Question: . PART 1: Please answer and upload the following question as Excel document. The Easterwood Corporation Capital Budgeting. Cost of new plant and equipment: $

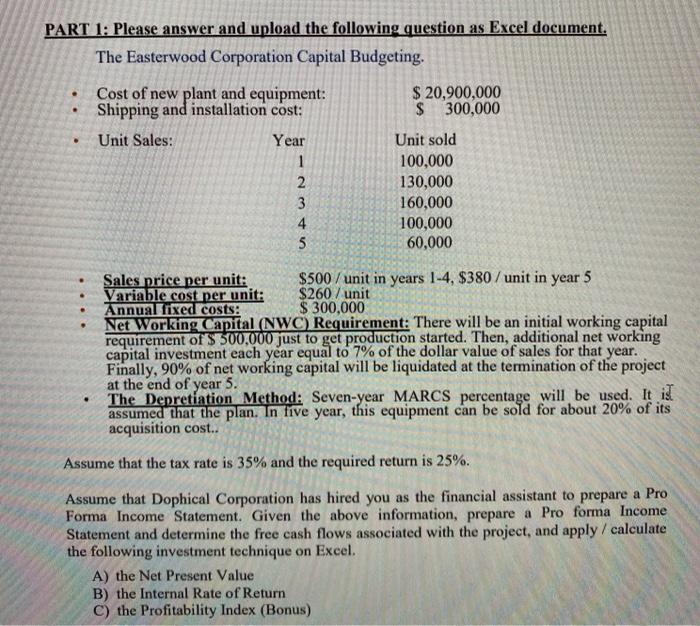

. PART 1: Please answer and upload the following question as Excel document. The Easterwood Corporation Capital Budgeting. Cost of new plant and equipment: $ 20,900,000 Shipping and installation cost: $ 300,000 Unit Sales: Year Unit sold 1 100,000 2 130,000 3 160,000 4 100,000 5 60,000 AN . Sales price per unit: $500 / unit in years 1-4, $380 / unit in year 5 Variable cost per unit: $260/unit Annual fixed costs: $ 300,000 Net Working Capital (NWC) Requirement: There will be an initial working capital requirement of $ 500,000 just to get production started. Then, additional net working capital investment each year equal to 7% of the dollar value of sales for that year. Finally, 90% of net working capital will be liquidated at the termination of the project at the end of year 5. The Depretiation Method: Seven-year MARCS percentage will be used. It id assumed that the plan. In five year, this equipment can be sold for about 20% of its acquisition cost.. Assume that the tax rate is 35% and the required return is 25%. Assume that Dophical Corporation has hired you as the financial assistant to prepare a Pro Forma Income Statement. Given the above information, prepare a Pro forma Income Statement and determine the free cash flows associated with the project, and apply / calculate the following investment technique on Excel. A) the Net Present Value B) the Internal Rate of Return C) the Profitability Index (Bonus)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts