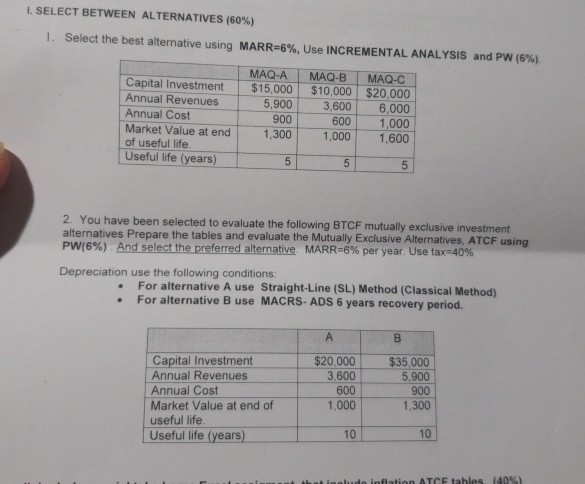

Question: Part 1. Select the best alternative using MARR= 6% . Use incremental analysis and PW(6%) Part 2. Prepare the tables and evaluate the mutually exvlusive

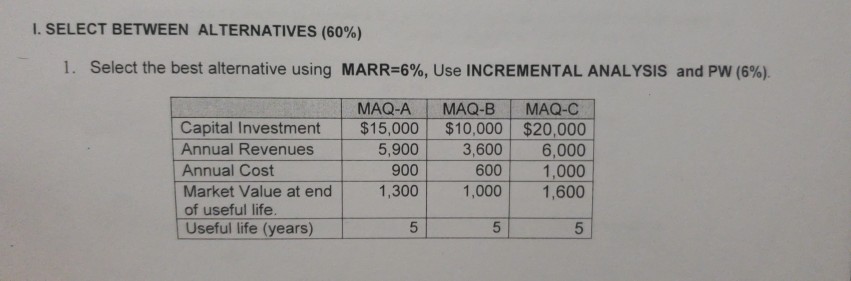

Part 1. Select the best alternative using MARR= 6%. Use incremental analysis and PW(6%)

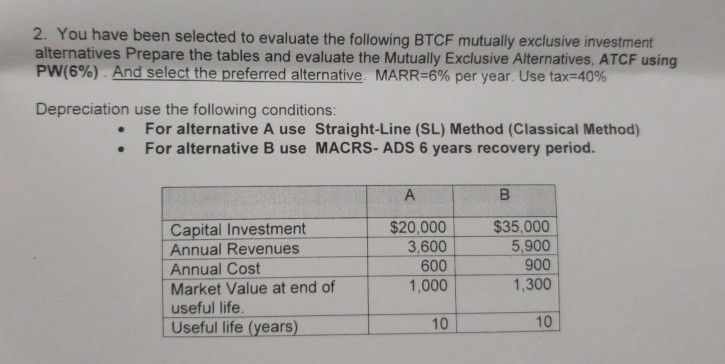

Part 2. Prepare the tables and evaluate the mutually exvlusive investments. ATCF using PW(6%) ,

MARR=6% per year and TAX= 40% For alternative A use STRAIGHT LINE METHOD For alternative B use MACRS- ADS 6 years recovery period.

I. SELECT BETWEEN ALTERNATIVES (60%) 1. Select the best alternative using MARR-6%, Use INCREMENTAL ANALYSIS and PW (6%) Annual Revenues Annual Cost Market Value at end of useful life MAQ-A-1 MAQ-B I -MAQ-C Capital Investment $15,000 $10,000$20,000 5,900 3,600 6,000 600 1,000 1,300 1,000 1,600 900 Useful life (years) 2. You have been selected to evaluate the following BTCF mutually exclusive investment alternatives Prepare the tables and evaluate the Mutually Exclusive Alternatives, ATCF using PM6%) And select the preferred alternative MARR-6% per year use tax-40% Depreciation use the following conditions: .For alternative A use Straight-Line (SL) Method (Classical Method) For alternative B use MACRS- AD S 6 years recovery period. Capital Investment Annual Revenues Annual Cost Market Value at end of useful life Useful life (years) $20,000 3,600 600 1,000 $35,000 5,900 900 1,300 10 10 CE tables (40%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts