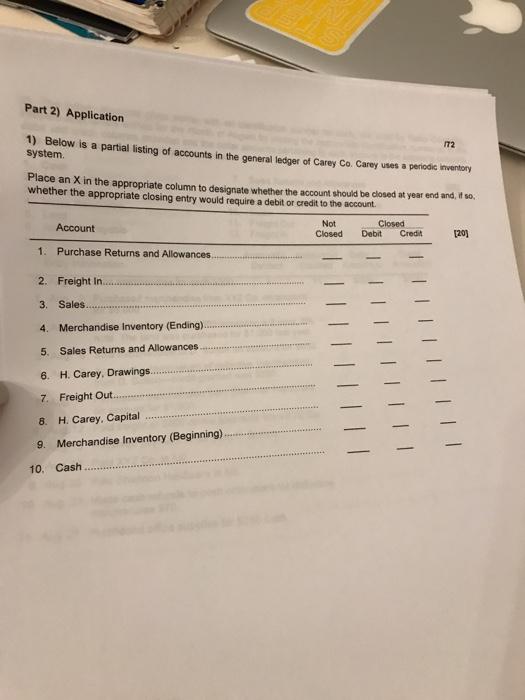

Question: Part 2) Application 172 1) Below is a partial listing of accounts in the general ledger of Carey Co. Carey uses a periodic Inventory system

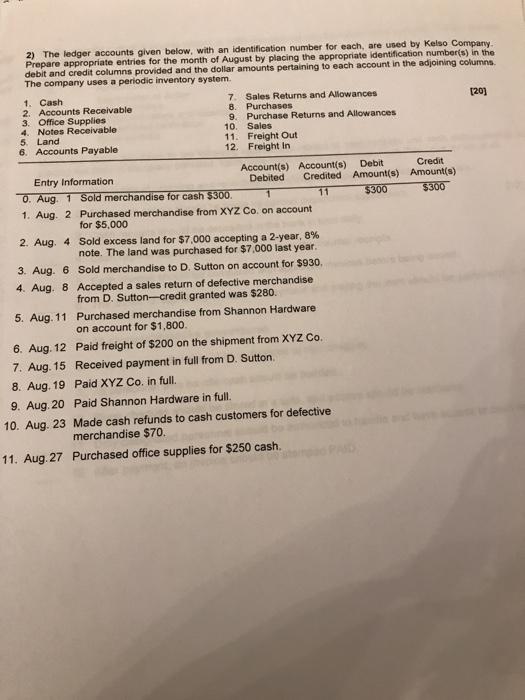

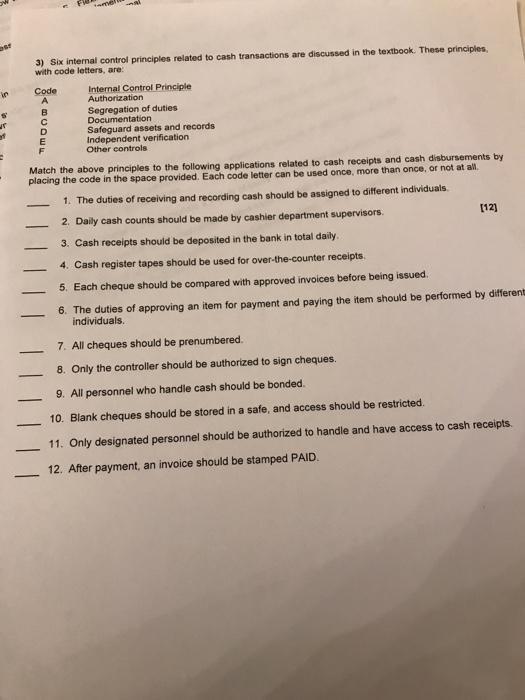

Part 2) Application 172 1) Below is a partial listing of accounts in the general ledger of Carey Co. Carey uses a periodic Inventory system Place an X in the appropriate column to designate whether the account should be closed at year end and, if so, whether the appropriate closing entry would require a debitor credit to the account. Closed Account [20) Closed Credit Not Debit 1. Purchase Returns and Allowances 2. Freight in 3. Sales. 4. Merchandise Inventory (Ending) 5. Sales Returns and Allowances 6. H. Carey, Drawings 7. Freight Out. 8. H. Carey, Capital 9. Merchandise Inventory (Beginning) 10. Cash 2) The ledger accounts given below, with an identification number for each, are used by Kelso Company. Prepare appropriate entries for the month of August by placing the appropriate identification number(s) in the debit and credit columns provided and the dollar amounts pertaining to each account in the adjoining columns The company uses a periodic inventory system 1. Cash 7 Sales Returns and Allowances [20] 2. Accounts Receivable 8. Purchases 3. Office Supplies 9 Purchase Returns and Allowances 4. Notes Receivable 10 Sales 5. Land 11. Freight Out 6. Accounts Payable 12. Freight in Account(s) Account(s) Debit Credit Entry Information Debited Credited Amount(s) Amount(s) 0. Aug. 1 Sold merchandise for cash $300 1 11 $300 $300 1. Aug. 2 Purchased merchandise from XYZ Co. on account for $5,000 2. Aug. 4 Sold excess land for $7.000 accepting a 2-year, 8% note. The land was purchased for $7,000 last year. 3. Aug. 6 Sold merchandise to D. Sutton on account for $930 4. Aug. 8 Accepted a sales return of defective merchandise from D. Sutton-credit granted was $280. 5. Aug. 11 Purchased merchandise from Shannon Hardware on account for $1,800 6. Aug. 12 Paid freight of $200 on the shipment from XYZ CO. 7. Aug. 15 Received payment in full from D. Sutton 8. Aug. 19 Paid XYZ Co. in full. 9. Aug. 20 Paid Shannon Hardware in full. 10. Aug. 23 Made cash refunds to cash customers for defective merchandise $70. 11. Aug.27 Purchased office supplies for $250 cash in ur 3) Six internal control principles related to cash transactions are discussed in the textbook. These principles, with code letters, are: Code Internal Control Principle Authorization B Segregation of duties Documentation D Safeguard assets and records E Independent verification Other controls Match the above principles to the following applications related to cash receipts and cash disbursements by placing the code in the space provided. Each code letter can be used once, more than once, or not at all 1. The duties of receiving and recording cash should be assigned to different individuals 2. Daily cash counts should be made by cashier department supervisors [12] 3. Cash receipts should be deposited in the bank in total daily 4. Cash register tapes should be used for over-the-counter receipts 5. Each cheque should be compared with approved invoices before being issued. 6. The duties of approving an item for payment and paying the item should be performed by different individuals. 7. All cheques should be prenumbered. 8. Only the controller should be authorized to sign cheques. 9. All personnel who handle cash should be bonded. 10. Blank cheques should be stored in a safe and access should be restricted. 11. Only designated personnel should be authorized to handle and have access to cash receipts. 12. After payment, an invoice should be stamped PAID

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts