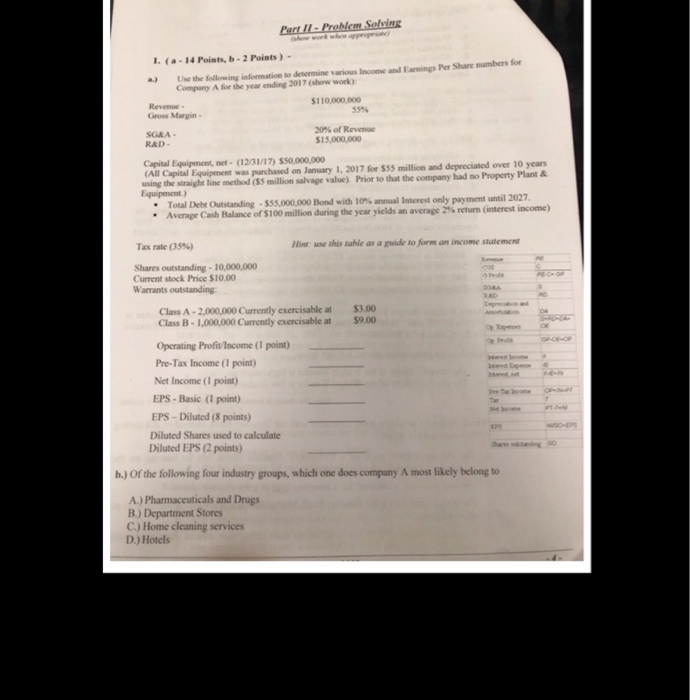

Question: Part 11 1. (a-14 Points, b- 2 Points) - ) Use the following information to determine various Income and Earnings Per Share numbers for Company

Part 11 1. (a-14 Points, b- 2 Points) - ) Use the following information to determine various Income and Earnings Per Share numbers for Company A for the year ending 201 7 (show work) $110,000,000 Revenue 55% Gross Margin 20% of Revenue SG&A 15,000,000 RAD- Capital Equipment, net (1231/17) ss0,000,000 using the straight line method (55 million salvage value) Prior to that the company had no Property Plant& (All Capital Equipment was purchased on January 1, 2017 for $$5 million and depreciated over 10 years Equipment) Total Debt Outstanding-555,000,000 Bord with 10% annual Interest only payment until 2027. Average Cash Balance of S 100 million during the year yields an average 2% return (interest income) . * Tax rate (35%) Hint: ase this table as a guide to form an income statement Shares outstanding- 10,000,000 Current stock Price $10.00 Warrants outstanding: Class A -2,000,000 Currently exercisable at $3.00 Class B- 1,000,000 Currently exercisable at $9.00 Operating Profit/Income (I point) Pre-Tax Income (1 point) Net Income (I point) EPS- Basic (1 point) EPS - Diluted (8 points) Diluted Shares used to calculate Diluted EPS (2 points) b.) Of the following four industry groups, which one does company A most likely belong to A.) Pharmaceuticals and Drugs B.) Department Stores C.) Home cleaning services D.) Hotels Part 11 1. (a-14 Points, b- 2 Points) - ) Use the following information to determine various Income and Earnings Per Share numbers for Company A for the year ending 201 7 (show work) $110,000,000 Revenue 55% Gross Margin 20% of Revenue SG&A 15,000,000 RAD- Capital Equipment, net (1231/17) ss0,000,000 using the straight line method (55 million salvage value) Prior to that the company had no Property Plant& (All Capital Equipment was purchased on January 1, 2017 for $$5 million and depreciated over 10 years Equipment) Total Debt Outstanding-555,000,000 Bord with 10% annual Interest only payment until 2027. Average Cash Balance of S 100 million during the year yields an average 2% return (interest income) . * Tax rate (35%) Hint: ase this table as a guide to form an income statement Shares outstanding- 10,000,000 Current stock Price $10.00 Warrants outstanding: Class A -2,000,000 Currently exercisable at $3.00 Class B- 1,000,000 Currently exercisable at $9.00 Operating Profit/Income (I point) Pre-Tax Income (1 point) Net Income (I point) EPS- Basic (1 point) EPS - Diluted (8 points) Diluted Shares used to calculate Diluted EPS (2 points) b.) Of the following four industry groups, which one does company A most likely belong to A.) Pharmaceuticals and Drugs B.) Department Stores C.) Home cleaning services D.) Hotels

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts