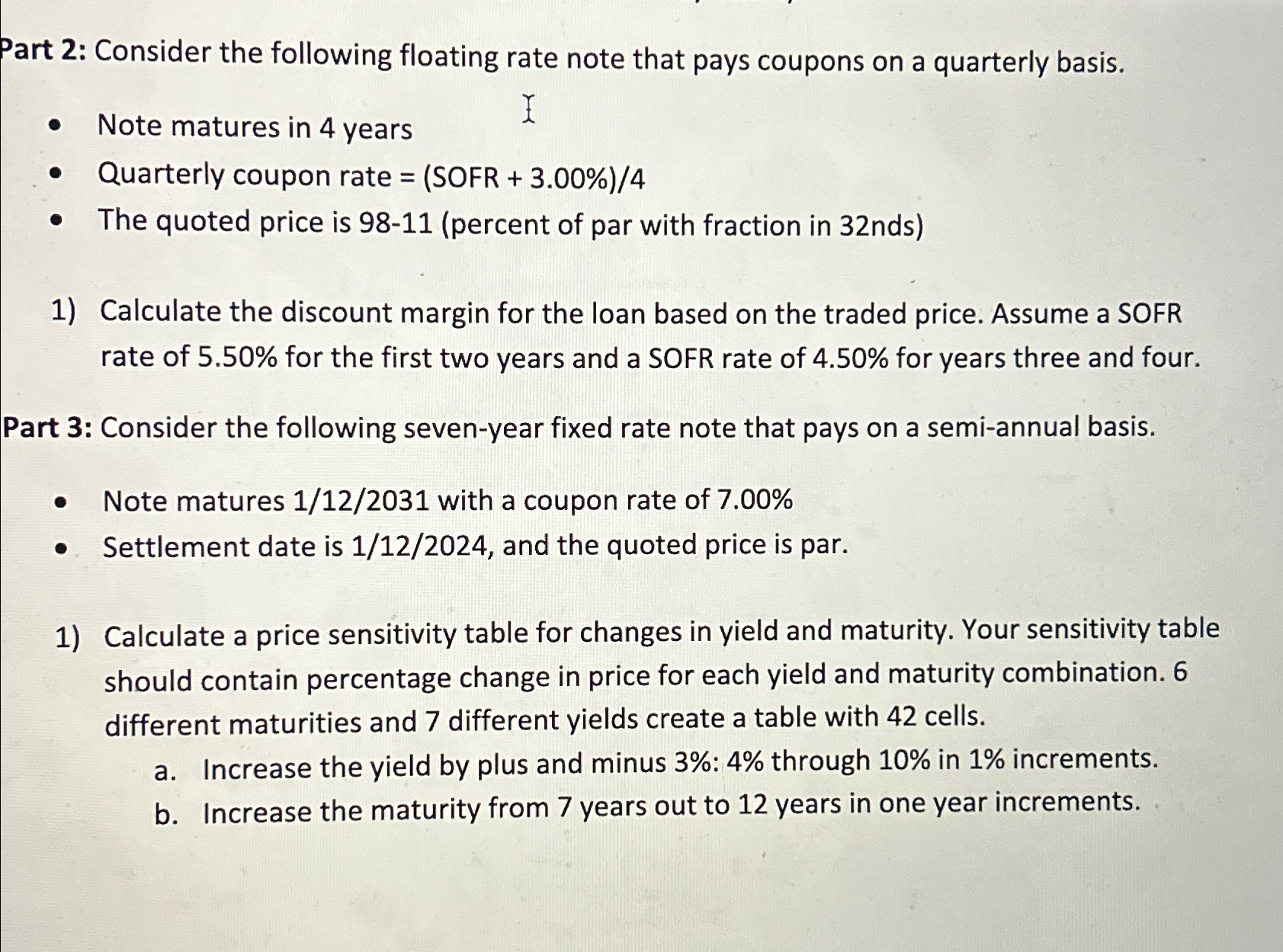

Question: Part 2 : Consider the following floating rate note that pays coupons on a quarterly basis. Note matures in 4 years Quarterly coupon rate =

Part : Consider the following floating rate note that pays coupons on a quarterly basis.

Note matures in years

Quarterly coupon rate

The quoted price is percent of par with fraction in

Calculate the discount margin for the loan based on the traded price. Assume a SOFR rate of for the first two years and a SOFR rate of for years three and four.

Part : Consider the following sevenyear fixed rate note that pays on a semiannual basis.

Note matures with a coupon rate of

Settlement date is and the quoted price is par.

Calculate a price sensitivity table for changes in yield and maturity. Your sensitivity table should contain percentage change in price for each yield and maturity combination. different maturities and different yields create a table with cells.

a Increase the yield by plus and minus : through in increments.

b Increase the maturity from years out to years in one year increments.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock