Question: Part 2: Buying Vs. Leasing 2. Explain the difference between buying a car (financing) and leasing a car. 3. Fill in the chart with some

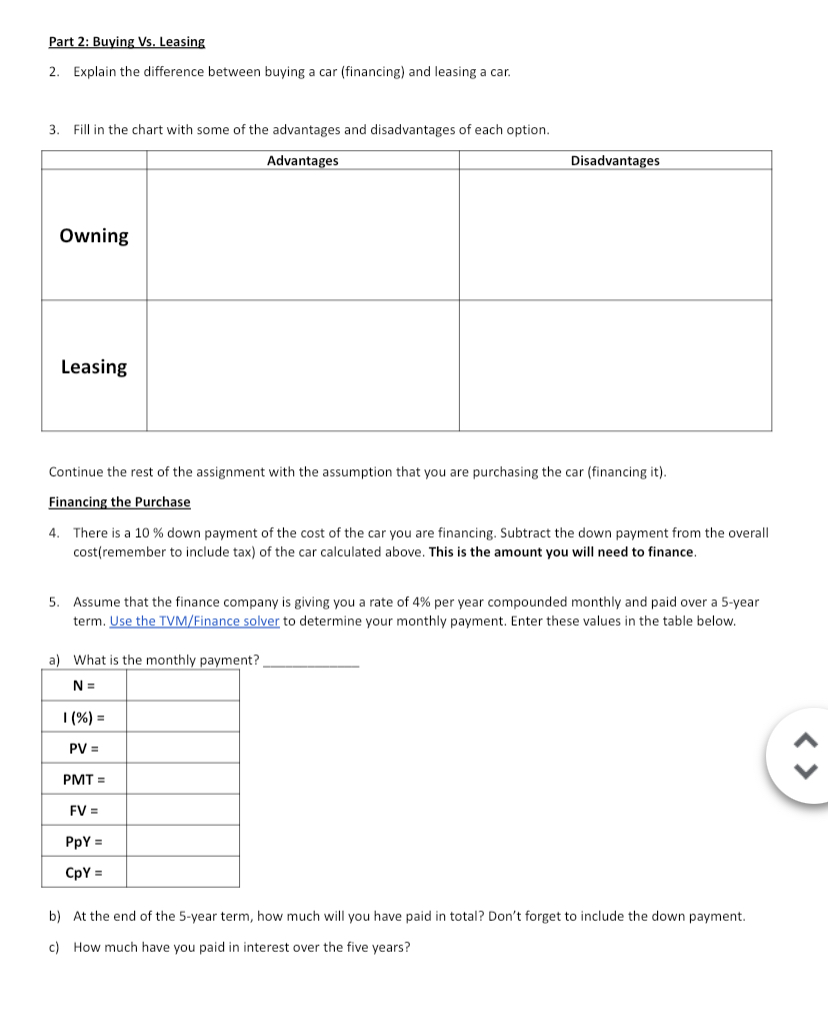

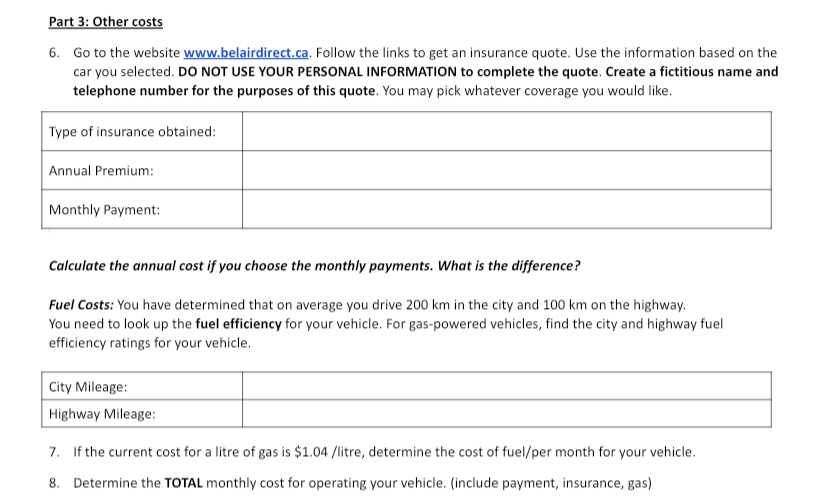

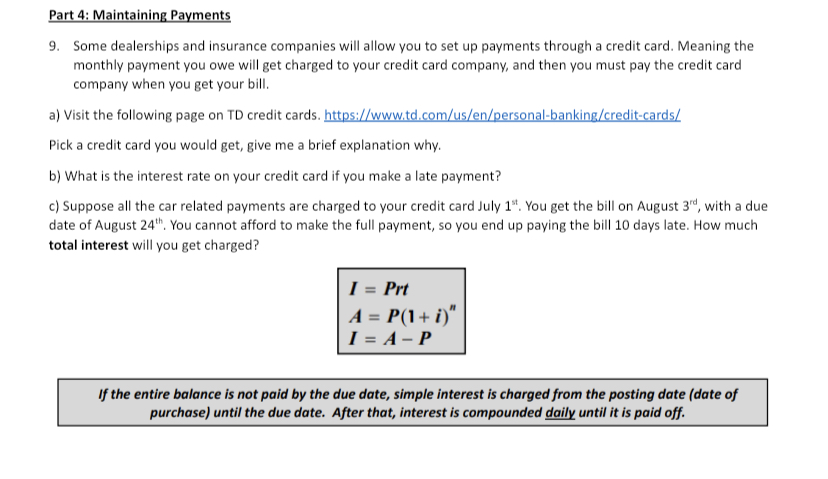

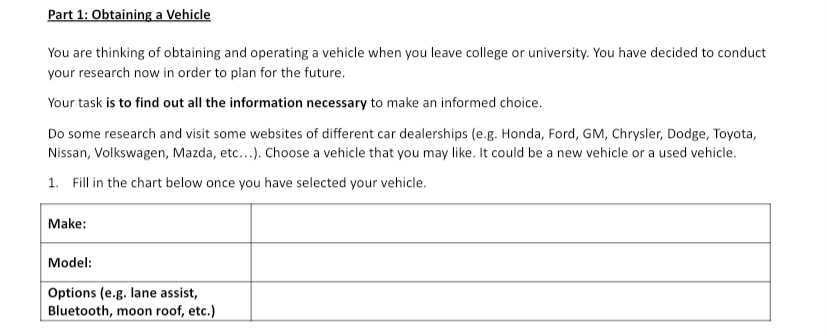

Part 2: Buying Vs. Leasing 2. Explain the difference between buying a car (financing) and leasing a car. 3. Fill in the chart with some of the advantages and disadvantages of each option. Advantages Disadvantages Owning Leasing Continue the rest of the assignment with the assumption that you are purchasing the car (financing it). Financing the Purchase 4. There is a 10 % down payment of the cost of the car you are financing. Subtract the down payment from the overall cost(remember to include tax) of the car calculated above. This is the amount you will need to finance. 5. Assume that the finance company is giving you a rate of 4% per year compounded monthly and paid over a 5-year term. Use the TVM/Finance solver to determine your monthly payment. Enter these values in the table below. a) What is the monthly payment? N = 1 (%) = PV = PMT = FV = PpY = CpY = b) At the end of the 5-year term, how much will you have paid in total? Don't forget to include the down payment. c) How much have you paid in interest over the five years?Part 3: Other costs 6. Go to the website www.belairdirect.ca. Follow the links to get an insurance quote. Use the information based on the car you selected. DO NOT USE YOUR PERSONAL INFORMATION to complete the quote. Create a fictitious name and telephone number for the purposes of this quote. You may pick whatever coverage you would like. Type of insurance obtained: Annual Premium: Monthly Payment: Calculate the annual cost if you choose the monthly payments. What is the difference? Fuel Costs: You have determined that on average you drive 200 km in the city and 100 km on the highway. You need to look up the fuel efficiency for your vehicle. For gas-powered vehicles, find the city and highway fuel efficiency ratings for your vehicle. City Mileage: Highway Mileage: 7. If the current cost for a litre of gas is $1.04 /litre, determine the cost of fuel/per month for your vehicle. 8. Determine the TOTAL monthly cost for operating your vehicle. (include payment, insurance, gas)Part 4: Maintaining Payments 9. Some dealerships and insurance companies will allow you to set up payments through a credit card. Meaning the monthly payment you owe will get charged to your credit card company, and then you must pay the credit card company when you get your bill. a) Visit the following page on TD credit cards. https://www.td.com/us/en/personal-banking/credit-cards/ Pick a credit card you would get, give me a brief explanation why. b) What is the interest rate on your credit card if you make a late payment? c) Suppose all the car related payments are charged to your credit card July 1". You get the bill on August 3", with a due date of August 24". You cannot afford to make the full payment, so you end up paying the bill 10 days late. How much total interest will you get charged? I = Prt A = P(1+ i)" I = A- P If the entire balance is not paid by the due date, simple interest is charged from the posting date (date of purchase) until the due date. After that, interest is compounded daily until it is paid off.Part 1: Obtaining a Vehicle You are thinking of obtaining and operating a vehicle when you leave college or university. You have decided to conduct your research now in order to plan for the future. Your task is to find out all the information necessary to make an informed choice. Do some research and visit some websites of different car dealerships (e.g. Honda, Ford, GM, Chrysler, Dodge, Toyota, Nissan, Volkswagen, Mazda, etc...). Choose a vehicle that you may like. It could be a new vehicle or a used vehicle. 1. Fill in the chart below once you have selected your vehicle. Make: Model: Options (e.g. lane assist, Bluetooth, moon roof, etc.)