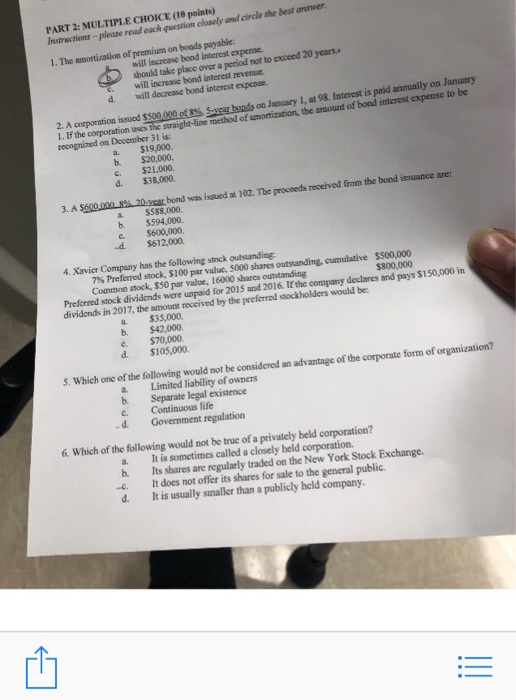

Question: PART 2: MULTIPLE CHOICE (10 points) Instructions-please read each question closely and circle the best annver 1. The amortization of premium on bouds payable will

PART 2: MULTIPLE CHOICE (10 points) Instructions-please read each question closely and circle the best annver 1. The amortization of premium on bouds payable will increase bond interest expense should take place over a period not to exceed 20 years. c. will increase bond interest reventue. d. will decrease bond interest expense Sycer bonss oa Janary I, at 98. Iaterest is paid annually on January 2. A corporation issued $500 l. If the corporation uses the straight-line rnethod of smortization, tbe amount of bond interest expes t e a. $19,000. b. $20,000. c. $21,000. d. $38,000. 3. A $500.00 8%. 20ar bond was issued at 102. The procceds received from the bond issuance are: a $588,000. b. $594,000. c $600,000. d. $612,000. 4. Xavicr Company has the following stock outstanding: 7% Preferred stock, $100 par value, 5000 shares outstanding, cumulative Common stock, $50 par value, 16000 shares outstanding S500.000 $800,000 Prefcrred stock dividends were unpaid for 2015 and 2016. If the company declares and pays $150,000 in dividends in 2017, the amount received by the preferred stockholders would be: a $35,000. b. $42,000. c $70,000 d. $105,000. 5. Which one of the following would not be considered an advantage of the corporate form of organization? a. Limited liability of owners b. Separate legal existence c. Continuous life -d. Government regulation 6. Which of the following would not be true of a privately held corporation? a. It is sometimes called a closely held corporation. h. Its shares are regularly traded on the New York Stock Exchange. -c. It does not offer its shares for sale to the general public. d. It is usually smaller than a publicly held company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts