Question: Part 1: Project Selection (from Week 4) 1. Which project should you choose between Project A and B ? Project A has a total benefit

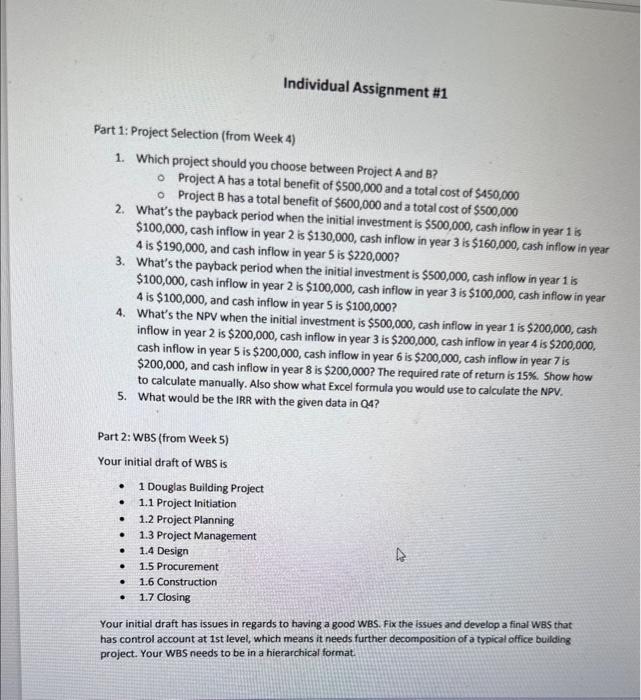

Part 1: Project Selection (from Week 4) 1. Which project should you choose between Project A and B ? Project A has a total benefit of $500,000 and a total cost of $450,000 - Project B has a total benefit of $600,000 and a total cost of $500,000 2. What's the payback period when the initial investment is $500,000, cash inflow in year 1 is. $100,000, cash inflow in year 2 is $130,000, cash inflow in year 3 is $160,000, cash inflow in year 4 is $190,000, and cash inflow in year 5 is $220,000? 3. What's the payback period when the initial investment is $500,000, cash inflow in year 1 is $100,000, cash inflow in year 2 is $100,000, cash inflow in year 3 is $100,000, cash inflow in year 4 is $100,000, and cash inflow in year 5 is $100,000? 4. What's the NPV when the initial investment is $500,000, cash inflow in year 1 is $200,000, cash inflow in year 2 is $200,000, cash inflow in year 3 is $200,000, cash inflow in year 4 is $200,000, cash inflow in year 5 is $200,000, cash inflow in year 6 is $200,000, cash inflow in year 7 is $200,000, and cash inflow in year 8 is $200,000 ? The required rate of return is 15%. Show how to calculate manually. Also show what Excel formula you would use to calculate the NPV. 5. What would be the IRR with the given data in Q4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts