Question: Part 2 (30 marks) risk and return You are considering investing in stocks and have identified the following potential stocks. They are Alibaba Group

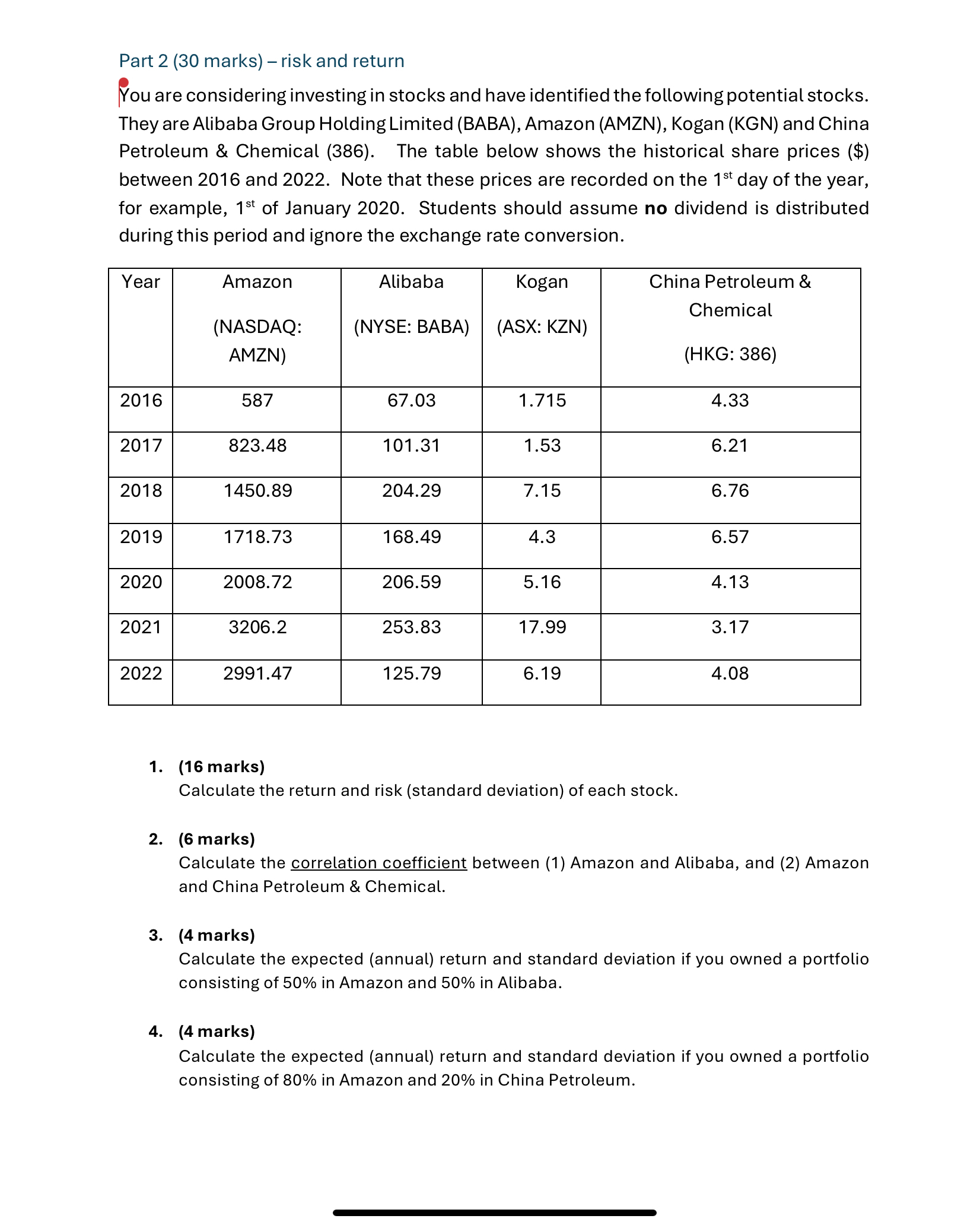

Part 2 (30 marks) risk and return You are considering investing in stocks and have identified the following potential stocks. They are Alibaba Group Holding Limited (BABA), Amazon (AMZN), Kogan (KGN) and China Petroleum & Chemical (386). The table below shows the historical share prices ($) between 2016 and 2022. Note that these prices are recorded on the 1st day of the year, for example, 1st of January 2020. Students should assume no dividend is distributed during this period and ignore the exchange rate conversion. Year Amazon Alibaba Kogan China Petroleum & Chemical (NASDAQ: (NYSE: BABA) (ASX: KZN) AMZN) (HKG: 386) 2016 587 67.03 1.715 4.33 2017 823.48 101.31 1.53 6.21 2018 1450.89 204.29 7.15 6.76 2019 1718.73 168.49 4.3 6.57 2020 2008.72 206.59 5.16 4.13 2021 3206.2 253.83 17.99 3.17 2022 2991.47 125.79 6.19 4.08 1. (16 marks) Calculate the return and risk (standard deviation) of each stock. 2. (6 marks) Calculate the correlation coefficient between (1) Amazon and Alibaba, and (2) Amazon and China Petroleum & Chemical. 3. (4 marks) Calculate the expected (annual) return and standard deviation if you owned a portfolio consisting of 50% in Amazon and 50% in Alibaba. 4. (4 marks) Calculate the expected (annual) return and standard deviation if you owned a portfolio consisting of 80% in Amazon and 20% in China Petroleum.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts