Question: part 1&2 to the same question Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below)

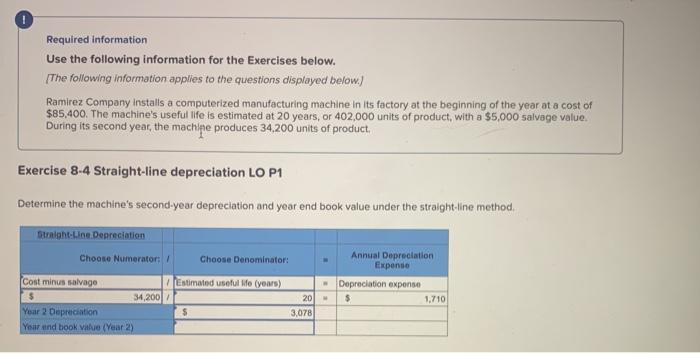

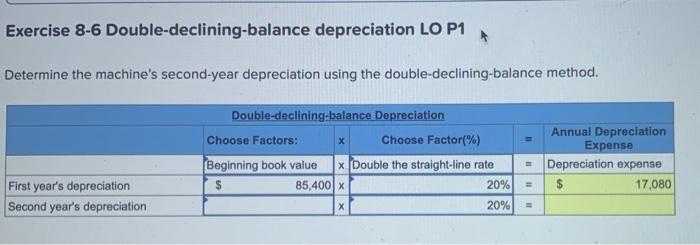

Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below) Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $85,400. The machine's useful life is estimated at 20 years, or 402,000 units of product, with a $5,000 salvage value During its second year, the machipe produces 34.200 units of product Exercise 8-4 Straight-line depreciation LO P1 Determine the machine's second-year depreciation and year end book value under the straight line method. Straight Line Depreciation Choose Numerator: Choose Denominator: Estimated useful life yours) Annual Depreciation Expense Depreciation expenso $ 1.710 Cont minun salvage $ 34,200 Year 2 Depreciation Year and book value (Year 2) 20 3.078 $ Exercise 8-6 Double-declining-balance depreciation LO P1 Determine the machine's second-year depreciation using the double-declining balance method. Double-declining balance Depreciation Choose Factors: Choose Factor(%) Beginning book value x Double the straight-line rate $ 85,400 20% 20% Annual Depreciation Expense Depreciation expense $ 17,080 First year's depreciation Second year's depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts