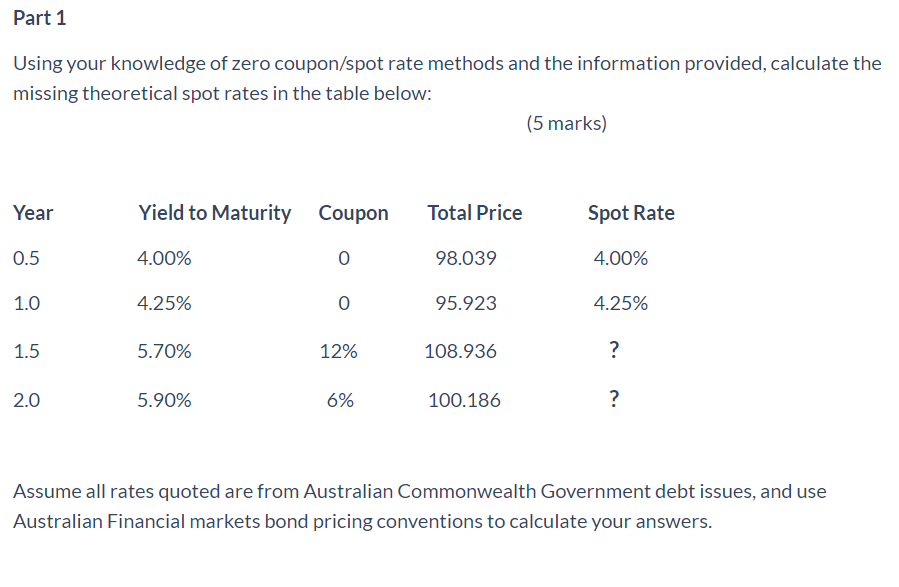

Question: Part 1 Using your knowledge of zero coupon/spot rate methods and the information provided, calculate the missing theoretical spot rates in the table below: (5

Part 1 Using your knowledge of zero coupon/spot rate methods and the information provided, calculate the missing theoretical spot rates in the table below: (5 marks) Year Yield to Maturity Coupon Total Price Spot Rate 0.5 4.00% 0 98.039 4.00% 1.0 4.25% o 95.923 4.25% 1.5 5.70% 12% 108.936 ? 2.0 5.90% 6% 100.186 ? Assume all rates quoted are from Australian Commonwealth Government debt issues, and use Australian Financial markets bond pricing conventions to calculate your answers. Part 1 Using your knowledge of zero coupon/spot rate methods and the information provided, calculate the missing theoretical spot rates in the table below: (5 marks) Year Yield to Maturity Coupon Total Price Spot Rate 0.5 4.00% 0 98.039 4.00% 1.0 4.25% o 95.923 4.25% 1.5 5.70% 12% 108.936 ? 2.0 5.90% 6% 100.186 ? Assume all rates quoted are from Australian Commonwealth Government debt issues, and use Australian Financial markets bond pricing conventions to calculate your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts