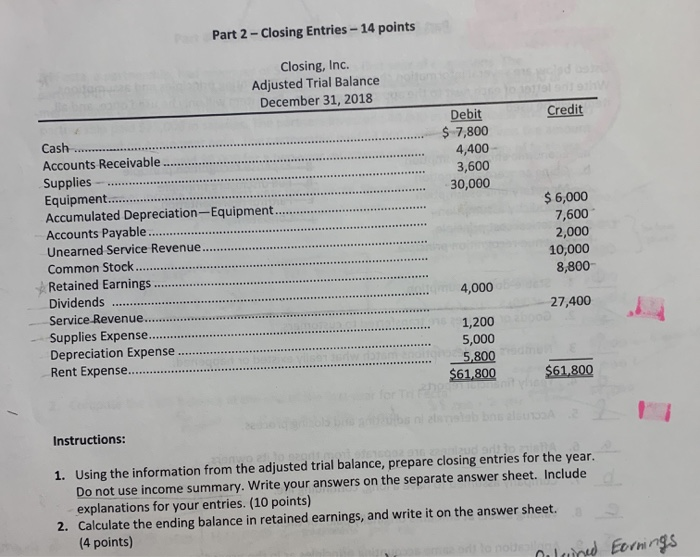

Question: Part 2 - Closing Entries - 14 points Closing, Inc. Adjusted Trial Balance December 31, 2018 Credit Debit $ 7,800 4,400 3,600 30,000 Cash .......

Part 2 - Closing Entries - 14 points Closing, Inc. Adjusted Trial Balance December 31, 2018 Credit Debit $ 7,800 4,400 3,600 30,000 Cash ....... Accounts Receivable ...... Supplies - .......... Equipment. Accumulated Depreciation-Equipment. Accounts Payable....... Unearned Service Revenue........ Common Stock.............. Retained Earnings ...................... Dividends Service Revenue.................. Supplies Expense........... ..... Depreciation Expense ................. Rent Expense....... $ 6,000 7,600 2,000 10,000 8,800 4,000 27,400 1,200 5,000 5,800 $61,800 $61.800 Instructions: 1. Using the information from the adjusted trial balance, prepare closing entries for the year. Do not use income summary. Write your answers on the separate answer sheet. Include explanations for your entries. (10 points) 2. Calculate the ending balance in retained earnings, and write it on the answer sheet. (4 points) focus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts