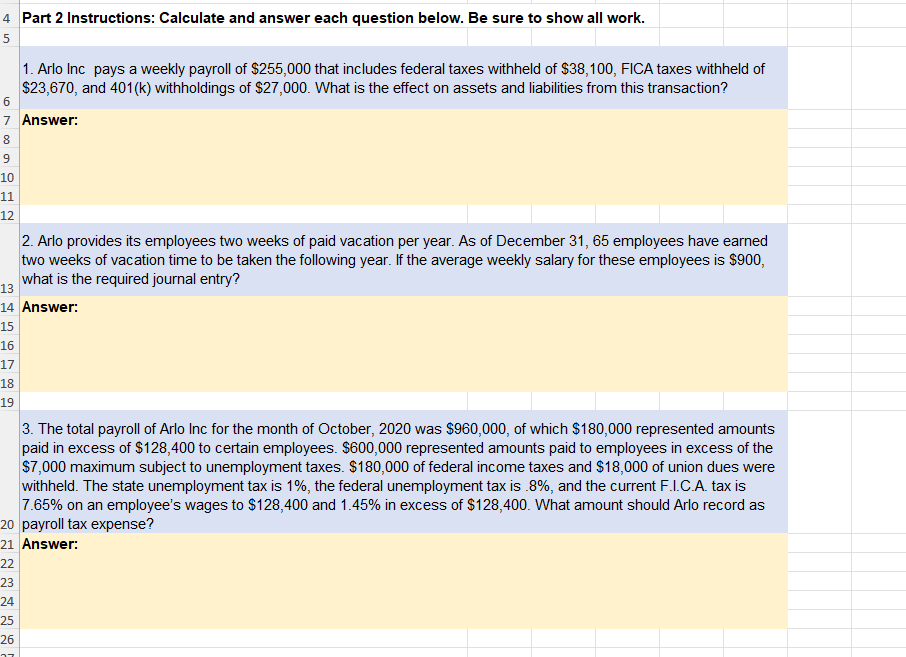

Question: Part 2 Instructions: Calculate and answer each question below. Be sure to show all work. Arlo Inc pays a weekly payroll of $ 2 5

Part Instructions: Calculate and answer each question below. Be sure to show all work.

Arlo Inc pays a weekly payroll of $ that includes federal taxes withheld of $ FICA taxes withheld of

$ and withholdings of $ What is the effect on assets and liabilities from this transaction?

Answer:

Arlo provides its employees two weeks of paid vacation per year. As of December employees have earned

two weeks of vacation time to be taken the following year. If the average weekly salary for these employees is $

what is the required journal entry?

Answer:

The total payroll of Arlo Inc for the month of October, was $ of which $ represented amounts

paid in excess of $ to certain employees. $ represented amounts paid to employees in excess of the

$ maximum subject to unemployment taxes. $ of federal income taxes and $ of union dues were

withheld. The state unemployment tax is the federal unemployment tax is and the current FI.CA tax is

on an employee's wages to $ and in excess of $ What amount should Arlo record as

payroll tax expense?

Answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock