Question: Part 1 - Record Journal entries for the transactions below Transactions 1. On December 1, Apollo purchased $420 of supplies. 2. On December 1,

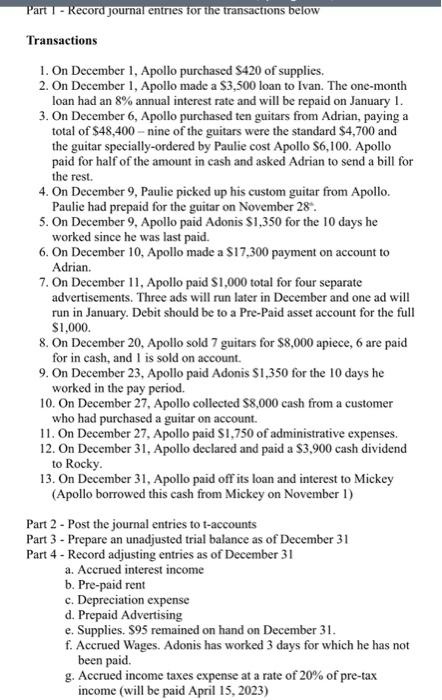

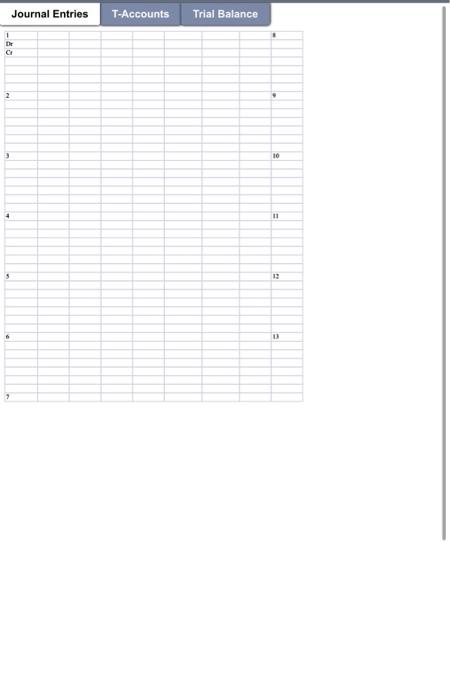

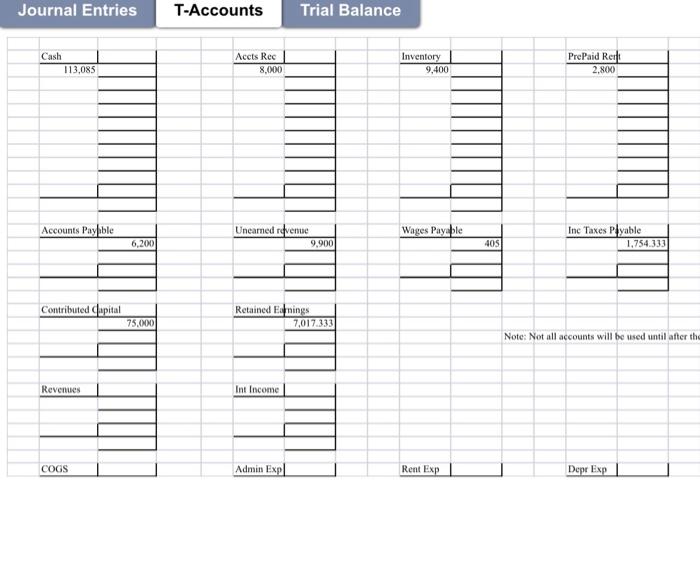

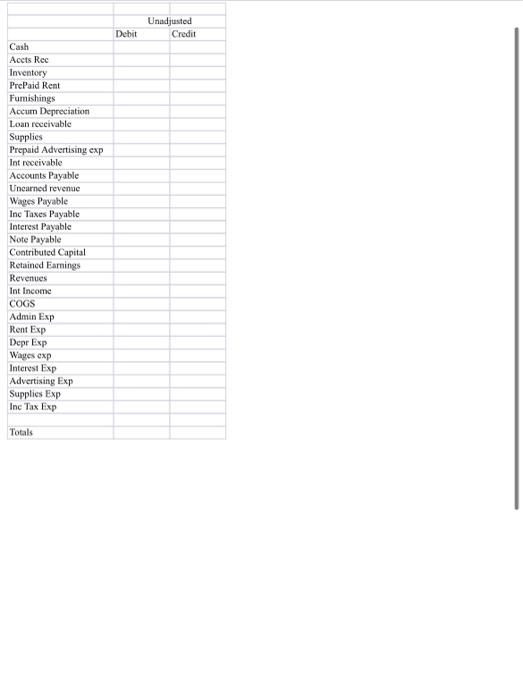

Part 1 - Record Journal entries for the transactions below Transactions 1. On December 1, Apollo purchased $420 of supplies. 2. On December 1, Apollo made a $3,500 loan to Ivan. The one-month loan had an 8% annual interest rate and will be repaid on January 1. 3. On December 6, Apollo purchased ten guitars from Adrian, paying a total of $48,400-nine of the guitars were the standard $4,700 and the guitar specially-ordered by Paulie cost Apollo $6,100. Apollo paid for half of the amount in cash and asked Adrian to send a bill for the rest. 4. On December 9, Paulie picked up his custom guitar from Apollo. Paulie had prepaid for the guitar on November 28. 5. On December 9, Apollo paid Adonis $1,350 for the 10 days he worked since he was last paid. 6. On December 10, Apollo made a $17,300 payment on account to Adrian. 7. On December 11, Apollo paid $1,000 total for four separate advertisements. Three ads will run later in December and one ad will run in January. Debit should be to a Pre-Paid asset account for the full $1,000. 8. On December 20, Apollo sold 7 guitars for $8,000 apiece, 6 are paid for in cash, and 1 is sold on account. 9. On December 23, Apollo paid Adonis $1,350 for the 10 days he worked in the pay period. 10. On December 27, Apollo collected $8,000 cash from a customer who had purchased a guitar on account. 11. On December 27, Apollo paid $1,750 of administrative expenses. 12. On December 31, Apollo declared and paid a $3,900 cash dividend to Rocky. 13. On December 31, Apollo paid off its loan and interest to Mickey (Apollo borrowed this cash from Mickey on November 1) Part 2 - Post the journal entries to t-accounts Part 3 - Prepare an unadjusted trial balance as of December 31 Part 4 - Record adjusting entries as of December 31 a. Accrued interest income b. Pre-paid rent c. Depreciation expense d. Prepaid Advertising e. Supplies. $95 remained on hand on December 31. f. Accrued Wages. Adonis has worked 3 days for which he has not been paid. g. Accrued income taxes expense at a rate of 20% of pre-tax income (will be paid April 15, 2023) 1 -80 Dr Journal Entries 2 3 5 7 T-Accounts Trial Balance 10 11 12 13 Journal Entries Cash 113,085 Accounts Payable Contributed Capital Revenues COGS 6,200 75,000 T-Accounts Accts Rec 8,000 Unearned revenue Trial Balance Int Income Retained Earnings Admin Exp 9,900 7,017.333 Inventory 9,400 Wages Payable Rent Exp 405 PrePaid Rent 2,800 Inc Taxes Payable 1,754.333 Note: Not all accounts will be used until after the Depr Exp Cash Acets Rec Inventory PrePaid Rent Furnishings Accum Depreciation Loan receivable Supplies Prepaid Advertising exp Int receivable Accounts Payable Unearned revenue Wages Payable Inc Taxes Payable Interest Payable Note Payable Contributed Capital Retained Earnings Revenues Int Income COGS Admin Exp Rent Exp Depr Exp Wages exp Interest Exp Advertising Exp Supplies Exp Inc Tax Exp Totals Debit Unadjusted Credit

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Part I Journal Entries 1 December 1 purchased supplies Debit Supplies 420 Credit Cash 420 2 December 1 loan to Ivan Debit Loans Receivable 3500 Credit ... View full answer

Get step-by-step solutions from verified subject matter experts