a fixe interest rate

A decreases.

B remains the same.

C increases.

D Not enough information to tell.

The dividend valuation model stresses the

A importance of earnings per share.

B importance of dividends and legal rules for maximum payment.

C relationship of dividends to market prices.

D relationship of dividends to earnings per share.

The profitability index is most closely related to which one of the followi

A payback

B modified internal rate of return

C average accounting return

D net present value

Which one of the following dates is used to determine the names of s who will receive a dividend payment?

A declaration date

B exdividend date

C date of record

D date of payment

PART

Multiple Choices

marks

The typical reason for a stock split is to

A allow for growth in the company assets

B allow liabilities to grow

C increase earnings per share

D keep the share price in a range

As the time period until receipt increases, the present value of an amount at a fixe interest rate

A decreases.

B remains the same.

C increases.

D Not enough information to tell.

The dividend valuation model stresses the

A importance of earnings per share.

B importance of dividends and legal rules for maximum payment.

C relationship of dividends to market prices.

D relationship of dividends to earnings per share.

The profitability index is most closely related to which one of the followi

A payback

B modified internal rate of return

C average accounting return

D net present value

Which one of the following dates is used to determine the names of s who will receive a dividend payment?

A declaration date

B exdividend date

C date of record

D date of payment

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock