Question: Part 1: Solutions Proposal Submit a completed project resource recommendation in the form of a two- to four microsoft Word documents Part 2: Executive Summary

Part 1: Solutions Proposal Submit a completed project resource recommendation in the form of a two- to four microsoft Word documents

Part 2: Executive Summary Submit a completed project resource recommendation in the form of a three- to five-page Word document

Part 1: Solutions Proposal Using the data set provided in the Supporting Materials section, examine the data and identify any data bias, ethical issues, and/or appropriateness issues in the model results provided in the Supporting Materials section. Examine the descriptions of the fields in the following

files:

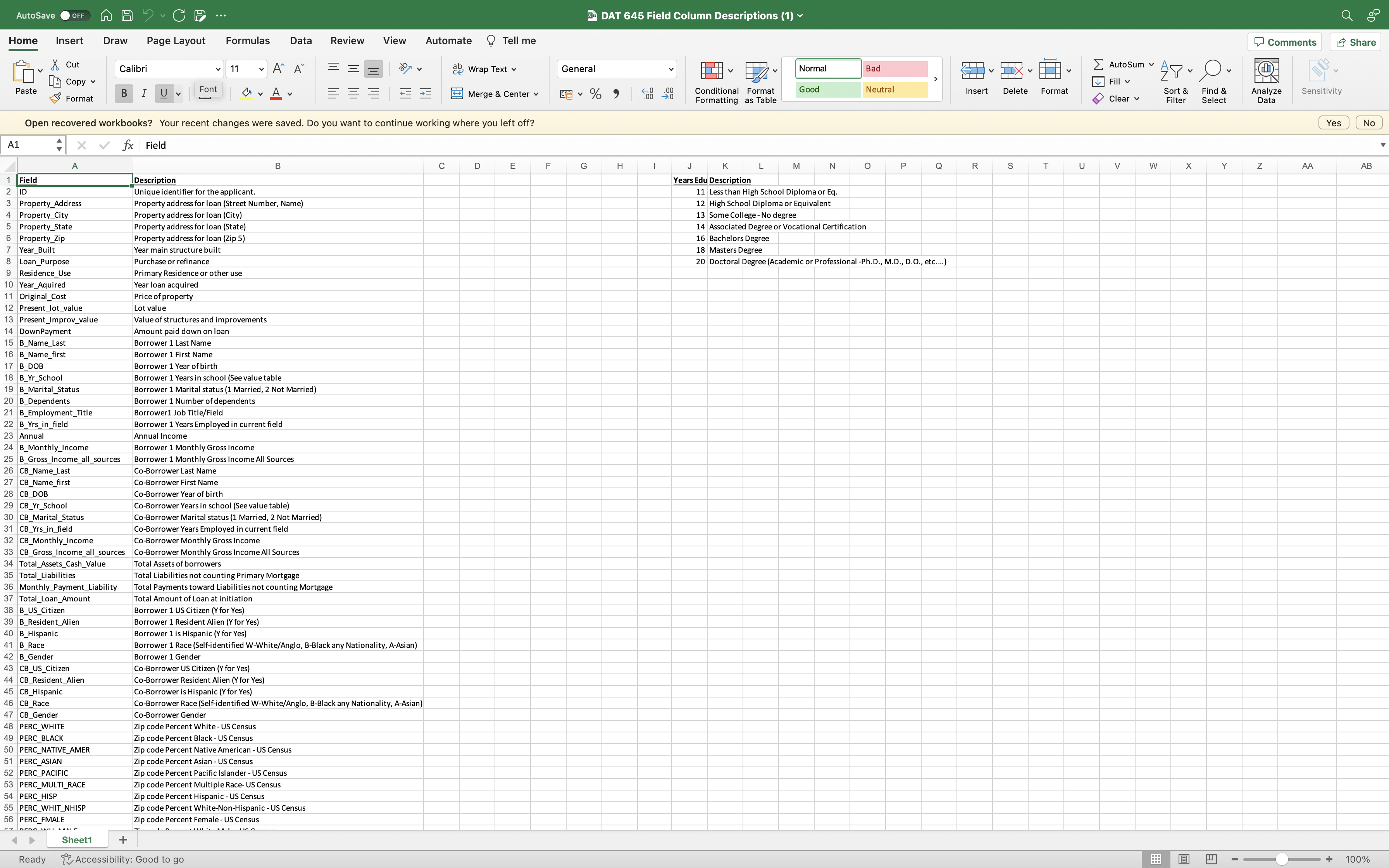

Field Column Descriptions file

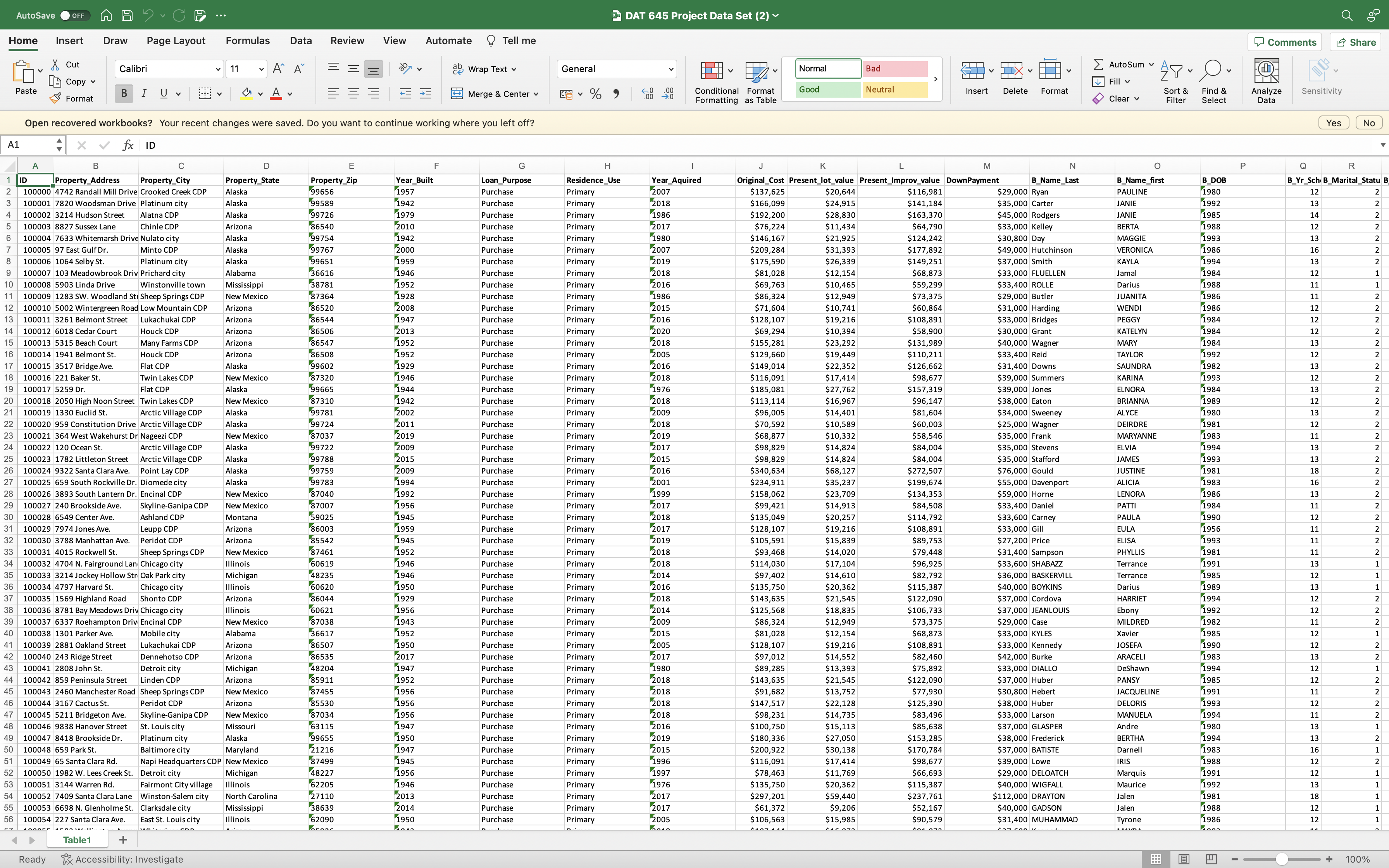

Data file

Predictive Demographics

The data file is the data you would use to train and test your algorithms if you were to build the analytic model. The results of the algorithms are based on the above data set.

1) Explain why this data could result in an algorithm with potential bias, ethical, or appropriateness issues. A) Explain the common sources of data bias that can affect analytical results.

2) Explain the implications of data bias, ethical, or appropriateness issues from the predictive model results provided.

A) Explain how these issues unfairly influence the lending decision.

B) In your position as a data scientist, are there any potential bias, ethical, or appropriateness concerns that you can identify? If so, explain.

3) Identify any fields that demonstrate data bias, ethical issues, or appropriateness or could result in such a bias in the algorithms built from this data.

A) Explain why the fields that you have identified demonstrate any data bias, ethical issue, or appropriateness issue.

B) Analyze the data sources and identify whether the sources are trustworthy and authoritative.

i) Explain why the sources are either trustworthy and authoritative or questionable.

4) Recommend a solution to stakeholders that includes the following:

A) By removing issues related to bias, ethical, and appropriateness issues, identify the potential increase of risk of default on a home mortgage.

B) Justify your solution and explain how it solves the issues you have identified.

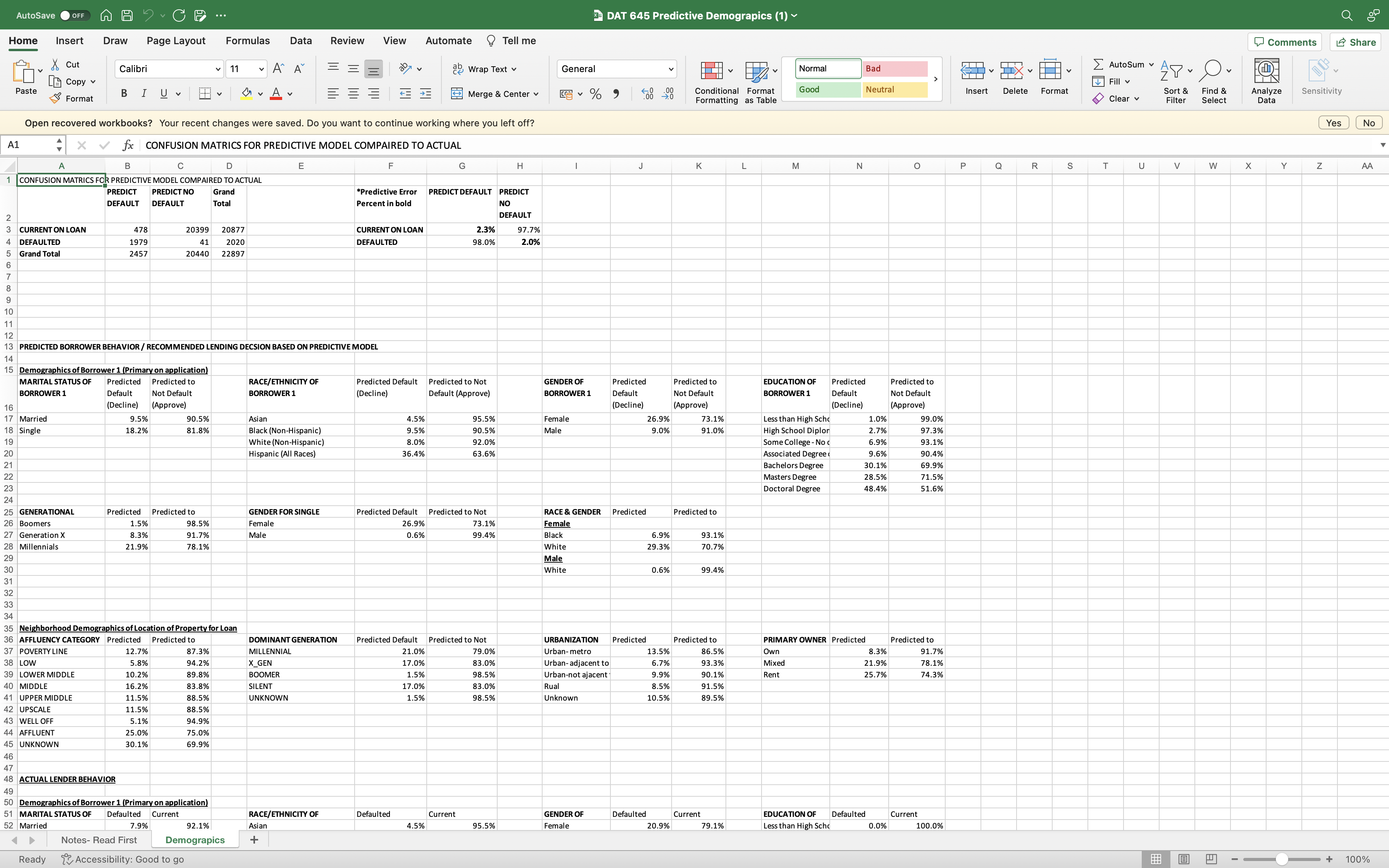

Part 2: Executive Summary The predictive demographics results provided in the Supporting Materials section contain summary data on the results of lending decisions based on algorithms created using the data from the data set in the Supporting Materials section. In your executive summary, address the following:

1) Identify if either (or both) of the algorithms seem unfair.

a) If you find the variables of either algorithm unfair, describe the unfairness including:

i) Explain if the unfairness is a data bias, an ethical issue, and/or an appropriateness issue.

ii) What fields in the data set used to create the algorithm do you think resulted in this bias?

iii) Explain the potential ramifications for both borrowers and lenders of unfair algorithms.

b) If you determine that either algorithm is fair, justify your reasoning, including:

i) Explain why it would be appropriate for a specific demographic to be approved for a lower rate.

2) Explain how algorithms can unintentionally discriminate.

a) Provide a hypothesis for the bias of one or both of the algorithms provided.

3) Explain the ethical dilemma(s) faced by the lending company as a result of the algorithms used in relation to the fair housing issues.

a) How do these algorithms skew the results against a specific population?

b) What are the ramifications of the skewed results for the mortgage company?

AutoSave O OFF A A ? . C E ... DAT 645 Project Data Set (2) ~ Q Home Insert Draw Page Layout Formulas Data Review View Automate ? Tell me Comments LE Share & Cut Calibri v 11 AA 27 V e Wrap Text v General Normal Bad AutoSum ~ As di- DE Copy v Fill v Paste Format BI UVV MVA Merge & Center v v % 9 08 300 Conditional Format Good Neutral Insert Delete Format Sort & Find 8 Analyze Formatting as Table Clear Sensitivity Filter Data Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Yes No A1 X fx ID B D Q ID Property_Address Property_City Property_State Property_Zip Year_Built Loan_Purpose Residence_Use Year_Aquired Original_Cost Present_lot_value Present_Improv_value DownPayment B_Name_Last B_Name_first B_DOB B_Yr_Sch B_Marital_Statu: 100000 4742 Randall Mill Drive Crooked Creek CDP Alaska 99656 1957 Purchase Primary 2007 $137,625 $20,644 $116,981 $29,000 Ryan PAULINE 1980 12 2 100001 7820 Woodsman Drive Platinum city Alash 9589 194 Purchase Primary 201 $166,099 $24,915 $141,18 $35,000 Carter JANIE 1992 13 100002 3214 Hudson Street Alatna CDP Alaska 99726 1979 Purchase Primary 1986 $192,200 $28,830 $163,370 $45,000 Rodgers JANIE 1985 14 100003 8827 Sussex Lane Chinle CDP Arizona 36540 2010 Purchase Primar 2017 $76,224 $11,434 $64,790 $33,000 Kelley BERTA 1988 12 100004 7633 Whitemarsh Drive Nulato city Alaska 99754 1942 Purchase Primary 198 $146,167 $21,925 $124,242 $30,800 Day MAGGIE 1993 13 NNNNN 100005 97 East Gulf Dr Minto CDP Alaska 99767 200 Purchase Primary 200 $209,284 $31,393 $177,892 $49,000 Hutchinson VERONICA 1986 16 100006 1064 Selby St. Platinum city Alaska 99651 1959 Purchase imary 201 $175,590 $26,339 149,251 $37,000 Smith KAYLA 1994 13 9 100007 103 Meadowbrook Driv Prichard city Alabama 36616 1946 Purchase Primary 2018 $81,028 $12,154 $68,873 $33,000 FLUELLEN Jamal 1984 12 10 100008 5903 Linda Drive Winstonville town Mississippi 3878: 1952 Purchase Primary 2016 $69,763 $10,465 $59,299 $33,400 ROLLE Darius 1988 11 11 100009 1283 SW. Woodland Sti Sheep Springs CDP New Mexico 87364 1928 Purchase Primary 1986 $86,324 $12,949 $73,375 $29,000 Butler JUANITA 1986 11 12 100010 5002 Wintergreen Road Low Mountain CDF Arizona 86520 2008 Purchase Primary 201 $71,604 $10,74 $60,864 $31,000 Harding WENDI 1986 12 13 100011 3261 Belmont Street t Lukachukai CDP Arizona 86544 1947 Purchase Primary 2016 128,107 $19,216 $108,891 $33,000 Bridge PEGGY 1984 12 4 100012 6018 Cedar Court Houck CDP Arizona 86506 201 Purchase Primary 202 $69,294 $10,39 $58,900 $30,000 Gran KATELYN 1984 12 15 100013 5315 Beach Court Many Farms CDP rizon 86547 1952 Purchase imary 201 $155,281 $23,292 $131,989 $40,000 Wagner MARY 1984 13 6 100014 1941 Belmont St. Houck CDP Arizona 86508 1952 Purchase Primary 2005 $129,660 $19,449 110,211 $33,400 Reid AYLO 1992 12 17 100015 3517 Bridge Ave Flat CDP Alaska 99602 192 Purchase Primary 2016 $149,014 $22,352 $126,662 $31,400 Downs AUNDRA 1982 13 18 100016 221 Baker St Twin Lakes CDP New Mexico 87320 1946 Purchase Primary 2018 $116,091 $17,414 $98,67 $39,000 Summers KARINA 1993 12 9 100017 5259 Dr. Flat CDP Alaska 99665 194 Purchase Primary 1976 $185,081 $27,762 157 ,319 $39,000 Jones ELNORA 1984 13 20 100018 2050 High Noon Street |Twin Lakes CDP New Mexico 87310 1942 Purchase Primary 2018 $113,114 $16,967 $96,147 $38,000 Eaton BRIANNA 1989 12 21 100019 1330 Euclid St. Arctic Village CDP Alaska 99781 2002 Purchase Primary 2009 $96,005 $14,401 $81,604 $34,000 Sweeney ALYCE 1980 13 22 100020 959 Constitution Drive Arctic Village CDP Alaska 99724 2011 Purchase imary 2018 $70,592 $60,003 $25,000 Wagner DEIRDRE 1981 12 23 100021 364 West Wakehurst Dr Nageezi CDP New Mexico 87037 2019 Purchase Primary 2019 $68,877 $10,332 $8,546 $35,000 Frank MARYANNE 1983 11 24 100022 120 Ocean St Arctic Village CDP Alaska 99722 200 Purchase Primary 2017 $98,82 $14,824 $84,004 $35,000 Stevens ELVI 1994 13 25 100023 1782 Littleton Street Arctic Village CDP Alaska 99788 2015 Purchase Primary 2015 $98,829 $14,824 $84,00 $35,000 Stafford JAMES 1993 13 NNN 26 100024 9322 Santa Clara Ave. Point Lay CDP Alaska 99759 2009 Purchase Primary 2016 $340,63 $68,127 $272,507 $76,000 Gould JUSTINE 198 27 100025 659 South Rockville Dr. Diomede city Alaska 99783 1994 Purchase Primary 2001 $234,911 :35,237 $199,67 $55,000 Davenport ALICIA 1983 28 100026 3893 South Lantern Dr. Encinal CDP New Mexico 87040 199 Purchase Primary 1999 $158,062 $23,70 $134,353 $59,000 Horne LENORA 1986 13 29 100027 240 Brookside Ave. Skyline-Ganipa CDP New Mexico 87007 1956 Purchase imary 2017 $99,421 $14,913 $84,50 $33,400 Dani PATTI 1984 11 30 100028 6549 Center Ave. Ashland CDP Montana 59025 1945 Purchase Primary 2018 $135,049 $20,257 $114,792 $33,600 Carney PAULA 1990 12 31 100029 7974 Jones Ave. Leupp CDP Arizona 86003 195 Purchase Primary 2017 $128,107 $19,216 $33,000 Gill EULA 1956 11 32 100030 3788 Manhattan Ave. Peridot CDP Arizona 85542 1945 Purchase Primary 2019 $105,591 $15,83 $9,753 $27,200 Price ELISA 1993 11 33 100031 4015 Rockwell St Sheep Springs CDP New Mexico 87461 1952 Purchase Primary 2018 $93,468 $14,020 $79,448 $31,400 Sampson PHYLLIS 198: 34 100032 4704 N. Fairground Lan Chicago city Illinois 60619 1946 Purchase Primary 2018 114,030 $17,104 6,925 $33,600 SHABAZZ Terrance 1991 13 35 100033 3214 Jockey Hollow Str Oak Park city Michigan 48235 194 Purchase Primary 2014 $97,402 $14,610 $82,792 $36,000 BASKERVILL Terrance 1985 12 36 100034 4797 Harvard St. Chicago city Illinois 60620 1950 Purchase imary 201 $135,750 $115,387 $40,000 BOYKINS Darius 1989 13 37 100035 1569 Highland Road Shonto CDP Arizona 86044 1929 Purchase Primary 2018 $143,635 $21,545 $122,090 $37,000 Cordova ARRIE 1994 12 38 100036 8781 Bay Meadows Driv Chicago city Illinois 60621 195 Purchase Primary 2014 $125,568 $18,835 $106,733 $37,000 JEANLOUIS Ebony 1992 12 39 100037 6337 Roehampton Driv Encinal CDP New Mexico 87038 1943 Purchase Primary 200 $86,324 $12,949 $73,375 $29,000 Case MILDRED 1982 11 100038 1301 Parker Ave. Mobile city Alabama 36617 1952 Purchase Primary 2015 $81,02 $12,15 $68,873 $33,000 KYLES Xavier 1985 41 100039 2881 Oakland Street Lukachukai CDP Arizona 86507 1950 Purchase Primary 2005 $128,107 $19,216 $108,891 $33,000 Kennedy JOSEFA 1990 12 42 100040 243 Ridge Street Dennehotso CDP Arizona 86535 201 Purchase Primary 201 $97,012 $14,55 82,46 $42,000 Burke ARACELI 1983 13 43 100041 2808 John St. Detroit city Michigan 48204 1947 Purchase imary 1980 $89,285 $13,39 $75,892 $33,000 DIALLO DeShawn 1994 12 44 100042 859 Peninsula Street Linden CDP Arizona 85911 195 Purchase Primary 2018 143,635 $21,545 $122,090 $37,000 Huber PANSY 1985 12 45 100043 2460 Manchester Road Sheep Springs CDP New Mexico 87455 195 Purchase Primary 2018 $91,682 $13,752 $77,930 $30,800 Hebert JACQUELINE 1991 11 46 100044 3167 Cactus St. Peridot CDP Arizona 85530 1956 Purchase Primary 2018 $147,517 $22,12 $125,390 $38,000 Huber DELORIS 1993 12 47 100045 5211 Bridgeton Ave. Skyline-Ganipa CDP New Mexico 87034 1956 Purchase Primary 2018 $98,231 $14,735 $83,496 $33,000 Larson MANUELA 1994 48 100046 9838 Hanover Street St. Louis city Missouri 63115 1947 Purchase Primary 2016 $100,750 $15,113 $85,638 $37,000 GLASPER Andre 1980 13 100047 8418 Brookside Dr. Platinum city Alaska 99655 195 Purchase Primary 2019 $180,336 $27,050 $153,285 $38,000 Frederick BERTHA 1994 13 50 100048 659 Park St. Baltimore city Maryland 21216 1947 Purchase imary 2015 $200,922 $170,784 $37,000 BATISTE Darnell 1983 16 51 100049 65 Santa Clara Rd. Napi Headquarters CDP New Mexico 87499 1945 Purchase Primary 1996 $116,091 $17,414 $98,677 $39,000 Lowe IRIS 1988 12 52 100050 1982 W. Lees Creek St. Detroit city Michigan 48227 195 Purchase Primary 1997 $78,463 $11,769 $66,693 $29,000 DELOATCH Marquis 1991 12 53 100051 3144 Warren Rd. Fairmont City village Illinois 62205 1946 Purchase Primary 1976 $135,750 $20,362 $115,38 $40,000 WIGFALL Maurice 1992 13 54 100052 7409 Santa Clara Lane Winston-salem city North Carolina 27110 2013 Purchase Primary 2017 $297,201 $59,440 $237,761 112,000 DRAYTON Jalen 1981 18 55 100053 6698 N. Glenholme St. Clarksdale city Mississippi 38639 2014 Purchase Primar 201 $61, 372 $9,206 $52,16 $40,000 GADSON Jalen 1988 12 56 100054 227 Santa Clara Ave. East St. Louis city Illinois 62090 1950 Purchase Primary 2005 $106,563 $15,985 $90,57 $31,400 MUHAMMAD Tyrone 1986 12 Table1 Ready fox Accessibility: Investigate + 100%AutoSave O OFF A A ? . C E ... DAT 645 Field Column Descriptions (1) ~ Q Home Insert Draw Page Layout Formulas Review View Automate ? Tell me Comments LE Share & Cut Calibri v 11 AA 27 V e Wrap Text v General Normal Bad LIX V V AutoSum ~ As DE Copy v hi- Paste Format B I UV Font Fill v MVA Merge & Center v v % 9 Conditional Format Good Neutral Insert Delete Format Sort & Find & Analyze Sensitivity Formatting as Table Clear Filter Selec Data Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Yes No A1 X V fx Field C D E F G H M N P Q R S W X Z AA AB 1 Field Description Years Edu Description ID Unique identifier for the applicant. 11 Less than High School Diploma or Eq. Property_Address Property address for loan (Street Number, Name) 12 High School Diploma or Equivalent Property_City Property address for loan (City) 13 Some College - No degree Property_State Property address for loan (State 14 Associated Degree or Vocational Certification Property_Zip Property address for loan (Zip 5) 16 Bachelors Degree 7 Year_Built Year main structure built 18 Masters Degree Loan_Purpose Purchase or refinance 20 Doctoral Degree (Academic or Professional -Ph.D., M.D., D.O., etc...) 9 Residence_Use Primary Residence or other use 10 Year_Aquired Year loan acquired 11 Original_Cost Price of property 12 Present_lot_value Lot value 13 Present_Improv_value Value of structures and improvements 14 DownPayment Amount paid down on loan 15 B_Name_Last Borrower 1 Last Name 16 B_Name_first Borrower 1 First Name 17 B_DOB Borrower 1 Year of birth 18 B_Yr_School Borrower 1 Years in school (See value table 19 B_Marital_Status Borrower 1 Marital status (1 Married, 2 Not Married) 20 B_Dependents Borrower 1 Number of dependents 21 B_Employment_Title Borrower1 Job Title/Field 22 B_Yrs_in_field Borrower 1 Years Employed in current field 23 Annual Annual Income 24 B_Monthly_Income Borrower 1 Monthly Gross Income 25 B_Gross_Income_all_sources Borrower 1 Monthly Gross Income All Sources 26 CB_Name_Last Co-Borrower Last Name 27 CB_Name_first Co-Borrower First Name 28 CB_DOB Co-Borrower Year of birth 29 CB_Yr_School Co-Borrower Years in school (See value table) 30 CB_Marital_Status Co-Borrower Marital status (1 Married, 2 Not Married) 31 CB_Yrs_in_field o-Borrower Years Employed in current field 32 CB_Monthly_Income Co-Borrower Monthly Gross Income 33 CB_Gross_Income_all_sources Co-Borrower Monthly Gross Income All Sources 34 Total_Assets_Cash_Value Total Assets of borrowers 35 Total_Liabilities Total Liabilities not counting Primary Mortgage 36 Monthly_Payment_Liability Total Payments toward Liabilities not counting Mortgage 37 Total_Loan_Amount Total Amount of Loan at initiation 38 B_US_Citizen Borrower 1 US Citizen (Y for Yes) 39 B_Resident_Alien Borrower 1 Resident Alien (Y for Yes) 40 B_Hispanic Borrower 1 is Hispanic (Y for Yes) 41 B_Race Borrower 1 Race (Self-identified W-White/Anglo, B-Black any Nationality, A-Asian) 42 B_Gender Borrower 1 Gender CB_US_Citizen Co-Borrower US Citizen (Y for Yes) 44 CB_Resident Alien Co-Borrower Resident Alien (Y for Yes) 45 CB_Hispanic o-Borrower is Hispanic (Y for Yes) 46 CB_Race Co-Borrower Race (Self-identified W-White/Anglo, B-Black any Nationality, A-Asian) 47 CB_Gende Co-Borrower Gender 48 PERC_WHIT Zip code Percent White - US Census 49 PERC_BLACK zip code Percent Black - US Census PERC_NATIVE_AMER Zip code Percent Native American - US Census 51 PERC_ASIAN Zip code Percent Asian - US Census 52 PERC_PACIFIC Zip code Percent Pacific Islander - US Census 53 PERC_MULTI_RACE Zip code Percent Multiple Race- US Census 54 PERC_HISP Zip code Percent Hispanic - US Census 55 PERC_WHIT_NHISP Zip code Percent White-Non-Hispanic - US Census 56 PERC_FMALE Zip code Percent Female - US Census Sheet1 + Ready Accessibility: Good to go 100%AutoSave O OFF A A ? . C E ... DAT 645 Predictive Demograpes (1) ~ Q Home Insert Draw Page Layout Formulas Data Review View Automate ? Tell me Comments LE Share & Cut Calibri v 11 AA 27 V e Wrap Text v General Normal Bad Autosum ~ As hi- DE Copy v Fill v Paste Format IUVV MVA Merge & Center v v % 9 08 508 Conditional Format Good Neutral Insert Delete Format Sort & Formatting as Table Clear Find & Analyze Filter Selec Sensitivity Data Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Yes No A1 X fx CONFUSION MATRICS FOR PREDICTIVE MODEL COMPAIRED TO ACTUAL N P Q R S V W AA CONFUSION MATRICS FOR PREDICTIVE MODEL COMPAIRED TO ACTUAL PREDICT PREDICT NO Grand Predictive Error PREDICT DEFAULT PREDICT DEFAULT DEFAULT Total Percent in bold NO DEFAULT 3 CURRENT ON LOAN 478 20399 20877 CURRENT ON LOAN 2.3% 97.7% DEFAULTED 1979 41 2020 DEFAULTED 98.0% 2.0% Grand Total 2457 20440 22897 10 11 12 PREDICTED BORROWER BEHAVIOR / RECOMMENDED LENDING DECSION BASED ON PREDICTIVE MODEL 14 15 Demographics of Borrower 1 (Primary on application) MARITAL STATUS OF Predicted Predicted to RACE/ETHNICITY OF Predicted Default Predicted to Not GENDER OF Predicted Predicted to EDUCATION OF Predicted Predicted to BORROWER Default Not Default BORROWER 1 Decline) Default (Approve) BORROWER 1 Default Not Default BORROWER 1 Default Not Default 16 (Decline) (Approve (Decline) (Approve) (Decline) (Approve) 17 Married 9.5% 90.59 Asian 4,5% 95.5% Female 26.9% 73.1% Less than High Scho 1.0% 99.0% 18 Single 18.29 81.8% Black (Non-Hispanic) 9.5% 90.5% Male 9.09 91.0% High School Diplor 2.7 97.3% 19 White (Non-Hispanic) 8.0% 92.0% Some College - No 6.9% 93.1% 20 Hispanic (All Races) 36.4% 63.6% Associated Degree 9.6% 90.4% 21 Bachelors Degree 30.19 59.9% 22 Masters Degree 28.5% 71.5% 23 Doctoral Degree 48.4% 51.6% 24 25 GENERATIONAL Predicted Predicted to GENDER FOR SINGLE Predicted Default Predicted to Not RACE & GENDER Predicted Predicted to Boomers 1.5% 98.5% Female 26.9% 73.1% Female 27 Generation X 8.3% 91.7% Male 0.6% 99.4% Black 6.9% 93.1% 28 Millennials 21.9% 78.1% White 29.3% 10% % 29 Male 30 White 0.6% 99.4% 31 32 33 34 35 Neighborhood Demographics of Location of Property for Loan 36 AFFLUENTY CATEGORY Predicted Predicted to DOMINANT GENERATION Predicted Default Predicted to Not URBANIZATION Predicted Predicted to PRIMARY OWNER Predicted Predicted to 37 POVERTY LINE 12.7% 87.3% MILLENNIAL 21.0% 79.0% Urban- metro 13.5% 86.5% Own 8.3% 91.7% 38 LOW 5.8% 94.2% X_GEN 17.0% 83.0% Urban- adjacent to 6.7% 93.3% Mixed 21.99 78.1% 39 LOWER MIDDLE 10.2% 89.8% BOOMER 1.5% 98.5% Urban-not ajacent 9.9% 90.1% Rent 25.7% 74.3% 40 MIDDLE 16.2% 83.8% SILENT 17.0% 83.0% Rual 8.5% 91.5% 41 UPPER MIDDLE 11.5% 88.5% UNKNOWN 1.5% 98.5% Unknown 10.5% 89.5% 42 UPSCALE 11.5% 88.5% 43 WELL OF 5,1% 94.9% 44 AFFLUENT 25.0% 75.0% 45 UNKNOWN 30.1% 69.9% 46 47 48 ACTUAL LENDER BEHAVIOR 49 Demographics of Borrower 1 (Primary on application) 51 MARITAL STATUS OF Defaulted Current RACE/ETHNICITY OF Defaulted Current GENDER OF Defaulted Current EDUCATION OF Defaulted Current 62 Married 7.9% 92.1% Asian 4.5% 95.5% Female 20.9% 79.1% Less than High Scho 0.0% 100.0% Notes- Read First Demograpes + Ready 1Accessibility: Good to go 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts