Question: Part 2: Fund performance evaluation Activity: Assume today is 1 January 2021. You plan to evaluate the Australian foundation investment company's (ASX: AFI) performance in

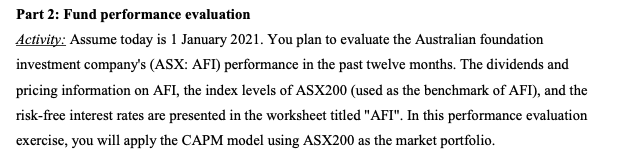

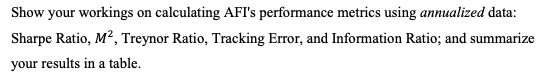

Part 2: Fund performance evaluation Activity: Assume today is 1 January 2021. You plan to evaluate the Australian foundation investment company's (ASX: AFI) performance in the past twelve months. The dividends and pricing information on AFI, the index levels of ASX200 (used as the benchmark of AFI), and the risk-free interest rates are presented in the worksheet titled "AFI". In this performance evaluation exercise, you will apply the CAPM model using ASX200 as the market portfolio. Show your workings on calculating AFI's performance metrics using annualized data: Sharpe Ratio, M?, Treynor Ratio, Tracking Error, and Information Ratio; and summarize your results in a table. Part 2: Fund performance evaluation Activity: Assume today is 1 January 2021. You plan to evaluate the Australian foundation investment company's (ASX: AFI) performance in the past twelve months. The dividends and pricing information on AFI, the index levels of ASX200 (used as the benchmark of AFI), and the risk-free interest rates are presented in the worksheet titled "AFI". In this performance evaluation exercise, you will apply the CAPM model using ASX200 as the market portfolio. Show your workings on calculating AFI's performance metrics using annualized data: Sharpe Ratio, M?, Treynor Ratio, Tracking Error, and Information Ratio; and summarize your results in a table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts