Question: Part 1 : The SolarTech Manufacturing Acquisition Proposal Spreadsheet Assignment Instructions: Create a spreadsheet that calculates pro forma financials, free cash flows, and the net

Part : The SolarTech Manufacturing Acquisition Proposal

Spreadsheet Assignment Instructions: Create a spreadsheet that calculates pro forma financials, free cash flows, and the net present value of the acquisition of BrightFuture Solar by Solar'Tech. The spreadsheet will be presented by Emma's supervisor to the board of directors, and Emma will not be present at the meeting. The spreadsheet must include all the necessary inputs, be formulabased, and appropriately use cell referencing. The spreadsheet should be dynamic in the sense that a user can easily see the effects of changing inputs. For example, if any inputs change, all the cash flow and NPV calculations will automatically update. Note: As part of grading your spreadsheet, I will change some of the assumptions and verify that the NPV changes appropriately, which will be the case if your spreadsheet is formulabased.

Upload your finished spreadsheet to Canvas before : PM April You must upload an Excel or Google Sheets file not a link, not a pdf You can work alone or in groups of up to four people no groups over four people If you work in a group, you should all plan to work on the second part of the case together also, which will be done on the date posted in Canvas.

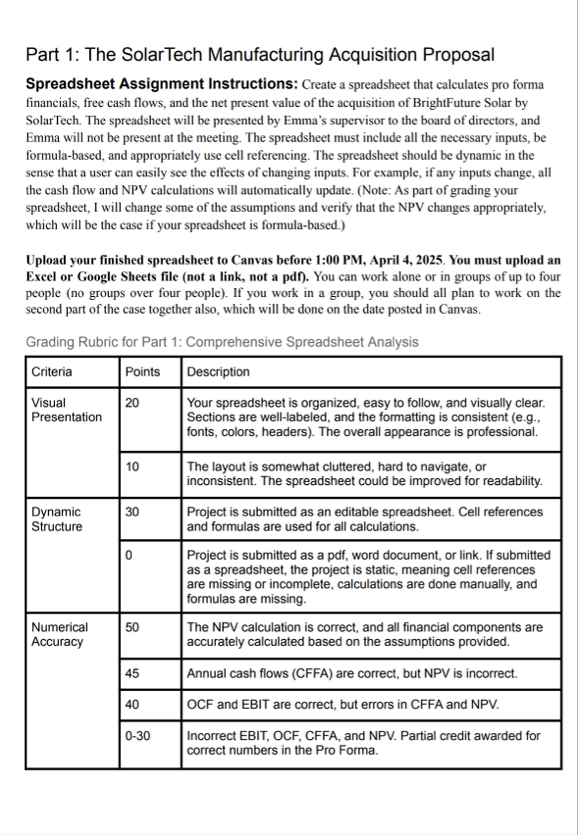

Grading Rubric for Part : Comprehensive Spreadsheet Analysis

tableCriteriaPoints,DescriptiontableVisualPresentationtableYour spreadsheet is organized, easy to follow, and visually clear.Sections are welllabeled, and the formatting is consistent egfonts colors, headers The overall appearance is professional.tableThe layout is somewhat cluttered, hard to navigate, orinconsistent The spreadsheet could be improved for readability.tableDynamicStructuretableProject is submitted as an editable spreadsheet. Cell referencesand formulas are used for all calculations.tableProject is submitted as a pdf word document, or link. If submittedas a spreadsheet, the project is static, meaning cell referencesare missing or incomplete, calculations are done manually, andformulas are missing.tableNumericalAccuracytableThe NPV calculation is correct, and all financial components areaccurately calculated based on the assumptions provided.Annual cash flows CFFA are correct, but NPV is incorrect.OCF and EBIT are correct, but errors in CFFA and NPVtableIncorrect EBIT, OCF, CFFA, and NPV Partial credit awarded forcorrect numbers in the Pro Forma.Email

To: Emma Brooks, Financial Analyst

From: Robert Lawson, CFO, SolarTech

Date: March

Subject: BrightFuture Solar Proposal

Hi Emma,

I hope you're doing well. I wanted to touch base regarding the analysis of the proposed acquisition of BrightFuture Solar for $ million. As discussed, we need to make an informed decision about acquiring their solar panel manufacturing assets, and Im counting on you to put together all the numbers concisely. Create a spreadsheet with the projected revenue, costs, and cash flows on this acquisition for the next five years, and calculate the Net Present Value NPV of the acquisition, using a discount rate.

Once you've compiled all the data, please submit your spreadsheet with the NPV calculation clearly presented. I will be sharing the spreadsheet with the Board, so it should be wellorganized, easily traceable, and include all the necessary assumptions sales projections, operating expenses, depreciation, etc. The deadline for this deliverable is PM Friday, April

I've copied key department leads below, as they will provide you with the necessary assumptions for your model. Be sure to reach out to them for any further details or clarifications:

Sales Projections Kelly Mitchell, VP of Sales

Operating Expenses and Working Capital Assumptions Mark Davis, Director of Operations

Tax and Depreciation Information Angela Carr, Senior Tax Manager

I look forward to seeing your work on thisplease let me know if you have any questions or need any help as you progress.

Best regards,

Robert Lawson

Chief Financial Officer, SolarTechEmail

To: Emma Brooks, Financial Analyst

From: Kelly Mitchell, VP of Sales, SolarTech

Date: March

Subject: Sales Projections for BrightFuture Solar Acquisition

Hi Emma,

As part of the financial model for the BrightFuture Solar acquisition, you'll need to incorporate the sales projections for the first few years after the acquisition. BrightFuture Solar's expected sales in Year postacquisition are estimated at $ million. We anticipate a growth in sales each year for the first five years, based on their current product offerings and market demand.

This sales forecast is critical to the model, so please use it as the starting point for your revenue projections. If you ne

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock