Question: Part 1: True False, Multiple Choice, Fall in the Blank (20%) Select/ Write the BEST answer for each Show work for partial credit 1. The

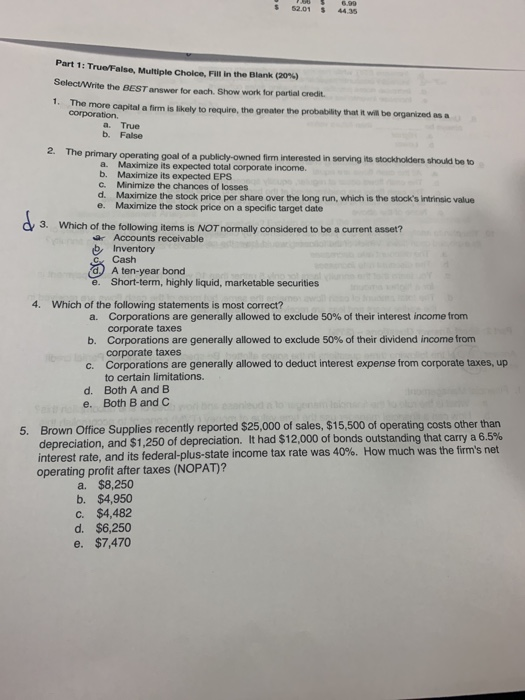

Part 1: True False, Multiple Choice, Fall in the Blank (20%) Select/ Write the BEST answer for each Show work for partial credit 1. The more capital a firm is likely to require the greater the probability that it will be organized as a corporation a. True b. False 2. The primary operating goal of a publicly-owned firm interested in serving its stockholders should be to a. Maximize its expected total corporate income. b. Maximize its expected EPS C. Minimize the chances of losses d. Maximize the stock price per share over the long run, which is the stock's Intrinsic value e. Maximize the stock price on a specific target date 3. Which of the following items is NOT normally considered to be a current asset? & Accounts receivable ib Inventory GCash A ten-year bond e. Short-term, highly liquid, marketable securities 4. Which of the following statements is most correct? a. Corporations are generally allowed to exclude 50% of their interest income from corporate taxes b. Corporations are generally allowed to exclude 50% of their dividend income from corporate taxes c. Corporations are generally allowed to deduct interest expense from corporate taxes, up to certain limitations. d. Both A and B e. Both B and C 5. Brown Office Supplies recently reported $25,000 of sales, $15,500 of operating costs other than depreciation, and $1.250 of depreciation. It had $12,000 of bonds outstanding that carry a 6.5% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's net operating profit after taxes (NOPAT)? a. $8,250 b. $4,950 C. $4,482 d. $6,250 e. $7,470 Part 1: True False, Multiple Choice, Fall in the Blank (20%) Select/ Write the BEST answer for each Show work for partial credit 1. The more capital a firm is likely to require the greater the probability that it will be organized as a corporation a. True b. False 2. The primary operating goal of a publicly-owned firm interested in serving its stockholders should be to a. Maximize its expected total corporate income. b. Maximize its expected EPS C. Minimize the chances of losses d. Maximize the stock price per share over the long run, which is the stock's Intrinsic value e. Maximize the stock price on a specific target date 3. Which of the following items is NOT normally considered to be a current asset? & Accounts receivable ib Inventory GCash A ten-year bond e. Short-term, highly liquid, marketable securities 4. Which of the following statements is most correct? a. Corporations are generally allowed to exclude 50% of their interest income from corporate taxes b. Corporations are generally allowed to exclude 50% of their dividend income from corporate taxes c. Corporations are generally allowed to deduct interest expense from corporate taxes, up to certain limitations. d. Both A and B e. Both B and C 5. Brown Office Supplies recently reported $25,000 of sales, $15,500 of operating costs other than depreciation, and $1.250 of depreciation. It had $12,000 of bonds outstanding that carry a 6.5% interest rate, and its federal-plus-state income tax rate was 40%. How much was the firm's net operating profit after taxes (NOPAT)? a. $8,250 b. $4,950 C. $4,482 d. $6,250 e. $7,470

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts