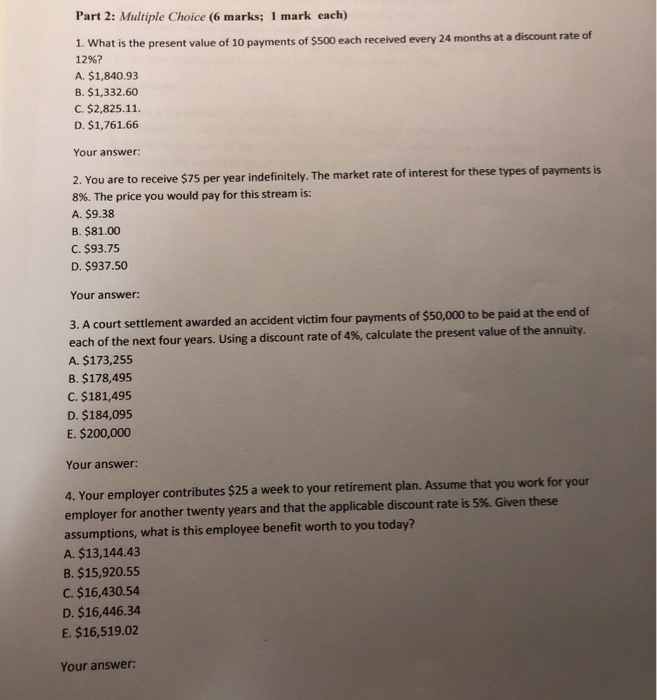

Question: Part 2: Multiple Choice (6 marks; 1 mark each) 1. What is the present value of 10 payments of $500 each received every 24 months

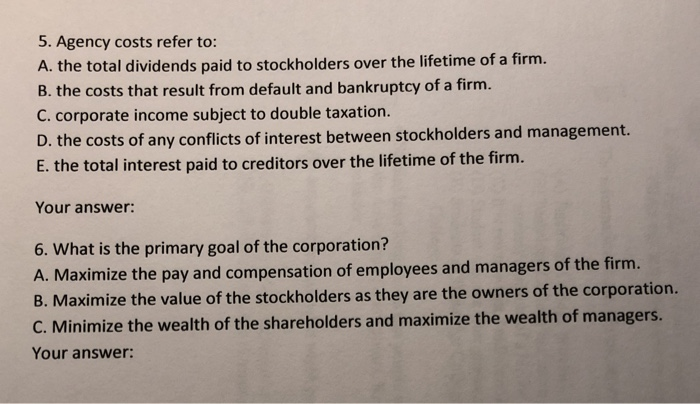

Part 2: Multiple Choice (6 marks; 1 mark each) 1. What is the present value of 10 payments of $500 each received every 24 months at a discount rate of 12% ? A. $1,840.93 B. $1,332.60 C. $2,825.11 D. $1,761.66 Your answer: 2. You are to receive $75 per year indefinitely. The market rate of interest for these types of payments is 8%. The price you would pay for this stream is: A. $9.38 .$81.00 C. $93.75 D. $937.50 Your answer: 3. A court settlement awarded an accident victim four payments of $50,000 to be paid at the end of each of the next four years. Using a discount rate of 4 % , calculate the present value of the annuity. A. $173,255 B. $178,495 C. $181,495 D. $184,095 E. $200,000 Your answer: 4. Your employer contributes $25 a week to your retirement plan. Assume that you work for your employer for another twenty years and that the applicable discount rate is 5%. Given these assumptions, what is this employee benefit worth to you today? A.$13,144.43 B. $15,920.55 C. $16,430.54 D. $16,446.34 E. $16,519.02 Your answer: 5. Agency costs refer to: A. the total dividends paid to stockholders over the lifetime of a firm. B. the costs that result from default and bankruptcy of a firm. C. corporate income subject to double taxation. D. the costs of any conflicts of interest between stockholders and management. E. the total interest paid to creditors over the lifetime of the firm. Your answer: 6. What is the primary goal of the corporation? A. Maximize the pay and compensation of employees and managers of the firm. B. Maximize the value of the stockholders as they are the owners of the corporation. C.Minimize the wealth of the shareholders and maximize the wealth of managers. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts