Question: Part 1: Short answer / fill in the blank, etc. (32 points) 1. (3 points) In what situation would the equivalent annual annuity or replacement

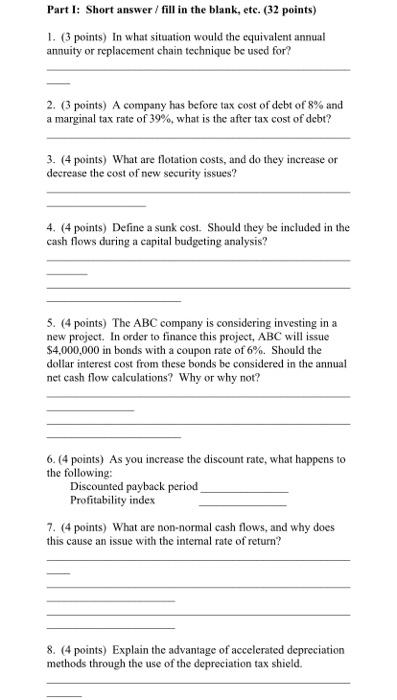

Part 1: Short answer / fill in the blank, etc. (32 points) 1. (3 points) In what situation would the equivalent annual annuity or replacement chain technique be used for? 2. (points) A company has before tax cost of debt of 8% and a marginal tax rate of 39%, what is the after tax cost of debt? 3. (4 points) What are flotation costs, and do they increase or decrease the cost of new security issues? 4. (4 points) Define a sunk cost. Should they be included in the cash flows during a capital budgeting analysis? 5. (4 points) The ABC company is considering investing in a new project. In order to finance this project, ABC will issue $4,000,000 in bonds with a coupon rate of 6%. Should the dollar interest cost from these bonds be considered in the annual net cash flow calculations? Why or why not? 6. (4 points) As you increase the discount rate, what happens to the following: Discounted payback period Profitability index 7. (4 points) What are non-normal cash flows, and why does this cause an issue with the internal rate of return? 8. (4 points) Explain the advantage of accelerated depreciation methods through the use of the depreciation tax shield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts