Question: Part 2) Heart Attack (Chapter 4- Regression) A study performed by a team of scientists at Fremont University Medical School evaluates how body mass index(BMI),

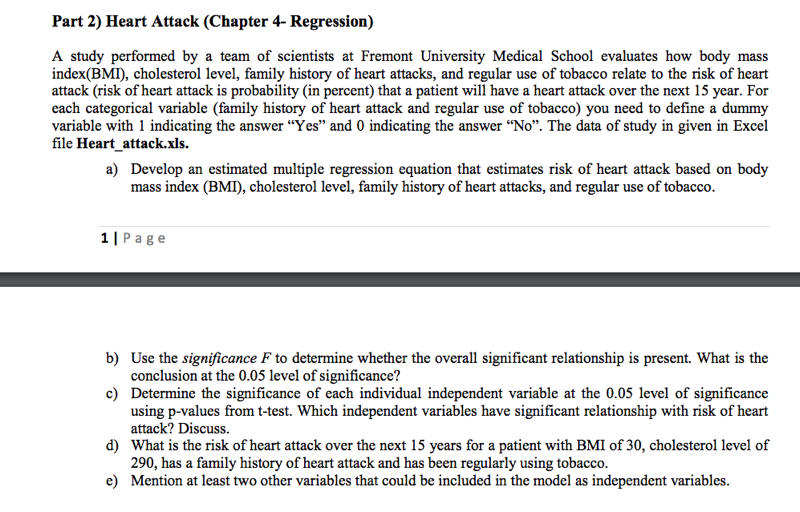

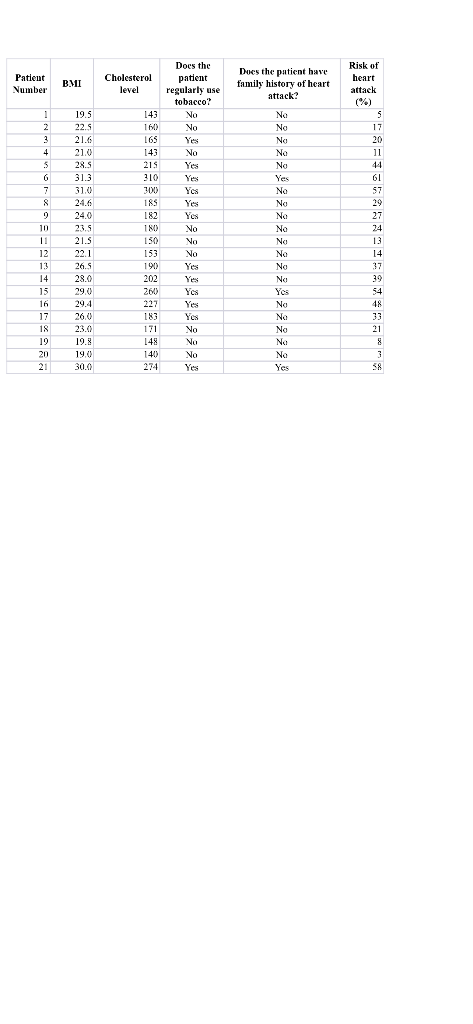

Part 2) Heart Attack (Chapter 4- Regression) A study performed by a team of scientists at Fremont University Medical School evaluates how body mass index(BMI), cholesterol level, family history of heart attacks, and regular use of tobacco relate to the risk of heart attack (risk of heart attack is probability (in percent) that a patient will have a heart attack over the next 15 year. For each categorical variable (family history of heart attack and regular use of tobacco) you need to define a dummy variable with 1 indicating the answer "Yes" and 0 indicating the answer No. The data of study in given in Excel file Heart_attack.xls. a) Develop an estimated multiple regression equation that estimates risk of heart attack based on body mass index (BMI), cholesterol level, family history of heart attacks, and regular use of tobacco. 1 Page b) Use the significance F to determine whether the overall significant relationship is present. What is the conclusion at the 0.05 level of significance? c) Determine the significance of each individual independent variable at the 0.05 level of significance using p-values from t-test. Which independent variables have significant relationship with risk of heart attack? Discuss. d) What is the risk of heart attack over the next 15 years for a patient with BMI of 30, cholesterol level of 290, has a family history of heart attack and has been regularly using tobacco. e) Mention at least two other variables that could be included in the model as independent variables. Patient Number BMI Cholesterol level Does the patient have family history of heart attack? 19.5 22.5 Risk of heart attack (%) 5 17 20 11 143 16) Does the patient regularly use tobacco? No No Yes No Yes 1 2 3 4 Na No Na Na No 5 Yes 6 7 7 8 9 21.0 28.5 31.3 31.0) 24.6 24.0 21.5 21.5 22.1 26.5 28.0 29.0 29.4 10 11 12 13 14 15 16S 143 215 310 300 18 182 IN) 150 153 190 202 200 227 183 171 Yes Yes No No No No Na No No Na Na No Nai Yes Yes Yes Yes Yes No No Na 61 57 19 27 24 13 14 37 39 54 48 33 21 8 3 58 18 19 20 19.8 19.0) 30.0 Na No No Na No Yes 140 Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts