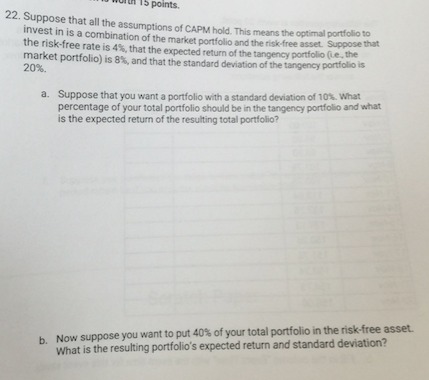

Question: Part 10. Interim Quality Performance Report Davis, Inc., had the following quality costs for the years ended December 31, 20x4 and 20x5: 20x4 20x5 Prevention

Part 10.

Interim Quality Performance Report

Davis, Inc., had the following quality costs for the years ended December 31, 20x4 and 20x5:

20x4 20x5

Prevention costs:

Quality audits $72,000 $108,000

Vendor certification 112,500 168,750

Appraisal costs:

Product acceptance $90,000 $135,000

Process acceptance 103,000 117,500

Internal failure costs:

Retesting $90,000 $82,000

Rework 200,000 182,000

External failure costs:

Recalls $155,000 $124,000

Warranty 300,000 294,000

At the end of 20x4, management decided to increase its investment in control costs by 50 percent for each category's items with the expectation that failure costs would decrease by 20 percent for each item of the failure categories. Sales were $12,000,000 for both 20x4 and 20x5.

Required:

1. Calculate the budgeted costs for 20x5.

$

Feedback

The costs of quality are associated with two subcategories of quality-related activities: control activities and failure activities.

Prepare an interim quality performance report. Enter all answers as positive amounts. If there is no variance enter "0" for your answer. If the budget variance amount is unfavorable select "Unfavorable" in the last column of the table, select "Favorable" if it is favorable, or No effect if there is no change. Round percentage answers to two decimal places. For example, 5.789% would be entered as "5.79".

Davis, Inc.

Interim Standard Performance Report: Quality Costs

For the Year Ended December 31, 20x5

Actual Costs Budgeted Costs Variance Unfavorable, Favorable or No effect

Prevention costs:

Quality audits $ $ No effect

Vendor certification No effect

Total prevention costs $ $ No effect

Appraisal costs:

Product acceptance $ $ No effect

Process acceptance $ Favorable

Total appraisal costs $ $ $ Favorable

Internal failure costs:

Retesting $ $ $ Unfavorable

Rework Unfavorable

Total internal failure costs $ $ $ Unfavorable

External failure costs:

Recalls $ $ No effect

Warranty Unfavorable

Total external failure costs $ $ $ Unfavorable

Total quality costs $ $ $ Unfavorable

Percentage of sales % % % Unfavorable

Feedback

Review the interim quality performance report comparing budgeted and actual performance you have learned in the chapter.

2. What can be inferred from the report regarding the progress Davis has made?

Davis has come very close to meeting the planned outcomes

3. What if sales were $12,000,000 for 20x4 and $15,000,000 for 20x5? What adjustment to budgeted rework costs would be made? (Note: Quality auditing is a discretionary cost and its budget is not affected by the change in sales revenue in 20x5.)

New total budgeted rework costs: $

2. Review the variances arising from comparing actual costs to budgeted costs.

3. To determine if an adjustment would need to be made, consider whether the cost is fixed or variable.

Compare the actual costs for 20x5 to the new budget.

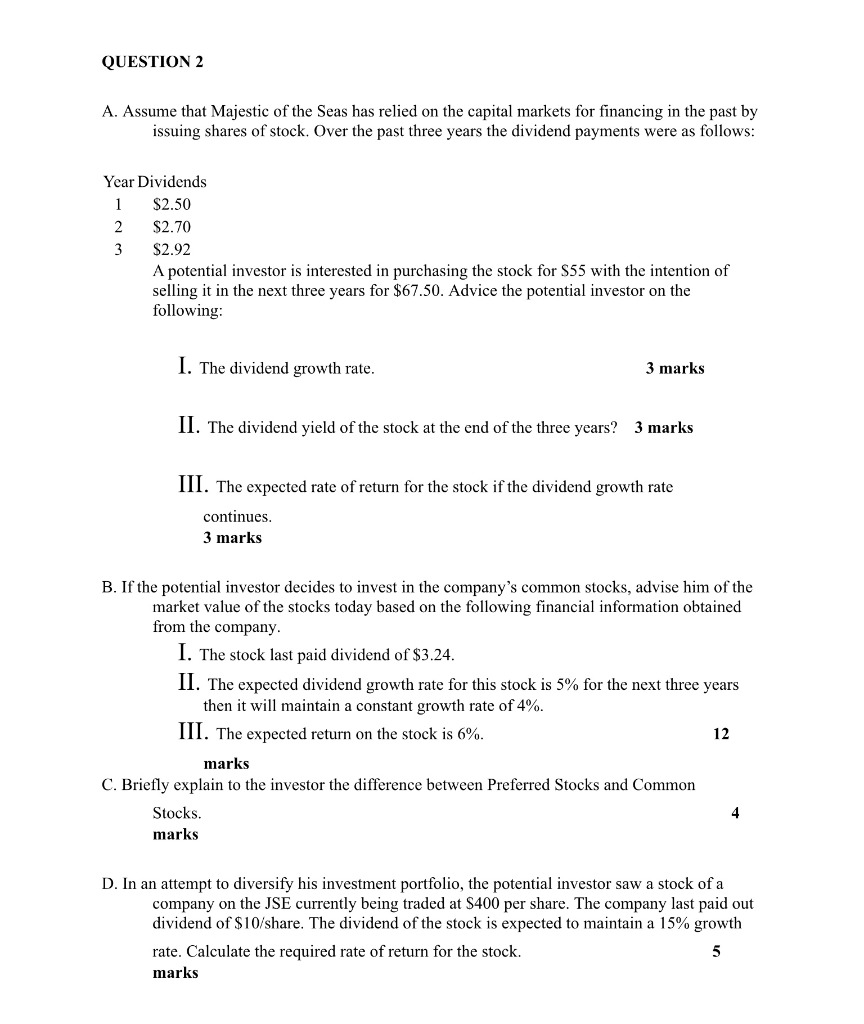

Part 11.

3. The trial balance of a trading company failed to balance on March 31,2018. The difference had been entered in a Suspense Account, and the final accounts for the year ended March 31,2018 and a Balance Sheet had been prepared on the basis of the figure shown in the trial balance. The net profit arrived at was GHs37,500.

a. The following errors were subsequently discovered and on correction, the Trial Balance agreed. Discounts, shown as GHs800 on the credit side of the three column Cash Book, had been posted to the debit of Discount Allowed Account.

b. A payment of GHs720 for repairs to motor vans had been debited to Motor Vans Account.

c. The bank overdraft of GHs1,720 had been entered in the Trial Balance GHs1,620

d. Premises were let to a sub-tenant from March 1. The sub-tenant paid GHs1,200 on March 1, representing three months' rent in advance. This had been entered in the Cash Book, but no other entry had been made.

e. Goods (selling price GHs750, cost price GHs55) were returned by a customer on March 31. No entry had been made in the books, and the goods had not been included in the closing stock.

f. P Doe's debit balance of GHs390 had been omitted from the debtors in the Trial Balance.

YOUR ARE REQUIRED TO:

i. tabulate an answer showing the effect of each of the above errors on the Trial Balance and on the net profit.

ii. show the Suspense Account bringing out the original difference in the books, and

iii. produce a statement showing the correct net profit after adjustment of the errors.

Part 12.

respond to the following questions.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts