Question: Part 2: Linear Programming Suppose that you are considering investing some of your money ($10,000) into two assets: government bonds and the stock market. You

Part 2: Linear Programming

Suppose that you are considering investing some of your money ($10,000) into two assets: government bonds and the stock market. You anticipate that the return rate for government bond is 10% and for the stock market is 20%. Since the stock market is riskier, you do not want to put more than $4,000 in it. Similarly, you plan to spend at least $3,000 on the government bonds. What will be your investment portfolio in order to maximize your total return? (Assume all for one year investment.)

1. Formulate the business scenario as an LP problem. Show the objective, the constraints, and decision variables.

2. Use the graphic approach (in Word/Excel or hand drawing) to show the constraints, the feasible region, and the optimal solution.

3. Use Excel OM package or Excel Solver Add-in to help you solve the problem. What are the optimal decisions and what is the optimal objective value?

4. Recently, there is a promotion for savings with 5% interest rate, and you would like to keep exact $1,000 savings in your total investment. Formulate these changes as a new LP problem to show the objective, the constraints, and decision variables.

5. Use Excel OM package or Excel Solver Add-in to help you solve the new LP problem above. What are the optimal decisions and what is the optimal objective value?

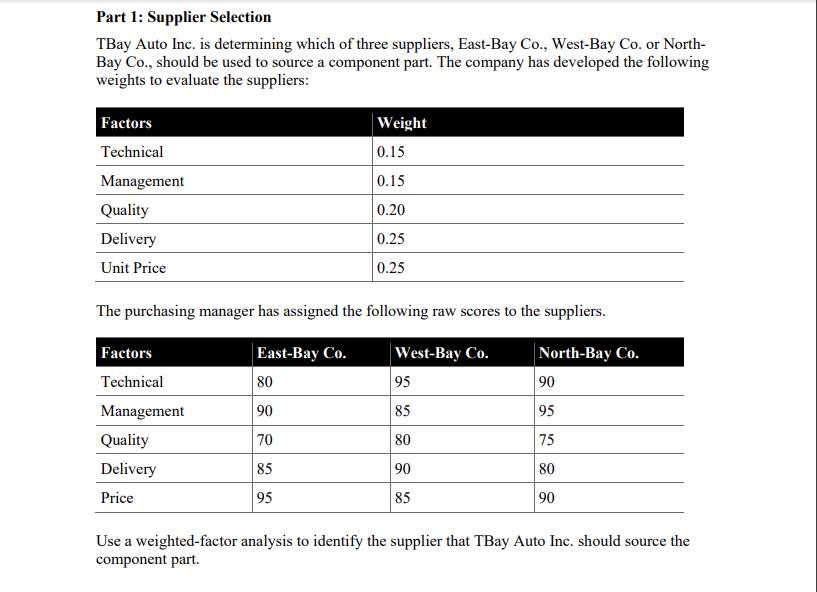

Part 1: Supplier Selection TBay Auto Inc. is determining which of three suppliers, East-Bay Co., West-Bay Co. or North- Bay Co., should be used to source a component part. The company has developed the following weights to evaluate the suppliers: Weight 0.15 0.15 Factors Technical Management Quality Delivery Unit Price 0.20 0.25 0.25 The purchasing manager has assigned the following raw scores to the suppliers. East-Bay Co. 80 90 West-Bay Co. 95 85 North-Bay Co. 90 95 Factors Technical Management Quality Delivery Price 70 80 75 85 90 80 95 85 90 Use a weighted-factor analysis to identify the supplier that TBay Auto Inc. should source the component partStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts