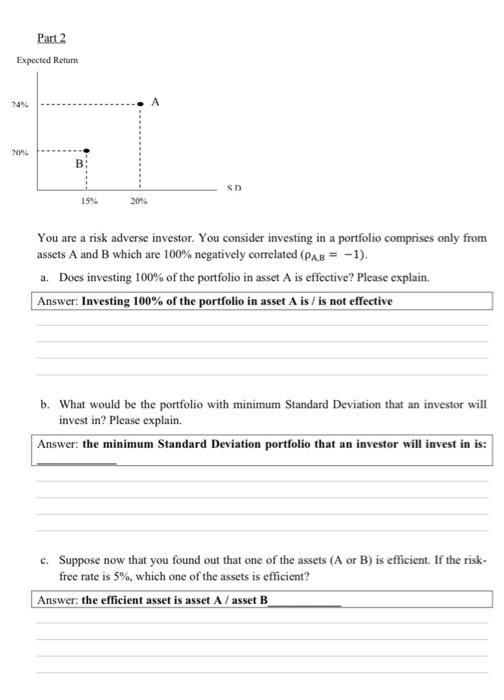

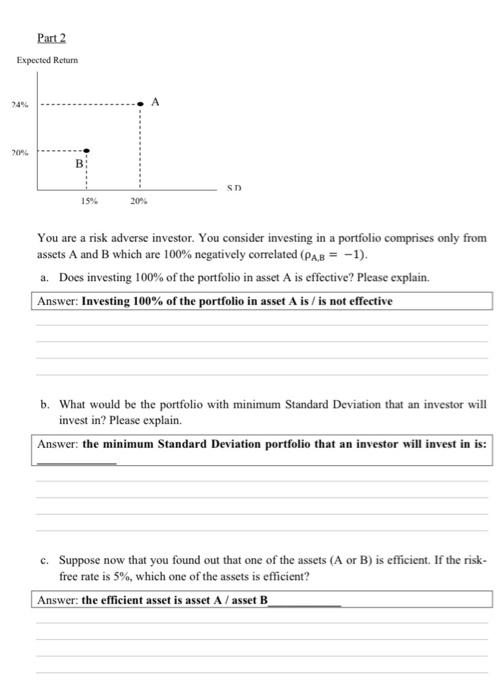

Question: Part 2 Expected Return 20% B: SD 15% 20%. You are a risk adverse investor. You consider investing in a portfolio comprises only from assets

Part 2 Expected Return 20% B: SD 15% 20%. You are a risk adverse investor. You consider investing in a portfolio comprises only from assets A and B which are 100% negatively correlated (PAB = -1). a. Does investing 100% of the portfolio in asset A is effective? Please explain. Answer: Investing 100% of the portfolio in asset A is / is not effective b. What would be the portfolio with minimum Standard Deviation that an investor will invest in? Please explain. Answer: the minimum Standard Deviation portfolio that an investor will invest in is: c. Suppose now that you found out that one of the assets (A or B) is efficient. If the risk- free rate is 5%, which one of the assets is efficient? Answer: the efficient asset is asset A/asset B Part 2 Expected Return 20% B: SD 15% 20%. You are a risk adverse investor. You consider investing in a portfolio comprises only from assets A and B which are 100% negatively correlated (PAB = -1). a. Does investing 100% of the portfolio in asset A is effective? Please explain. Answer: Investing 100% of the portfolio in asset A is / is not effective b. What would be the portfolio with minimum Standard Deviation that an investor will invest in? Please explain. Answer: the minimum Standard Deviation portfolio that an investor will invest in is: c. Suppose now that you found out that one of the assets (A or B) is efficient. If the risk- free rate is 5%, which one of the assets is efficient? Answer: the efficient asset is asset A/asset B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts