Question: Part 2 Case Problem (See the Syllabus for the Due Date) James Baldwin is thinking of buying an apartment complex that is offered for sale

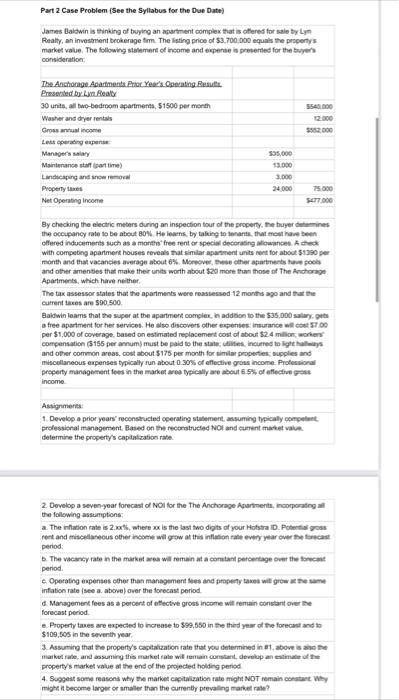

Part 2 Case Problem (See the Syllabus for the Due Date James Baldwin is thinking of buying an apartment complex that is offered for sale by Lyn Realty, an investment brokerage firm. The listing price of 53.700.000 equals the proponys market value. The following statement of income and expenses presented for the buyers consideration The Anchorage, Apartment. Prior Years Operating Results Presented by La Realty 30 units, all two-bedroom apartments, S1500 per month Washer and dryer rentals Gross annual income Last party Manager's salary Maintenance staff part time) Landscaping and now removal Property taxes Net Operating income 335.000 13.000 3.000 75.000 By checking the electric meters during an inspection tour of the property. the buyer termines the occupancy rate to be about 80%. He learns by taking to enants that most have been offered inducements such as a month free rent or special decorating allowances Acheck with competing apartment houses reveals that similar apartment units rent for about 51390 per month and that vacancies average about 8%. Moreover, the other apartments to pools and other amenities that make their units worth about $20 more than those of The Anchorage Apartments, which have neither The tax assessor states that the apartments were reassessed 12 months ago and that the Currences are 590.500 Baldwin leams that the super at the apartment complex in addition to the $35.000 salary.get a tree apartment for her services. He also discovers other expenses insurance will cost 57.00 per $1,000 of coverage, based on estimated replacement cost of about $2.4 millions compensation ($155 per annum) must be paid to the state is incurred to light hay and other common areas, cost about $175 per month for similar properties, supplies and miscellaneous expenses typically run about 30% of effective gross income Professional property management fons in the market are typically rembout 6.5% of effective gross income Assignments 1. Develop a prior years' reconstructed operating statement, assuming typically competent professional management Based on the reconstructed Not and current market value determine the property's capitalization rate. period 2 Develop a seven-year forecast of Nol for the The Anchorage Apartments, operating the following assumptions a The inflation rate is 2.0, where is the last two digits of your Hotstra. Potentious rent and miscellaneous other income will grow at this inflation rate every year over forecast period The vacancy rate in the market we will remain at a constant percentage over the forecast Operating expenses other than management fees and property taxes will grow the same inflation rate (see a above) over the forecast period 4. Management fees as a percent of effective grous income will remain constant over the forecast period - Property taxes are expected to increase to $99.550 in the the year of the forecast and to $109.505 in the seventh year 3. Assuming that the property's capitalization rate that you determined in t. above is the markolate and assuming this market rate will remain constant develop an estimate of property's market value at the end of the projected holding period 4. Suggest some reasons why the market capitalization rate might NOT remain constant Why might it become larger or smaller than the currently prevailing market rate? Part 2 Case Problem (See the Syllabus for the Due Date James Baldwin is thinking of buying an apartment complex that is offered for sale by Lyn Realty, an investment brokerage firm. The listing price of 53.700.000 equals the proponys market value. The following statement of income and expenses presented for the buyers consideration The Anchorage, Apartment. Prior Years Operating Results Presented by La Realty 30 units, all two-bedroom apartments, S1500 per month Washer and dryer rentals Gross annual income Last party Manager's salary Maintenance staff part time) Landscaping and now removal Property taxes Net Operating income 335.000 13.000 3.000 75.000 By checking the electric meters during an inspection tour of the property. the buyer termines the occupancy rate to be about 80%. He learns by taking to enants that most have been offered inducements such as a month free rent or special decorating allowances Acheck with competing apartment houses reveals that similar apartment units rent for about 51390 per month and that vacancies average about 8%. Moreover, the other apartments to pools and other amenities that make their units worth about $20 more than those of The Anchorage Apartments, which have neither The tax assessor states that the apartments were reassessed 12 months ago and that the Currences are 590.500 Baldwin leams that the super at the apartment complex in addition to the $35.000 salary.get a tree apartment for her services. He also discovers other expenses insurance will cost 57.00 per $1,000 of coverage, based on estimated replacement cost of about $2.4 millions compensation ($155 per annum) must be paid to the state is incurred to light hay and other common areas, cost about $175 per month for similar properties, supplies and miscellaneous expenses typically run about 30% of effective gross income Professional property management fons in the market are typically rembout 6.5% of effective gross income Assignments 1. Develop a prior years' reconstructed operating statement, assuming typically competent professional management Based on the reconstructed Not and current market value determine the property's capitalization rate. period 2 Develop a seven-year forecast of Nol for the The Anchorage Apartments, operating the following assumptions a The inflation rate is 2.0, where is the last two digits of your Hotstra. Potentious rent and miscellaneous other income will grow at this inflation rate every year over forecast period The vacancy rate in the market we will remain at a constant percentage over the forecast Operating expenses other than management fees and property taxes will grow the same inflation rate (see a above) over the forecast period 4. Management fees as a percent of effective grous income will remain constant over the forecast period - Property taxes are expected to increase to $99.550 in the the year of the forecast and to $109.505 in the seventh year 3. Assuming that the property's capitalization rate that you determined in t. above is the markolate and assuming this market rate will remain constant develop an estimate of property's market value at the end of the projected holding period 4. Suggest some reasons why the market capitalization rate might NOT remain constant Why might it become larger or smaller than the currently prevailing market rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts