Question: PART 11 MULTIPLE CHOICE (2 POINTS ach) Choose the best anaver 1. Which of the following i. considered in co puting depreciation of an asset

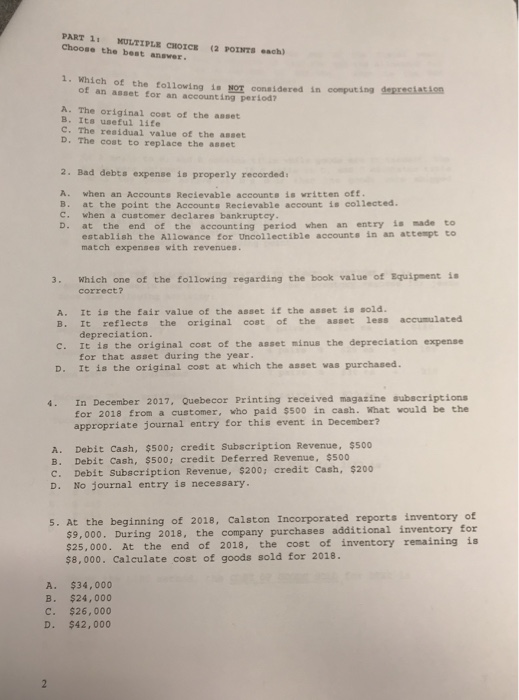

PART 11 MULTIPLE CHOICE (2 POINTS ach) Choose the best anaver 1. Which of the following i. considered in co puting depreciation of an asset for an account ing period? A. The original cost of the asset B. Its useful life C. The residual value of the asset D. The cost to replace the asset 2. Bad debts expense is properly recorded A. when an Accounts Recievable accounts is vritten off. B. at the point the Accounta Recievable account is collected. C. when a customer declares bankruptcy. D. at the end of the accounting period when an entry is made to establish the Allowance for Uncollectible accounts in an attempt to match expenses with revenues. 3. Which one of the following regarding the book value of Equipment i correct? A. It is the Eair value of the asset it the asset is sold. B. It reflects the original cost of the asset less accumulated c. It is the original cost of the asset minus the depreciation expense D. It is the original cost at which the asset was purchased depreciation for that asset during the year 4. In December 2017, Quebecor Printing received magazine subscriptions for 2018 from a customer, who paid $500 in cash. What would be the appropriate journal entry for this event in December? A. Debit Cash, $500 credit Subscription Revenue, $500 B. Debit Cash, $500; credit Deferred Revenue, $500 c. Debit Subscription Revenue, $200; credit Cash, $200 D. No journal entry is necessary 5. At the beginning of 2018, Calston Incorporated reports inventory of $9,000. During 2018, $25,000. At the end of 2018, the cost of inventory remaining is the company purchases additional inventory for $8,000. Calculate cost of goods sold for 2018. A. $34,000 B. $24, 000 c. $26,000 D. $42,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts