Question: Part 2 - Assessing risk and return (40 marks) (up to 1000 words) You are required to form a two-asset portfolio from the stock and

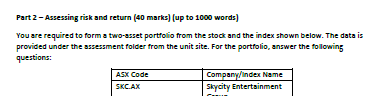

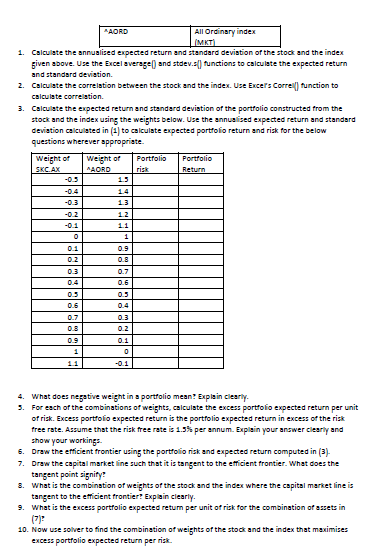

Part 2 - Assessing risk and return (40 marks) (up to 1000 words) You are required to form a two-asset portfolio from the stock and the index shown below. The data is provided under the assessment folder from the unit site. For the portfolio answer the following questions: ASX Code Company/Index Name SKC.AX Skycity Entertainment AAORD All Ordinary index IMKTI 1. Calculate the annualised expected return and standard deviation of the stock and the index given above. Use the Excel average and stdev.s) functions to calculate the expected return and standard deviation. 2. Calculate the correlation between the stock and the index. Use Excers Correll) function to calculate correlation 3. Calculate the expected return and standard deviation of the portfolio constructed from the stock and the index using the weights below. Use the annualised expected return and standard deviation calculated in (1) to calculate expected portfolio return and risk for the below questions wherever appropriate Weight of Weight of Portfolio Portfolio SKC.AX AAORD Return 1.5 risk 1.3 -0.2 1.2 1 0.9 0.2 03 0.7 03 0.2 0.1 0.9 1 0 -0.1 4. What does negative weight in a portfolio mean! Explain clearly 5. For each of the combinations of weights, calculate the excess portfolio expected return per unit of risk. Excess portfolio expected return is the portfolio expected return in excess of the risk free rate. Assume that the risk free rate is 1.5% per annum. Explain your answer clearly and show your working 6. Draw the efficient frontier using the portfolio risk and expected return computed in (3) 7. Draw the capital market line such that it is tangent to the efficient frontier. What does the tangent point signity 3. What is the combination of weights of the stock and the index where the capital market line is tangent to the efficient frontier! Explain clearly 9. What is the excess portfolio expected retum per unit of risk for the combination of assets in (7) 10. Now use solver to find the combination of weights of the stock and the index that maximises excess portfolio expected return per risk Part 2 - Assessing risk and return (40 marks) (up to 1000 words) You are required to form a two-asset portfolio from the stock and the index shown below. The data is provided under the assessment folder from the unit site. For the portfolio answer the following questions: ASX Code Company/Index Name SKC.AX Skycity Entertainment AAORD All Ordinary index IMKTI 1. Calculate the annualised expected return and standard deviation of the stock and the index given above. Use the Excel average and stdev.s) functions to calculate the expected return and standard deviation. 2. Calculate the correlation between the stock and the index. Use Excers Correll) function to calculate correlation 3. Calculate the expected return and standard deviation of the portfolio constructed from the stock and the index using the weights below. Use the annualised expected return and standard deviation calculated in (1) to calculate expected portfolio return and risk for the below questions wherever appropriate Weight of Weight of Portfolio Portfolio SKC.AX AAORD Return 1.5 risk 1.3 -0.2 1.2 1 0.9 0.2 03 0.7 03 0.2 0.1 0.9 1 0 -0.1 4. What does negative weight in a portfolio mean! Explain clearly 5. For each of the combinations of weights, calculate the excess portfolio expected return per unit of risk. Excess portfolio expected return is the portfolio expected return in excess of the risk free rate. Assume that the risk free rate is 1.5% per annum. Explain your answer clearly and show your working 6. Draw the efficient frontier using the portfolio risk and expected return computed in (3) 7. Draw the capital market line such that it is tangent to the efficient frontier. What does the tangent point signity 3. What is the combination of weights of the stock and the index where the capital market line is tangent to the efficient frontier! Explain clearly 9. What is the excess portfolio expected retum per unit of risk for the combination of assets in (7) 10. Now use solver to find the combination of weights of the stock and the index that maximises excess portfolio expected return per risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts