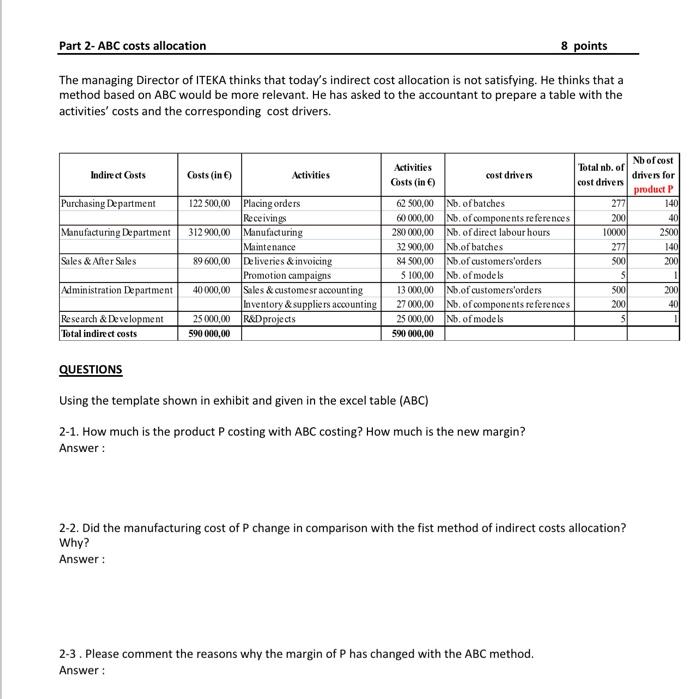

Question: Part 2- ABC costs allocation 8 points The managing Director of ITEKA thinks that today's indirect cost allocation is not satisfying. He thinks that a

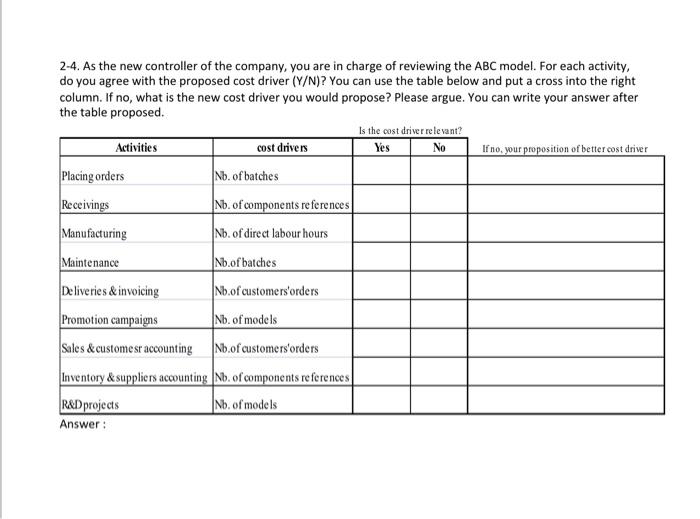

Part 2- ABC costs allocation 8 points The managing Director of ITEKA thinks that today's indirect cost allocation is not satisfying. He thinks that a method based on ABC would be more relevant. He has asked to the accountant to prepare a table with the activities' costs and the corresponding cost drivers. Indirect Costs Costs (in) Activities Purchasing Department Manufacturing Department Sales & After Sales Administration Department Research & Development Total indirect costs 122 500,00 Placing orders Receivings 312900,00 Manufacturing Maintenance 89 600,00 Deliveries & invoicing Promotion campaigns 40000,00 Sales & customer accounting Inventory & suppliers accounting 25 000,00 R&D projects 590 000,00 Activities cost drivers Costs (in ) 62 500,00 Nb. of batches 60000,00 No. of components references 280 000,00 Nb. of direct labour hours 32 900,00 Nb.of batches 84 500,00 No.of customers'orders 5 100,00 Nb. of models 13.000,00 Nb of customers'orders 27 000,00 No. of components references 25 000,00 Nb.of models 590 000,00 Nb of cost Total nb. of drivers for cost drivers product P 277 140 200 40 10000 2500 277 140 500 200 S 1 500 200 200 40 5 QUESTIONS Using the template shown in exhibit and given in the excel table (ABC) 2-1. How much is the product P costing with ABC costing? How much is the new margin? Answer: 2-2. Did the manufacturing cost of P change in comparison with the fist method of indirect costs allocation? Why? Answer: 2-3. Please comment the reasons why the margin of P has changed with the ABC method. Answer: 2-4. As the new controller of the company, you are in charge of reviewing the ABC model. For each activity, do you agree with the proposed cost driver (Y/N)? You can use the table below and put a cross into the right column. If no, what is the new cost driver you would propose? Please argue. You can write your answer after the table proposed Is the cost driver relevant? Activities cost drivers Yes No If no, your proposition of better cost driver Placing orders No. of batches Receivings No. of components references Manufacturing No. of direct labour hours Maintenance No.of batches Deliveries & invoicing Nb.of customers'orders Promotion campaigns No. of models Sales &customer accounting No.of customers'orders Inventory & suppliers accounting No. of components references R&D projects No. of models Answer: Part 2- ABC costs allocation 8 points The managing Director of ITEKA thinks that today's indirect cost allocation is not satisfying. He thinks that a method based on ABC would be more relevant. He has asked to the accountant to prepare a table with the activities' costs and the corresponding cost drivers. Indirect Costs Costs (in) Activities Purchasing Department Manufacturing Department Sales & After Sales Administration Department Research & Development Total indirect costs 122 500,00 Placing orders Receivings 312900,00 Manufacturing Maintenance 89 600,00 Deliveries & invoicing Promotion campaigns 40000,00 Sales & customer accounting Inventory & suppliers accounting 25 000,00 R&D projects 590 000,00 Activities cost drivers Costs (in ) 62 500,00 Nb. of batches 60000,00 No. of components references 280 000,00 Nb. of direct labour hours 32 900,00 Nb.of batches 84 500,00 No.of customers'orders 5 100,00 Nb. of models 13.000,00 Nb of customers'orders 27 000,00 No. of components references 25 000,00 Nb.of models 590 000,00 Nb of cost Total nb. of drivers for cost drivers product P 277 140 200 40 10000 2500 277 140 500 200 S 1 500 200 200 40 5 QUESTIONS Using the template shown in exhibit and given in the excel table (ABC) 2-1. How much is the product P costing with ABC costing? How much is the new margin? Answer: 2-2. Did the manufacturing cost of P change in comparison with the fist method of indirect costs allocation? Why? Answer: 2-3. Please comment the reasons why the margin of P has changed with the ABC method. Answer: 2-4. As the new controller of the company, you are in charge of reviewing the ABC model. For each activity, do you agree with the proposed cost driver (Y/N)? You can use the table below and put a cross into the right column. If no, what is the new cost driver you would propose? Please argue. You can write your answer after the table proposed Is the cost driver relevant? Activities cost drivers Yes No If no, your proposition of better cost driver Placing orders No. of batches Receivings No. of components references Manufacturing No. of direct labour hours Maintenance No.of batches Deliveries & invoicing Nb.of customers'orders Promotion campaigns No. of models Sales &customer accounting No.of customers'orders Inventory & suppliers accounting No. of components references R&D projects No. of models