Question: PART 2: Financial Reporting in Practice *10.6 The main activity of J&T Ltd is to buy old vehicles which are sold after converting them

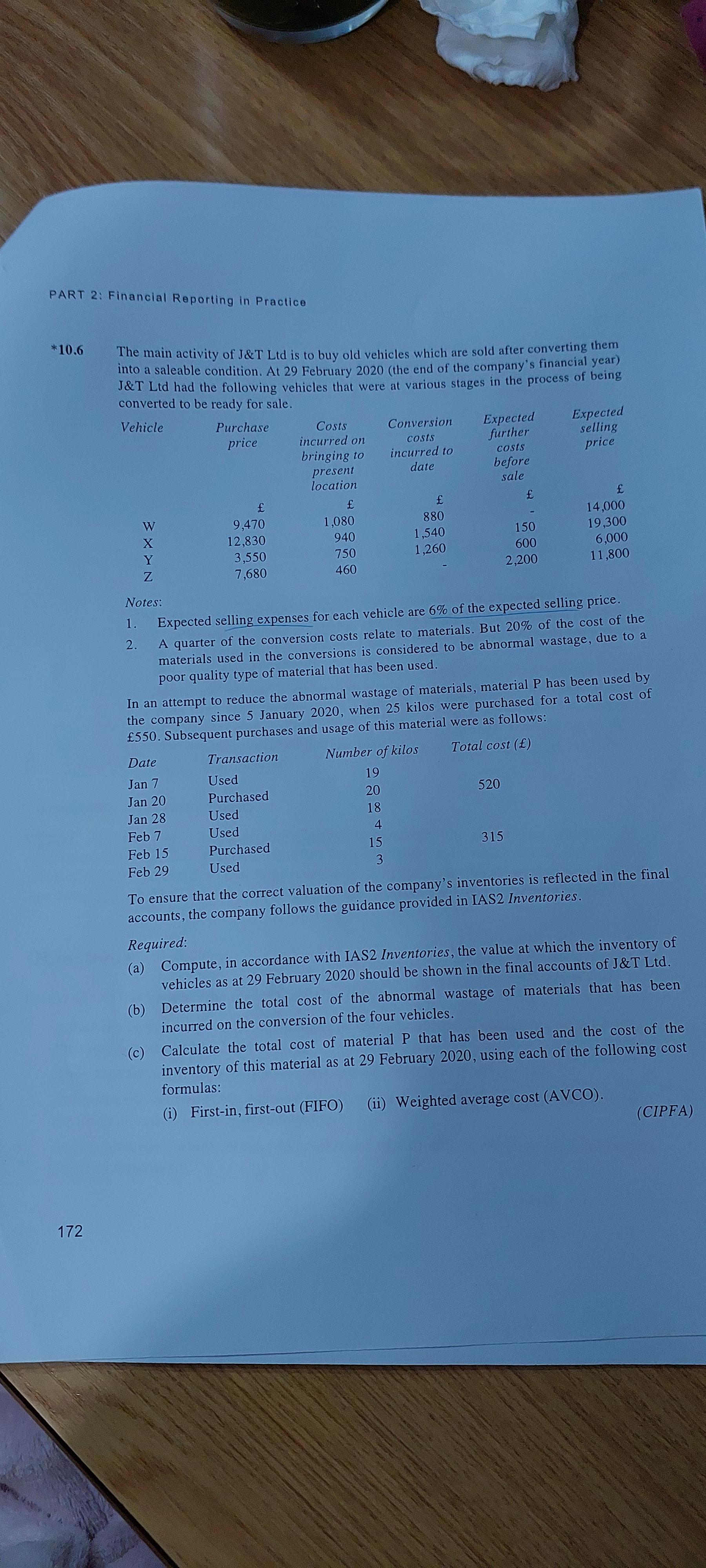

PART 2: Financial Reporting in Practice *10.6 The main activity of J&T Ltd is to buy old vehicles which are sold after converting them into a saleable condition. At 29 February 2020 (the end of the company's financial year) J&T Ltd had the following vehicles that were at various stages in the process of being converted to be ready for sale. Vehicle Purchase price Expected selling 172 Costs incurred on bringing to Conversion costs incurred to Expected further present date costs before price location sale 9,470 1,080 880 14,000 X 12,830 940 1,540 150 19,300 Y 3,550 750 1,260 600 6,000 Z 7,680 460 2,200 11,800 Notes: 1. 2. Expected selling expenses for each vehicle are 6% of the expected selling price. A quarter of the conversion costs relate to materials. But 20% of the cost of the materials used in the conversions is considered to be abnormal wastage, due to a poor quality type of material that has been used. In an attempt to reduce the abnormal wastage of materials, material P has been used by the company since 5 January 2020, when 25 kilos were purchased for a total cost of 550. Subsequent purchases and usage of this material were as follows: Date Transaction Jan 7 Jan 20 Used Purchased Jan 28 Used Feb 7 Feb 15 Used Feb 29 Purchased Used Number of kilos 19 20 18 4 15 3 Total cost () 520 315 To ensure that the correct valuation of the company's inventories is reflected in the final accounts, the company follows the guidance provided in IAS2 Inventories. Required: (a) Compute, in accordance with IAS2 Inventories, the value at which the inventory of vehicles as at 29 February 2020 should be shown in the final accounts of J&T Ltd. (b) Determine the total cost of the abnormal wastage of materials that has been incurred on the conversion of the four vehicles. (c) Calculate the total cost of material P that has been used and the cost of the inventory of this material as at 29 February 2020, using each of the following cost formulas: (i) First-in, first-out (FIFO) (ii) Weighted average cost (AVCO). (CIPFA)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts