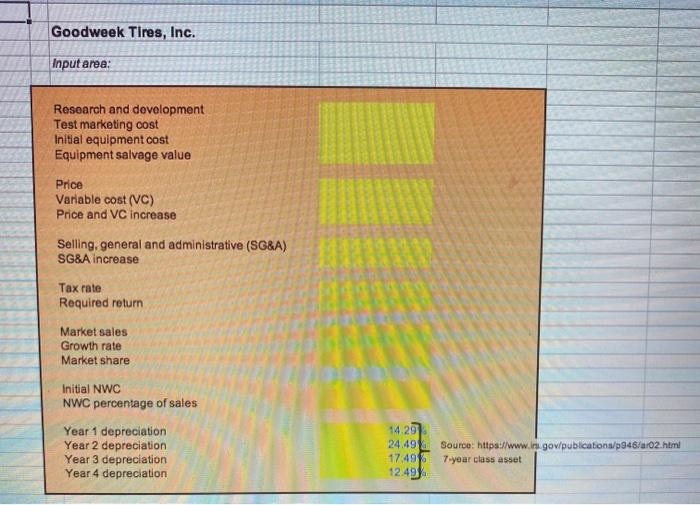

Question: (part 2) Goodweek Tires, Inc. Input area: Research and development Test marketing cost Initial equipment cost Equipment salvage value Price Variable cost (VC) Price and

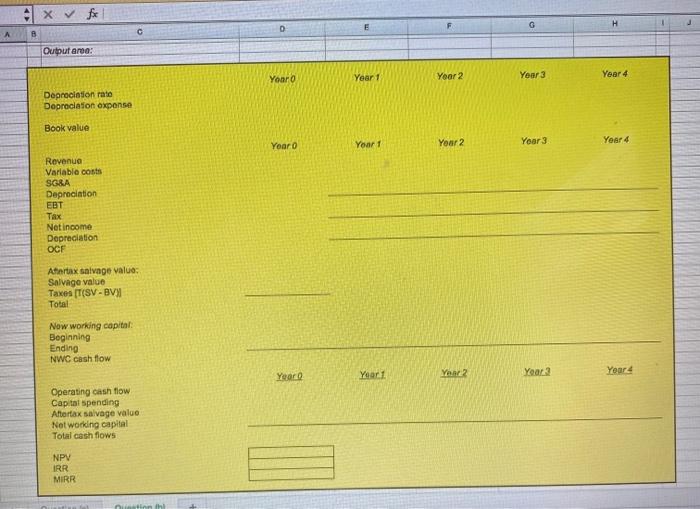

Goodweek Tires, Inc. Input area: Research and development Test marketing cost Initial equipment cost Equipment salvage value Price Variable cost (VC) Price and VC increase Selling, general and administrative (SG&A) SG&A increase Tax rate Required return Market sales Growth rate Market share Initial NWC NWC percentage of sales Year 1 depreciation Year 2 depreciation Year 3 depreciation Year 4 depreciation 14.29 24.49 Source: https://www.img.gov/publication/p946/a102.html 17.49% 7 year class asset 12.4944 x fx H A B Output area: Your 0 Year 1 Year 2 Year 3 Year 4 Depreciation rate Depreciation opens Book value Year o Yoar 1 Your 2 Year 3 Year 4 Revenue Variable costs SGRA Depreciation EBT Net income Depreciation OCF Antax salvage value: Salvage value Taxes (SV-BV Total Now working capital Beginning Ending NWC cash flow Year Yeart Year 2 Year 2 Yoar 4 Operating cash flow Capital spending Afterfax salvage value Not working capital Total cash flows NPV IRR MIRR Goodweek Tires, Inc. Input area: Research and development Test marketing cost Initial equipment cost Equipment salvage value Price Variable cost (VC) Price and VC increase Selling, general and administrative (SG&A) SG&A increase Tax rate Required return Market sales Growth rate Market share Initial NWC NWC percentage of sales Year 1 depreciation Year 2 depreciation Year 3 depreciation Year 4 depreciation 14.29 24.49 Source: https://www.img.gov/publication/p946/a102.html 17.49% 7 year class asset 12.4944 x fx H A B Output area: Your 0 Year 1 Year 2 Year 3 Year 4 Depreciation rate Depreciation opens Book value Year o Yoar 1 Your 2 Year 3 Year 4 Revenue Variable costs SGRA Depreciation EBT Net income Depreciation OCF Antax salvage value: Salvage value Taxes (SV-BV Total Now working capital Beginning Ending NWC cash flow Year Yeart Year 2 Year 2 Yoar 4 Operating cash flow Capital spending Afterfax salvage value Not working capital Total cash flows NPV IRR MIRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts