Question: Part 1: Problems: Reminder: For problems, be sure to show your work below to receive credit for problems). If you use a financial calculator, please

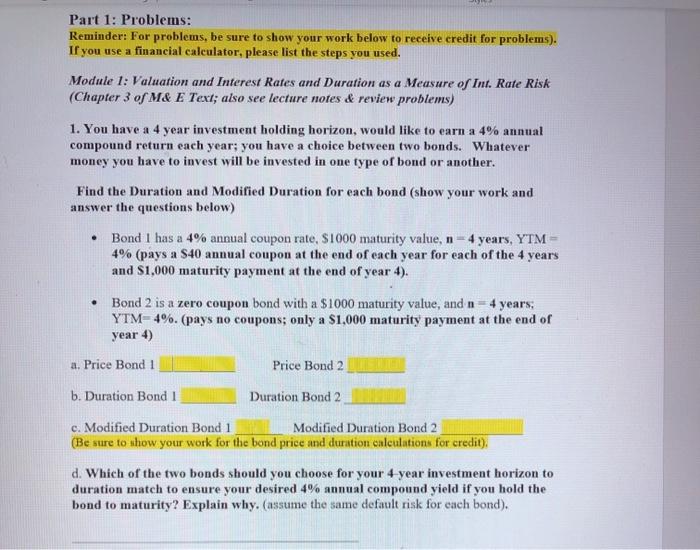

Part 1: Problems: Reminder: For problems, be sure to show your work below to receive credit for problems). If you use a financial calculator, please list the steps you used. Module 1: Valuation and Interest Rates and Duration as a Measure of Int. Rate Risk (Chapter 3 of M& E Text; also see lecture notes & review problems) 1. You have a 4 year investment holding horizon, would like to earn a 4% annual compound return each year; you have a choice between two bonds. Whatever money you have to invest will be invested in one type of bond or another. Find the Duration and Modified Duration for each bond (show your work and answer the questions below) . Bond I has a 4% annual coupon rate, S1000 maturity value, n - 4 years, YTM - 4% (pays a $40 annual coupon at the end of each year for each of the 4 years and $1,000 maturity payment at the end of year 4). . Bond 2 is a zero coupon bond with a $1000 maturity value, and n-4 years YTM-4%. (pays no coupons; only a $1,000 maturity payment at the end of year 4) a. Price Bond 1 Price Bond 2 b. Duration Bond I Duration Bond 2 c. Modified Duration Bond 1 Modified Duration Bond 2 (Be sure to show your work for the bond price and duration calculations for credit). d. Which of the two bonds should you choose for your 4 year investment horizon to duration match to ensure your desired 4% annual compound yield if you hold the bond to maturity? Explain why. (assume the same default risk for each bond)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts