Question: PART 1 : PROBLEM SCENARIO ( LOAN ANALYSIS SHEET ) : You are a small business owner and have decided to purchase a building for

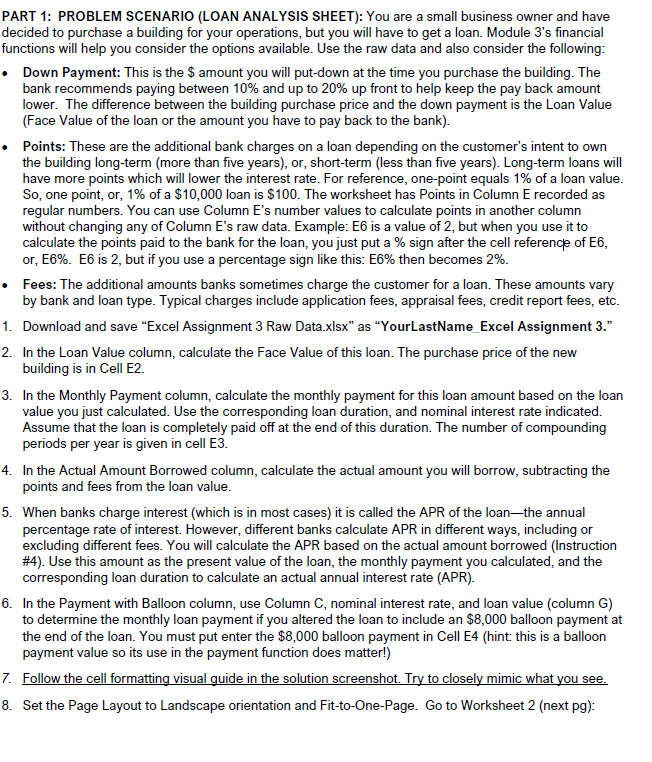

PART : PROBLEM SCENARIO LOAN ANALYSIS SHEET: You are a small business owner and have

decided to purchase a building for your operations, but you will have to get a loan. Module s financial

functions will help you consider the options available. Use the raw data and also consider the following:

Down Payment: This is the $ amount you will putdown at the time you purchase the building. The

bank recommends paying between and up to up front to help keep the pay back amount

lower. The difference between the building purchase price and the down payment is the Loan Value

Face Value of the loan or the amount you have to pay back to the bank

Points: These are the additional bank charges on a loan depending on the customer's intent to own

the building longterm more than five years or shortterm less than five years Longterm loans will

have more points which will lower the interest rate. For reference, onepoint equals of a loan value.

So one point, or of a $ loan is $ The worksheet has Points in Column E recorded as

regular numbers. You can use Column Es number values to calculate points in another column

without changing any of Column Es raw data. Example: E is a value of but when you use it to

calculate the points paid to the bank for the loan, you just put a sign after the cell reference of E

or E E is but if you use a percentage sign like this: E then becomes

Fees: The additional amounts banks sometimes charge the customer for a loan. These amounts vary

by bank and loan type. T

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock