Question: Part 2: For Margin and Short Sales Calculation (1 point) Solve Chapter 3 program No. 15 and 16 from the textbook. You must show detailed

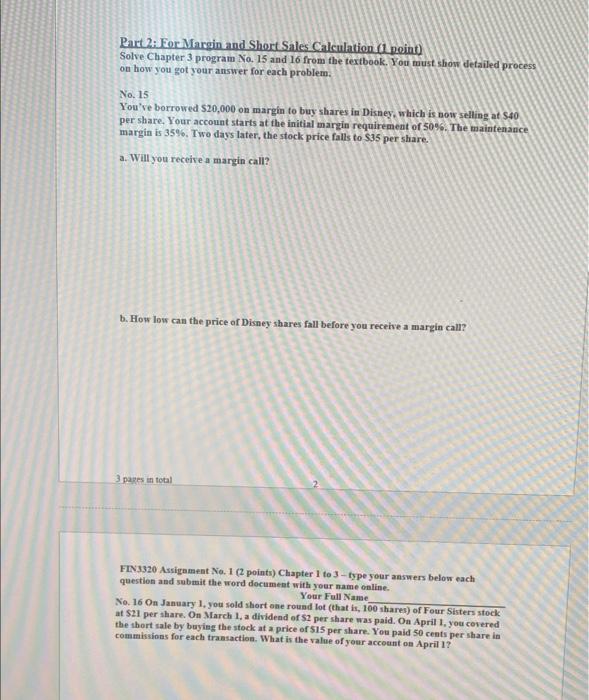

Part 2: For Margin and Short Sales Calculation (1 point) Solve Chapter 3 program No. 15 and 16 from the textbook. You must show detailed process on how you got your answer for each problem. No. 15 You've borrowed $20,000 on margin to buy shares in Disney, which is now selling at $40 per share. Your account starts at the initial margin requirement of 50%. The maintenance margin is 35%. Two days later, the stock price falls to $35 per share. a. Will you receive a margin call? 1. How low can the price of Disney shares fall before you receive a margin call? 3 pares in total FIN 3320 Assignment No. 12 points) Chapter 1 to 3 - type your answers below each question and submit the word document with your name online. Your Full Name No. 16 On January 1, you sold short one round lot (that is, 100 shares) of Four Sisters stock at 21 per share on March 1, a dividend of S2 per share was paid. On April 1, you covered the short sale by buying the stock at a price of $15 per share. You paid 50 cents per share in commissions for each transaction. What is the value of your account on April 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts