Question: Part 2 ( 7 0 % ) : Below are the 2 0 2 4 tax brackets for single American taxpayers: a ) Build this

Part :

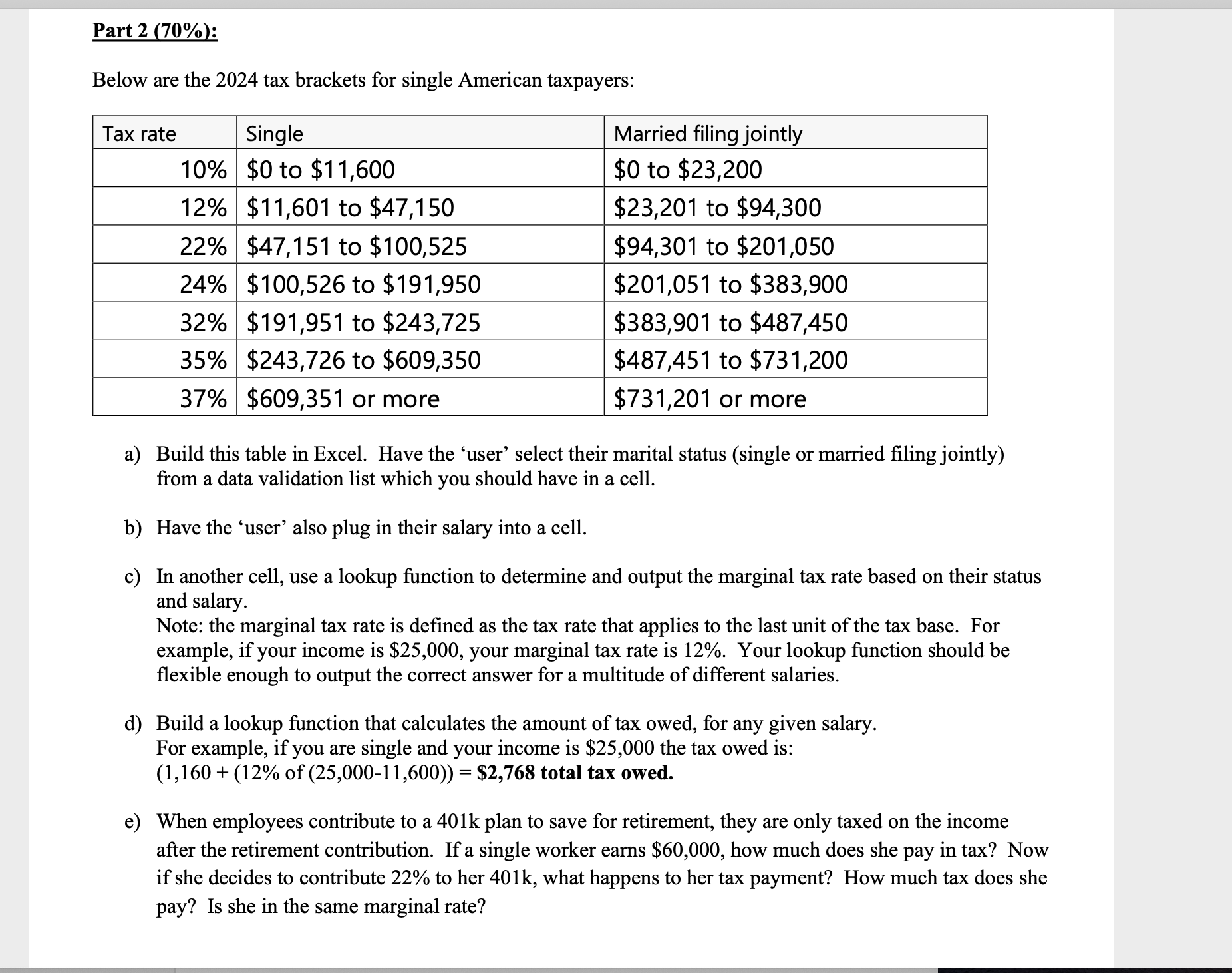

Below are the tax brackets for single American taxpayers:

a Build this table in Excel. Have the 'user' select their marital status single or married filing jointly

from a data validation list which you should have in a cell.

b Have the 'user' also plug in their salary into a cell.

c In another cell, use a lookup function to determine and output the marginal tax rate based on their status

and salary.

Note: the marginal tax rate is defined as the tax rate that applies to the last unit of the tax base. For

example, if your income is $ your marginal tax rate is Your lookup function should be

flexible enough to output the correct answer for a multitude of different salaries.

d Build a lookup function that calculates the amount of tax owed, for any given salary.

For example, if you are single and your income is $ the tax owed is:

of total tax owed.

e When employees contribute to a k plan to save for retirement, they are only taxed on the income

after the retirement contribution. If a single worker earns $ how much does she pay in tax? Now

if she decides to contribute to her k what happens to her tax payment? How much tax does she

pay? Is she in the same marginal rate? Please help me solve part e only

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock