Question: PART 2: LEVERAGE, RISK & RETURNS A non-bank with a leverage multiple of 10 is seeking high returns on its investment (total) assets, currently valued

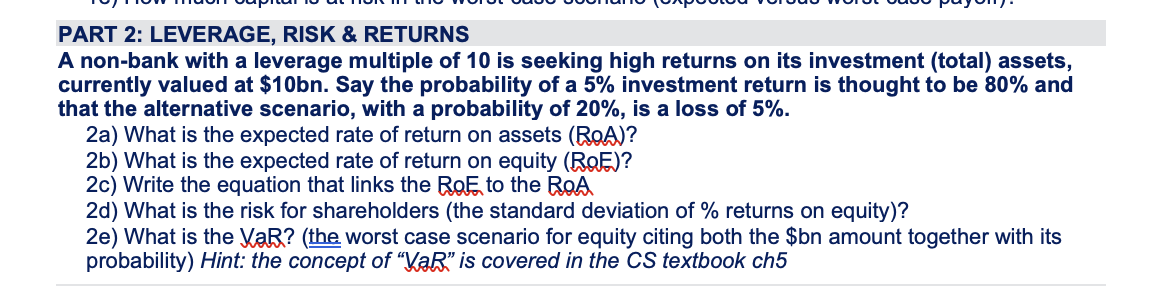

PART 2: LEVERAGE, RISK \& RETURNS A non-bank with a leverage multiple of 10 is seeking high returns on its investment (total) assets, currently valued at $10bn. Say the probability of a 5% investment return is thought to be 80% and that the alternative scenario, with a probability of 20%, is a loss of 5%. 2a) What is the expected rate of return on assets (RoA)? 2b) What is the expected rate of return on equity (RoF) ? 2c) Write the equation that links the RoF to the RaA 2d) What is the risk for shareholders (the standard deviation of % returns on equity)? 2e) What is the YaR? (the worst case scenario for equity citing both the $ bn amount together with its probability) Hint: the concept of " VaR " is covered in the CS textbook ch5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts