Question: part 2 only Accepi My courses > Sec 01 > HW5 Problem 5 Intro A new bottling machine will cost $22,000 initially. The machine will

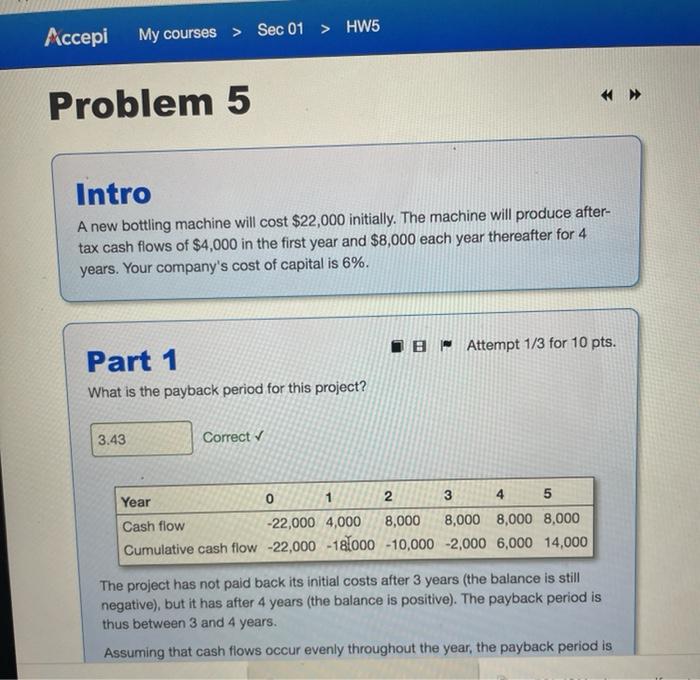

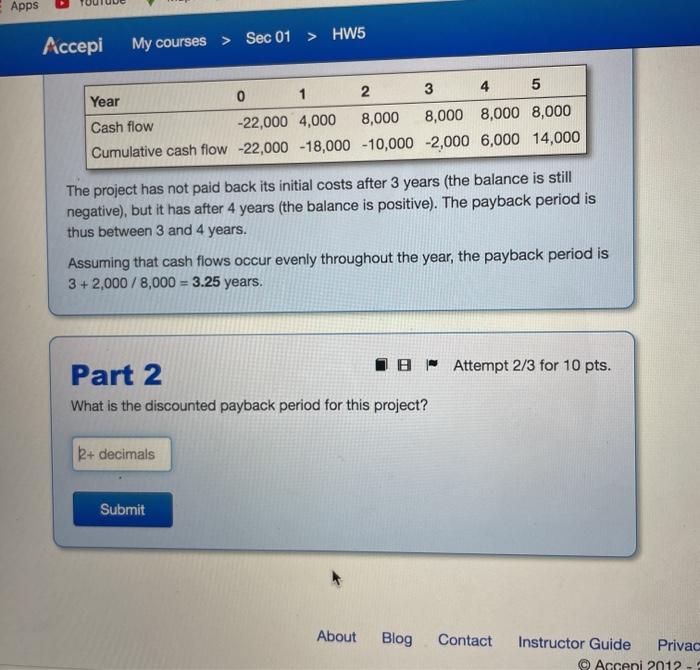

Accepi My courses > Sec 01 > HW5 Problem 5 Intro A new bottling machine will cost $22,000 initially. The machine will produce after- tax cash flows of $4,000 in the first year and $8,000 each year thereafter for 4 years. Your company's cost of capital is 6%. IB Attempt 1/3 for 10 pts. Part 1 What is the payback period for this project? 3.43 Correct Year 0 1 2 3 4 5 Cash flow -22,000 4,000 8,000 8,000 8,000 8,000 Cumulative cash flow -22,000 -18.000 -10,000 -2,000 6,000 14,000 The project has not paid back its initial costs after 3 years (the balance is still negative), but it has after 4 years the balance is positive). The payback period is thus between 3 and 4 years. Assuming that cash flows occur evenly throughout the year, the payback period is Apps > HW5 Accepi My courses > Sec 01 Year 0 1 2 3 4 5 Cash flow -22,000 4,000 8,000 8,000 8,000 8,000 Cumulative cash flow -22,000 -18,000 -10,000 -2,000 6,000 14,000 The project has not paid back its initial costs after 3 years (the balance is still negative), but it has after 4 years (the balance is positive). The payback period is thus between 3 and 4 years. Assuming that cash flows occur evenly throughout the year, the payback period is 3+ 2,000 / 8,000 = 3.25 years. Part 2 IB Attempt 2/3 for 10 pts. What is the discounted payback period for this project? + decimals Submit About Blog Contact Instructor Guide Privac Arseni 2012

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts