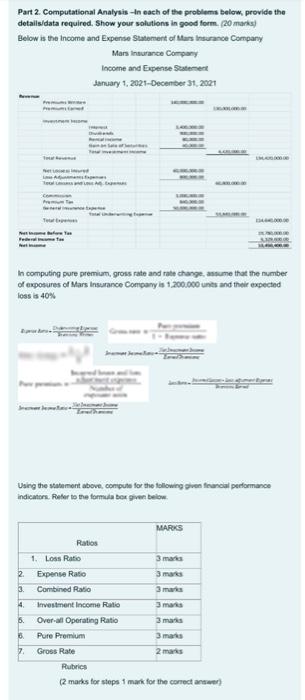

Question: Part 2. Computational Analysis - In each of the preblems belew, provide the details/data required. Show your solutions in good form. (20 marks) Below is

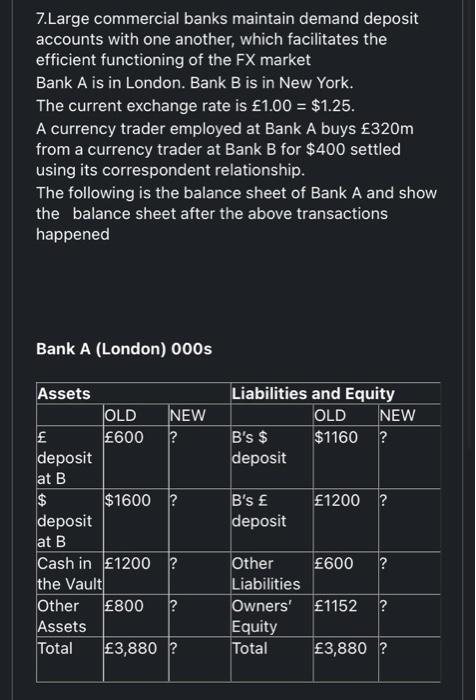

Part 2. Computational Analysis - In each of the preblems belew, provide the details/data required. Show your solutions in good form. (20 marks) Below is the income and Expense Slatement of Mars lnsurance Company Mars lnsurance Company In computing pure premium, gross rate and rate change, annume that the number of exposures of Mars insurance Compary is 1200.000 units and their expected loss in 407 Using the stabement above, conpute for the following given feancal performance indicanara. Peser to the formula bea given beiow. furberies (2 marks for stops 1 mank for the corsest andare?) 7.Large commercial banks maintain demand deposit accounts with one another, which facilitates the efficient functioning of the FX market Bank A is in London. Bank B is in New York. The current exchange rate is 1.00=$1.25. A currency trader employed at Bank A buys 320m from a currency trader at Bank B for $400 settled using its correspondent relationship. The following is the balance sheet of Bank A and show the balance sheet after the above transactions happened Bank A (London) 000 s Part 2. Computational Analysis - In each of the preblems belew, provide the details/data required. Show your solutions in good form. (20 marks) Below is the income and Expense Slatement of Mars lnsurance Company Mars lnsurance Company In computing pure premium, gross rate and rate change, annume that the number of exposures of Mars insurance Compary is 1200.000 units and their expected loss in 407 Using the stabement above, conpute for the following given feancal performance indicanara. Peser to the formula bea given beiow. furberies (2 marks for stops 1 mank for the corsest andare?) 7.Large commercial banks maintain demand deposit accounts with one another, which facilitates the efficient functioning of the FX market Bank A is in London. Bank B is in New York. The current exchange rate is 1.00=$1.25. A currency trader employed at Bank A buys 320m from a currency trader at Bank B for $400 settled using its correspondent relationship. The following is the balance sheet of Bank A and show the balance sheet after the above transactions happened Bank A (London) 000 s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts