Question: Part 2: Following your written budget evaluation, include with your Word document a reflection of 200-300 words responding to the following questions: 1. How will

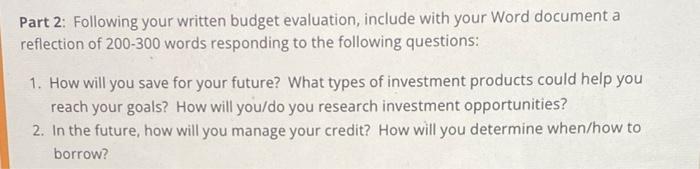

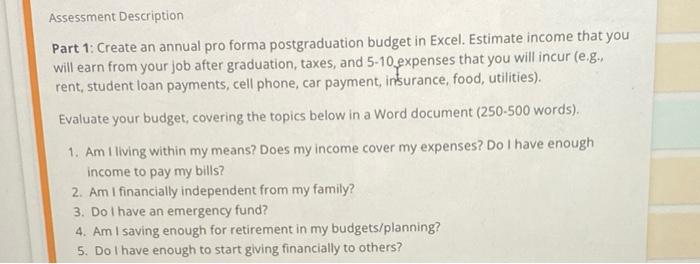

Part 2: Following your written budget evaluation, include with your Word document a reflection of 200-300 words responding to the following questions: 1. How will you save for your future? What types of investment products could help you reach your goals? How will you/do you research investment opportunities? 2. In the future, how will you manage your credit? How will you determine when/how to borrow? Assessment Description Part 1: Create an annual pro forma postgraduation budget in Excel. Estimate income that you will earn from your job after graduation, taxes, and 5-10 expenses that you will incur (e.g., rent student loan payments, cell phone, car payment, insurance, food, utilities). Evaluate your budget, covering the topics below in a Word document (250-500 words). 1. Am I living within my means? Does my income cover my expenses? Do I have enough income to pay my bills? 2. Am I financially independent from my family? 3. Do I have an emergency fund? 4. Am I saving enough for retirement in my budgets/planning? 5. Do I have enough to start giving financially to others? Part 2: Following your written budget evaluation, include with your Word document a reflection of 200-300 words responding to the following questions: 1. How will you save for your future? What types of investment products could help you reach your goals? How will you/do you research investment opportunities? 2. In the future, how will you manage your credit? How will you determine when/how to borrow? Assessment Description Part 1: Create an annual pro forma postgraduation budget in Excel. Estimate income that you will earn from your job after graduation, taxes, and 5-10 expenses that you will incur (e.g., rent student loan payments, cell phone, car payment, insurance, food, utilities). Evaluate your budget, covering the topics below in a Word document (250-500 words). 1. Am I living within my means? Does my income cover my expenses? Do I have enough income to pay my bills? 2. Am I financially independent from my family? 3. Do I have an emergency fund? 4. Am I saving enough for retirement in my budgets/planning? 5. Do I have enough to start giving financially to others

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts